As filed with the U.S. Securities and Exchange Commission on November 19, 2018

Registration No. 333-228313

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_______________________

DIAMEDICA THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

|

Canada (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

Not Applicable (I.R.S. Employer Identification Number) |

2 Carlson Parkway, Suite 260

Minneapolis, Minnesota 55447

(763) 496-5454

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

_______________________

Rick Pauls

President and Chief Executive Officer

DiaMedica Therapeutics Inc.

2 Carlson Parkway, Suite 260

Minneapolis, Minnesota 55447

(763) 496-5454

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_______________________

Copies to:

|

Amy E. Culbert Brett R. Hanson Fox Rothschild LLP Campbell Mithun Tower, Suite 2000 222 South Ninth Street Minneapolis, Minnesota 55402 (612) 607-7000 |

Keith Inman Pushor Mitchell LLP 301 – 1665 Ellis Street Kelowna, British Columbia Canada V1Y 2B3 (250) 762-2108 |

Jonathan R. Zimmerman Ben A. Stacke Faegre Baker Daniels LLP 2200 Wells Fargo Center 90 South Seventh Street Minneapolis, Minnesota 55402 (612) 766-7000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

Smaller reporting company ☒ |

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered(1) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3)(4) |

|

Voting Common Shares, no par value per share |

$15,000,000 |

$1,818 |

|

(1) |

Each voting common share, no par value per share (“common shares”), includes one common share purchase right pursuant to a Shareholder Rights Plan Agreement dated December 21, 2017 by and between DiaMedica Therapeutics Inc. and Computershare Investor Services Inc. Any value attributable to such rights is reflected in the market price of the common shares. |

|

(2) |

Estimated solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of shares that the underwriter has the option to purchase to cover over-allotments, if any. |

|

(3) |

Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

|

(4) |

Previously paid. |

_______________________

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 19, 2018

PRELIMINARY PROSPECTUS

Shares

Common Shares

_______________________

This is the initial public offering of common shares of DiaMedica Therapeutics Inc. in the United States. All common shares being offered are being sold by the Company. We expect the initial public offering price will be between $ and $ per share. We have applied to list our common shares in the United States on The Nasdaq Capital Market under the symbol “DMAC.” Although this is our initial public offering of our common shares in the United States, our common shares trade in Canada on the TSX Venture Exchange under the symbol “DMA” and over-the-counter in the United States on the OTCQB marketplace under the symbol “DMCAF.” The last reported sale price of our common shares at the close of business on November 16, 2018 on the TSX Venture Exchange was CAD $6.50 per share (US $4.94) and over-the-counter in the United States as quoted by the OTCQB marketplace was $4.95 per share.

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be eligible for, and have decided to comply with, reduced public company disclosure requirements in future reports after completion of this offering. See “Prospectus Summary – Implications of Being an Emerging Growth Company.”

Investing in our common shares involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that should be considered in connection with an investment in our common shares.

_______________________

Neither the Securities and Exchange Commission nor any state securities regulators have approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

_______________________

|

Per Share |

Total |

|||||||

|

Initial public offering price |

$ | $ | ||||||

|

Underwriting discounts and commissions(1) |

$ | $ | ||||||

|

Proceeds, before expenses, to us |

$ | $ | ||||||

__________________________

|

(1) |

In addition, we have agreed to reimburse the underwriter for certain expenses. See “Underwriting” for additional disclosure regarding underwriting discounts, commissions and estimated offering expenses. |

We have granted the underwriter an option for a period of 30 days from the date of this prospectus to purchase up to an additional common shares from us at the initial public offering price less the underwriting discounts and commissions to cover over-allotments, if any.

Delivery of the common shares is expected to be made on or about , 2018, subject to customary closing conditions.

___________________

Craig-Hallum Capital Group

Prospectus dated , 2018

TABLE OF CONTENTS

|

|

Page |

|

Prospectus Summary |

1 |

|

Summary Consolidated Financial Data |

10 |

|

Risk Factors |

11 |

|

Special Note Regarding Forward-Looking Statements |

44 |

|

Use of Proceeds |

45 |

|

Price Range of Our Common Shares |

46 |

|

Dividend Policy |

47 |

|

Capitalization |

48 |

|

Dilution |

49 |

|

Selected Financial Data |

50 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

51 |

|

Business |

59 |

|

Management |

80 |

|

Executive and Director Compensation |

88 |

|

Certain Relationships and Related Party Transactions |

97 |

|

Principal Shareholders |

99 |

|

Description of Share Capital |

101 |

|

Shares Eligible For Future Sale |

112 |

|

Certain United States Federal Income Tax Considerations |

114 |

|

Material Canadian Federal Income Tax Considerations |

120 |

|

Underwriting |

121 |

|

Legal Matters |

127 |

|

Experts |

127 |

|

Where You Can Find Additional Information |

127 |

|

Index To Consolidated Financial Statements |

F-1 |

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the underwriter has authorized anyone to provide you with information that is different. We are offering to sell our common shares, and seeking offers to buy our common shares, only in jurisdictions where offers and sales are permitted. The information in this prospectus is complete and accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common shares.

For investors outside the United States: neither we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our common shares and the distribution of this prospectus outside the United States.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “DiaMedica,” “the Company,” “we,” “us,” “our” or similar references mean DiaMedica Therapeutics Inc. and its subsidiaries. References in this prospectus to “common shares” means our voting common shares, no par value per share.

We own various unregistered trademarks and service marks, including our corporate logo. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that the owner of such trademarks and trade names will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

INDUSTRY AND MARKET DATA

In addition to the industry, market and competitive position data referenced in this prospectus from our own internal estimates and research, some market data and other statistical information included in this prospectus are based in part upon information obtained from third-party industry publications, research, surveys and studies, none of which we commissioned. Third-party industry publications, research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information.

We are responsible for all of the disclosure in this prospectus and while we believe that each of the publications, research, surveys and studies included in this prospectus are prepared by reputable sources, neither we nor the underwriter have independently verified market and industry data from third-party sources. In addition, while we believe our internal company research and estimates are reliable, such research and estimates have not been verified by independent sources. Assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common shares. Before you decide to invest in our common shares, you should read and carefully consider the following summary together with the entire prospectus, including our financial statements and the related notes thereto appearing elsewhere in this prospectus and the matters discussed in the sections in this prospectus entitled “Risk Factors,” “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections of this prospectus.

Overview

We are a clinical stage biopharmaceutical company primarily focused on the development of novel recombinant (synthetic) proteins. Our goal is to use our patented and licensed technologies to establish our company as a leader in the development and commercialization of novel recombinant proteins to treat neurological and kidney diseases. Our primary focus is on acute ischemic stroke (“AIS”) and chronic kidney disease (“CKD”). We plan to advance our lead drug candidate, DM199, through clinical trials, as appropriate, to create shareholder value by establishing its clinical and commercial potential as a therapy for AIS and CKD.

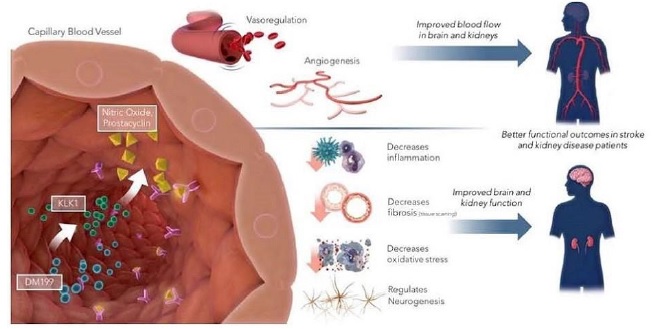

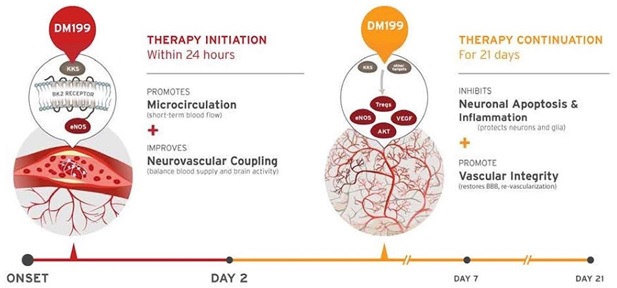

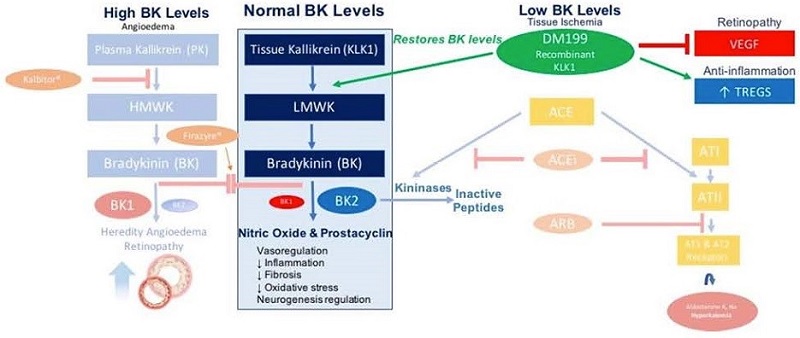

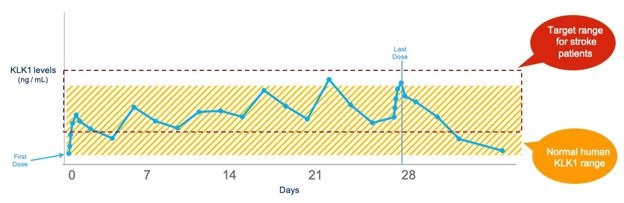

DM199 is a recombinant form of human tissue kallikrein-1 (“KLK1”). KLK1 is an endogenous serine protease (protein) produced in the kidneys, pancreas and salivary glands, which plays a critical role in the regulation of local blood flow and vasodilation (the widening of blood vessels which decreases blood pressure) in the body, as well as an important role in managing inflammation and oxidative stress (an imbalance between potentially damaging reactive oxygen species, or free radicals, and antioxidants in your body). We believe DM199 has the potential to treat a variety of diseases where healthy functioning requires sufficient activity of KLK1 and its biochemical system, the kallikrein-kinin system (“KKS”).

AIS and CKD patients suffer from a lack of blood flow to the brain and kidneys, respectively. These patients also tend to exhibit lower than normal levels of endogenous KLK1. We believe treatment with DM199 could replenish low levels of endogenous KLK1, thereby releasing physiological levels of bradykinin (“BK”) when and where needed, generating beneficial nitric oxide and prostacyclin setting in motion metabolic pathways that can improve blood flow (through vasoregulation) to damaged end-organs, such as the brain and kidneys, supporting the structural integrity and normal functioning.

Today, forms of KLK1 derived from human urine and porcine pancreas are sold in Japan, China and Korea to treat AIS, CKD, retinopathy, hypertension and related vascular diseases. We believe millions of patients have been treated with these KLK1 therapies, and the data from more than 100 published papers and studies support their clinical benefit. However, there are numerous regulatory, commercial, and clinical drawbacks associated with KLK1 derived from human urine and porcine pancreas that can be overcome by developing a synthetic version of KLK1 such as DM199. We believe regulatory drawbacks are the primary reason why KLK1 derived from human urine and porcine pancreas are not currently available and used in the United State or Europe. We are not aware of any synthetic version of KLK1 with regulatory approval for human use in any country, nor are we aware of any synthetic version in development other than our drug candidate DM199. We believe at least five companies have attempted to create a synthetic version of KLK1, but have been unsuccessful.

We have conducted numerous internal and third-party analyses to evaluate the structural and functional performance of DM199 as compared to KLK1 derived from human urine. The results of these studies have demonstrated that DM199 is structurally and functionally equivalent to KLK1 derived from human urine in that (i) the amino acid structure of DM199 is identical to the human urine form, (ii) the enzymatic and pharmacokinetic profiles are substantially similar to human urinary derived KLK1 and (iii) the physiological effects of DM199 on blood pressure mirror that of human urinary derived KLK1. We believe that the results of this work suggest that the therapeutic action of DM199 will be the same or better than that of the forms of KLK1 marketed in Asia. In addition, we have completed five clinical trials with DM199 treating over 120 volunteers and the results have shown that DM199 has been well-tolerated. However, DM199 has not been, and we cannot provide any assurance that it ultimately will be, determined to be safe or effective for purposes of granting marketing approval by the FDA or any comparable agency.

1

Our recombinant form of DM199 is protected by issued composition of matter and delivery patents in the United States and Europe (2033); a pending worldwide patent (2038) that covers a range of DM199 dose levels and dosing regimens useful for treating a wide range of diseases associated with microvascular dysfunction; an exclusive license with our manufacturing partner for use of their cell line and proprietary expression system for manufacturing synthetic KLK1; and numerous trade-secrets. In addition, we believe DM199 cannot be reverse engineered to develop a copycat version of our therapy. This adds additional protection to our intellectual property, especially as we engage in DM199 licensing activities. We do not intend to share formulary secrets with licensing partners outside of the United States, but we will supply our partners with bulk active ingredient which we manufacture domestically.

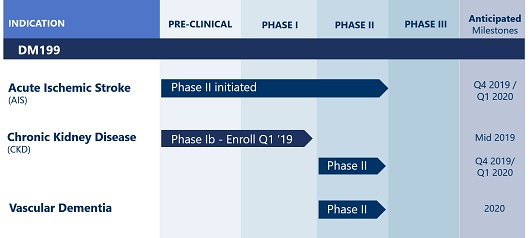

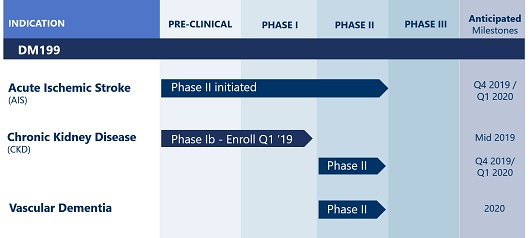

Our Programs

The primary focus for our DM199 program development is on AIS and CKD; however, we also intend to pursue advancement in the vascular dementia market. The current status of our product candidates in clinical development is as follows:

|

● |

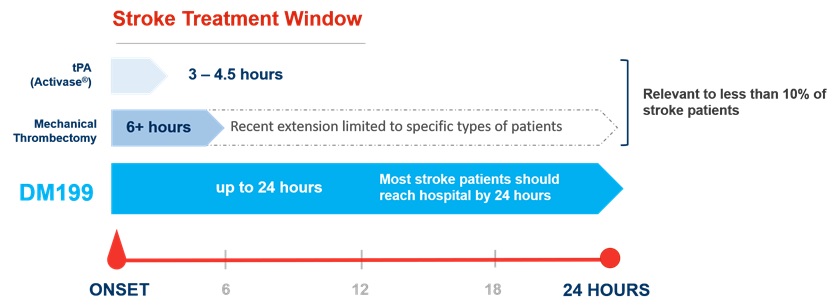

Acute Ischemic Stroke. According to the World Health Organization, each year approximately 15 million people worldwide suffer a stroke, of which 5.0 million will die and 5.0 million will be permanently disabled. The majority of stroke patients suffer an ischemic event, which according to the U.S. Center for Disease Control and Prevention is approximately 87% of all stroke patients. We believe that stroke represents an area of significant unmet medical need, and a KLK1 treatment (such as DM199) could provide a significant patient benefit with its proposed therapeutic window of up to 24 hours after the first sign of symptoms. Currently, the only FDA-approved pharmacological intervention for AIS is tissue plasminogen activator (“tPA”), which must be given within 4.5 hours of symptom onset. Treating patients with tPA during this time window can be challenging because it is difficult to determine precisely when symptoms began and a patient must undergo complex brain imaging before treatment to rule out a hemorrhagic stroke. Mechanical thrombectomy, a procedure in which the clot is removed using catheter-based tools, is also available to certain patients. Despite the availability of these treatments, we believe they are relevant to less than 10% of ischemic stroke patients due to the location of the clot, the elapsed time after the stroke occurred, or safety considerations. Thus, we believe DM199 may offer significant advantages over the current treatment options and fill an unmet need for patients who cannot receive tPA or mechanical thrombectomy (most stroke patients will be diagnosed in less than 24 hours). Additionally, DM199 may also offer a complimentary follow-on treatment for patients who initially receive tPA or mechanical thrombectomy treatments by enabling sustained blood flow improvements to the brain during the critical first few weeks after a stroke. Based on the number of strokes each year (approximately 1.7 million in the U.S., Europe and Japan and 15 million worldwide) and the $8,500 estimated cost per patient for the current standard of care, tPA, we believe the annual market opportunity for DM199 could be significant. |

2

|

● |

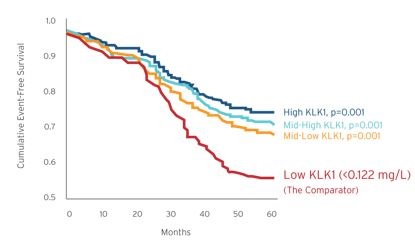

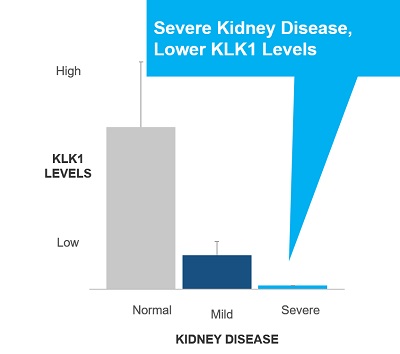

Chronic Kidney Disease. CKD is a widespread health problem that generates significant economic burden throughout the world. According to the National Kidney Foundation, 30 million Americans and 120 million Chinese suffer from this debilitating and potentially life-threatening condition. CKD is a progressive condition causing the kidneys to lose function over time, increasing the risk of premature death, cardiovascular events, and hospitalization. End stage renal disease (“ESRD”) is the final stage of CKD and requires ongoing dialysis or a kidney transplant to survive, but many patients suffer serious health consequences or die from CKD prior to developing ESRD. Currently, there is no cure for CKD and treatment involves management of the disease. Blood pressure medications, such as angiotensin converting enzyme inhibitors (“ACEi”) or angiotensin receptor blockers (“ARB”), are often prescribed to control hypertension, and hopefully, slow the progression of CKD. Nevertheless, according to the National Kidney Foundation, many patients continue to show declining kidney function. We believe DM199 offers a potentially novel approach for the treatment of CKD because KLK1 protein plays a vital role in normal kidney function. Since patients with moderate to severe CKD often excrete abnormally low levels of KLK1 in their urine, we believe that DM199 may prevent or reduce further kidney damage by replenishing endogenous KLK1 and restoring the protective kallikrein-kinin system to regulate the production and release of nitric oxide and prostacyclin. |

Human Urine-Extracted KLK1 Studies in AIS Patients

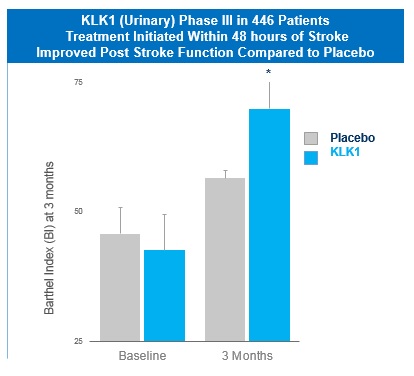

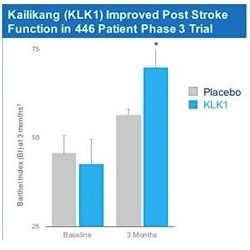

In China, a human urine-extracted KLKl protein (Kailikang®) is approved and marketed by Techpool Bio-Pharma Inc., a company controlled by Shanghai Pharmaceuticals Holding Co. Ltd. According to a publication in the China Journal of Neurology, in a double-blinded, placebo-controlled trial of 446 patients treated with either KLK1 or a placebo administered up to 48 hours after a stroke, such patients showed significantly better scores on the European Stroke Scale and Activities of Daily Living at three weeks post-treatment and after three months using the Barthel Index. Numerous internal and Third party analyses demonstrate DM199 bioequivalence to Kailikang®.

Furthermore, a comprehensive meta-analysis covering 24 clinical studies involving 2,433 patients published in the Journal of Evidenced Based Medicine concluded that human urinary KLK1 appears to ameliorate neurological deficits for patients with AIS and improves long-term outcomes, though a few treated patients suffered from transient hypotension.

3

Porcine-Derived KLK1 Studies in CKD Patients

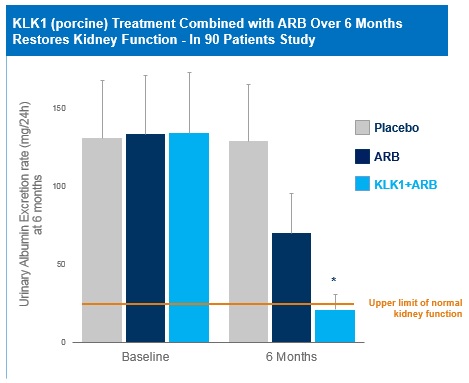

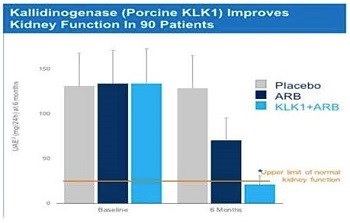

Over 20 clinical papers have been published in the Chinese literature supporting the therapeutic activity in CKD patients of porcine KLK1 given alone or in combination with an ARB or an ACEi. These unblinded studies involve treatment durations ranging from a few weeks up to six months and report improvement in kidney disease based on decreased urinary albumin excretion rates (“UAER”) and other clinical endpoints of kidney disease. In a 2011 study of 90 patients, CKD patients treated with porcine KLK1 combined with ARB restored kidney function to normalized levels based on UAER.

License to Ahon Pharma, a Subsidiary of Fosun Pharma

On September 27, 2018, we entered into a license and collaboration agreement with Ahon Pharmaceutical Co Ltd. (“Ahon Pharma”), a subsidiary of Shanghai Fosun Pharmaceutical (Group) Co. Ltd. (“Fosun Pharma”), which grants Ahon Pharma the exclusive rights to develop and commercialize DM199 for acute ischemic stroke in mainland China, Taiwan, Hong Kong S.A.R. and Macau S.A.R. Fosun Pharma is one of China’s largest pharmaceutical firms with annual sales of more than USD $2 billion and an extensive related hospital sales force. Under the terms of the license agreement, we are entitled to receive an upfront payment of $5 million, consisting of $500,000 on signing and $4.5 million upon regulatory clearance to initiate a clinical trial in China. We also have the potential to receive an additional $27.5 million in development and sales related milestones and up to approximately 10% royalties on net sales of DM199 in the licensed territories. All development, regulatory, sales, marketing, and commercial activities and associated costs in the licensed territories will be the sole responsibility of Ahon Pharma. Fosun Pharma, through its partnership with SK Group (a South Korea based Fortune Global 100 Company) is an investor in DiaMedica through an equity investment made in 2016.

Potential DM199 Commercial Advantages

The growing understanding of KLK1’s role in human health and its use in Asia as an approved therapeutic highlights two important potential commercial advantages for DM199:

|

● |

KLK1 treatments currently sold in Japan, China and Korea. Research has shown that patients with low levels of KLK1 are associated with a variety of diseases related to vascular dysfunction, such as chronic kidney disease, acute ischemic stroke, retinopathy and hypertension. Clinical trial data with human urine and porcine derived KLK1 has demonstrated statistically significant clinical benefits in treating a variety of patients with KLK1 compared to placebo. These efficacy results are further substantiated by established markets in Japan, China and Korea for pharmaceutical sales of KLK1 derived from human urine and porcine pancreas. We estimate that millions of patients have been treated with these forms of KLK1 in Asia. Altogether, we believe this supports a strong market opportunity for a synthetic version of KLK1 such as DM199. |

4

|

● |

KLK1 treatment has had limited side effects and has been well tolerated to date. KLK1 is naturally produced by the human body; and, therefore, the body’s own control mechanisms act to limit potential side effects. The only notable side effect observed in our clinical trials was orthostatic hypotension, or a sudden drop in blood pressure, which was only seen at doses ten to twenty times higher than our anticipated therapeutic dose levels. Moreover, routine clinical use of KLK1 treatment in Asia we understand has been well-tolerated by patients for several decades. In 2017, we completed a clinical trial comparing the pharmacokinetic profile of DM199 to the human urinary form of KLK1 (Kailikang®), which showed DM199, when administered in intravenous form, had a similar pharmacokinetic profile. Further, when DM199 was administered subcutaneously, DM199 demonstrated a longer acting pharmacokinetic profile, superior to the intravenously administered Kailikang® and DM199. |

In addition, we believe there are also significant formulation, manufacturing, regulatory and other advantages for our synthetic human KLK1 drug candidate DM199:

|

● |

Potency and Impurity Considerations. KLK1 derived from human urine or porcine pancreas may contain impurities, endotoxins, and chemical byproducts due to the inherent variability of the isolation and purification process. We believe that this creates the risk of inconsistencies in potency and impurities from one production run to the next. However, we expect to produce a consistent formulation of KLK1 that is free of endotoxins and other impurities. |

|

● |

Cost and Scalability. Large quantities of human urine and porcine pancreas must be obtained to derive a small amount of KLK1. This creates potential procurement, cost and logistical challenges to source the necessary raw material, particularly for human urine sourced KLK1. Once sourced, the raw material is processed using chemicals and costly capital equipment and produces a significant amount of byproduct waste. Our novel recombinant manufacturing process utilizes widely available raw materials and can be readily scaled for commercial production. Accordingly, we believe our manufacturing process will have significant cost and scalability advantages. |

|

● |

Regulatory. We are not aware of any attempts by manufacturers of the urine or porcine based KLK1 products to pursue regulatory approvals in the United States. We believe that this is related to challenges presented by using inconsistent and potentially hazardous biomaterials, such as human urine and porcine pancreas, and their resulting ability to produce a consistent drug product. Our novel recombinant manufacturing process utilizes widely available raw materials which we believe provides a significant regulatory advantage, particularly in regions such as the United States, Europe and Canada, where safety standards are high. In addition, we believe that DM199 could qualify for 12 years of data exclusivity under the Biologics Price Competition and Innovation Act of 2009, which was enacted as part of the Patient Protection and Affordable Care Act as amended by the Health Care and Education Reconciliation Act of 2010 (collectively, the “ACA”). |

Our Strategy

We aim to become a leader in the development and commercialization of novel recombinant proteins to treat neurological and kidney diseases. To achieve this goal, we are pursuing the following strategies:

|

● |

Complete our Phase II clinical development for DM199 in AIS patients; |

|

● |

Advance Phase Ib and Phase II studies for DM199 in CKD patients; |

|

● |

Initiate a Phase II study for DM199 in patients with vascular dementia; |

|

● |

Explore potential new indications for DM199; |

|

● |

Leverage our experience and technologies to develop new recombinant therapies and programs; and |

|

● |

License our lead product candidate into new territories and prepare for commercialization of DM199. |

5

Our Team

We have assembled a seasoned management team with extensive experience in drug discovery, development, manufacturing, and commercialization. Our Chief Executive Officer, Rick Pauls, MBA, is a successful venture capitalist and formerly the Co-Founder and Managing Director of CentreStone Ventures Inc., a life sciences venture capital fund which made early investments in DiaMedica. Our Chief Scientific Officer, Todd Verdoorn, PhD, has more than 26 years of experience in the pharmaceutical and biotechnology industries, including five years working with Bristol-Myers Squibb’s stroke group. Our Chief Medical Officer, Harry Alcorn Jr., PhD, has more than 30 years’ experience planning, operating, and executing clinical development programs across a range of diseases including kidney disease, diabetes, and cardiovascular disease, and most recently served as Chief Scientific Officer of DaVita Clinical Research. Our Chief Financial Officer, Scott Kellen, CPA, brings over two decades of operational and corporate finance expertise including an extensive background working with publicly-traded healthcare and biotechnology companies.

Over the last two years we have also been supported by significant investments from Hermed Capital, an investment fund affiliated with our partner Fosun Pharma’s subsidiary Ahon Pharma, and Dr. Nancy Chang, PhD, CEO and President of Apex Enterprises, and a member of our strategic advisory board.

Risks Affecting Us

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. Some of these risks include:

|

● |

we are an early stage company with no approved products and no revenue; |

|

● |

our prospects depend on the success of our DM199 product candidate; |

|

● |

we rely on third parties to plan, conduct and monitor our preclinical and clinical trials; |

|

● |

we rely on a contract manufacturer over whom we have limited control to manufacture DM199; |

|

● |

we are in litigation with a contract research organization which could harm our ability to obtain regulatory approval for DM199; |

|

● |

clinical trials are expensive and complex with uncertain outcomes, which may prevent or delay regulatory approval of or commercialization of our DM199 product candidate; |

|

● |

we may not be successful in finding collaboration partners to assist us with the development or commercialization of our DM199 product candidate; |

|

● |

regulatory approval processes are lengthy, expensive and inherently unpredictable, and even if our DM199 product candidate achieves positive clinical trial results, we may fail to obtain required regulatory approvals; |

|

● |

even if we obtain required regulatory approvals, the successful commercialization of our DM199 product candidate may fail to achieve market acceptance among physicians, patients, healthcare payors and the medical community; |

|

● |

if we fail to obtain coverage and adequate reimbursement for our DM199 product candidate, our revenue-generating ability will be diminished and there is no assurance that the anticipated market for our product will be sustained; |

|

● |

we face competition from other biotechnology and pharmaceutical companies and may face such competition sooner than expected if we do not qualify for data exclusivity as anticipated; and |

|

● |

we may be classified as a “passive foreign investment company,” which may have adverse U.S. federal income tax consequences for U.S. shareholders. |

6

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion of revenue during our last fiscal year, we are an emerging growth company as defined in the JOBS Act, and we may remain an emerging growth company for up to five years from the date of the first sale in this offering. However, if certain events occur prior to the end of such five-year period, including if we become a large accelerated filer, our annual gross revenue exceeds $1.07 billion, or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not emerging growth companies. In particular, in this prospectus, we have provided only two years of audited financial statements and have not included all of the executive compensation related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold equity interests. However, we have irrevocably elected not to avail ourselves of the extended transition period for complying with new or revised accounting standards, and, therefore, we are subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Our Corporate Information

We are a corporation organized under CBCA. Our company was initially incorporated under the name Diabex Inc. pursuant to The Corporations Act (Manitoba) by articles of incorporation dated January 21, 2000. Our articles were amended (i) on February 26, 2001 to change our corporate name to DiaMedica Inc., (ii) on April 11, 2016 to continue the Company from The Corporations Act (Manitoba) to the CBCA, (iii) on December 28, 2016 to change our corporate name to DiaMedica Therapeutics Inc., (iv) on September 24, 2018 to permit us to hold shareholder meetings in the U.S. and to permit our directors, between annual meetings of our shareholders, to appoint one or more additional directors to serve until the next annual meeting of shareholders; provided, however, that the number of additional directors shall not at any time exceed one-third of the number of directors who held office at the expiration of the last meeting of shareholders, and (v) on November 15, 2018 to effect a 1-for-20 consolidation of our common shares.

Our registered office is located at 301-1665 Ellis Street, Kelowna, British Columbia, V1Y 2B3 and our principal executive office is located at our wholly owned subsidiary, DiaMedica USA Inc., located at 2 Carlson Parkway, Suite 260, Minneapolis, Minnesota, USA 55447. Our telephone number is 763-496-5454. Our internet website address is http://www.diamedica.com. Information contained on our website does not constitute part of this prospectus.

7

The Offering

The following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus.

|

Issuer |

DiaMedica Therapeutics Inc. |

|

Common shares offered by us |

shares |

|

Over-allotment option |

The underwriter has an option for a period of 30 days from the date of this prospectus to purchase up to additional common shares from us at the initial public offering price, less the underwriting discounts and commissions to cover over-allotments, if any. |

|

Common shares to be outstanding immediately after this offering(1) |

common shares (or common shares if the underwriter exercises its option to purchase additional shares in full). |

|

Use of proceeds |

We estimate that the net proceeds from this offering, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million, or approximately $ million if the underwriter exercises its over-allotment option to purchase additional common shares from us in full, based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus. We intend to use the net proceeds from this offering to fund clinical development of DM199, to conduct research activities and for working capital and general corporate purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

|

Dividend policy |

We do not expect to pay any dividends or other distributions on our common shares in the foreseeable future. We currently intend to retain future earnings. See “Dividend Policy.” |

|

Risk factors |

You should read the “Risk Factors” section of this prospectus and the other information in this prospectus for a discussion of factors to consider carefully before deciding to invest in our common shares. |

|

Proposed listing |

We have applied to have our common shares listed on The Nasdaq Capital Market. No assurance can be given that such listing will be approved. |

|

Proposed Nasdaq Capital Market symbol |

DMAC |

8

|

(1) |

The number of common shares to be outstanding after this offering is based on 7,839,176 common shares outstanding as of September 30, 2018 and excludes: |

|

● |

639,359 common shares issuable upon the exercise of stock options outstanding under the DiaMedica Therapeutics Inc. Stock Option Plan as of September 30, 2018, at a weighted-average exercise price of $7.87 per share; |

|

● |

21,183 common shares issuable upon the settlement of deferred share units outstanding under the DiaMedica Therapeutics Inc. Deferred Share Unit Plan as of September 30, 2018; |

|

● |

123,374 common shares reserved for future issuance under the DiaMedica Therapeutics Inc. Stock Option and DiaMedica Therapeutics Inc. Deferred Share Unit Plans as of September 30, 2018; |

|

● |

825,264 common shares issuable upon the exercise of outstanding warrants as of September 30, 2018, at a weighted average exercise price of $6.67 per share; and |

|

● |

common shares issuable upon the exercise of the warrant that will be issued to the underwriter in connection with this offering, with an exercise price equal to 120% of the initial public offering price per share. |

Except as otherwise indicated, all information in this prospectus reflects the consummation of the 1-for-20 share consolidation of our common shares effected on November 15, 2018 and assumes the following:

|

● |

no exercise of options or warrants described above after September 30, 2018; and |

|

● |

no exercise by the underwriter of its option to purchase additional common shares to cover over-allotments. |

9

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables set forth summary consolidated financial data of our company. The summary consolidated statements of operations and comprehensive loss data for the years ended December 31, 2017 and 2016 and the consolidated balance sheet data as of December 31, 2017 as set forth below are derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations and comprehensive loss data for the nine months ended September 30, 2018 and 2017 and the consolidated balance sheet data as of September 30, 2018 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. These unaudited financial statements have been prepared on a basis consistent with our audited financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of such financial data.

The information is only a summary and you should read it in conjunction with our audited consolidated financial statements, including the related notes, and other financial information and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Historical results are not necessarily indicative of the results for future periods.

|

Year Ended |

Nine Months |

|||||||||||||||

|

2016 |

2017 |

2017 |

2018 |

|||||||||||||

|

(unaudited) |

||||||||||||||||

|

(in thousands, exept share and per share data) |

||||||||||||||||

|

Consolidated Statements of Operations Data: |

||||||||||||||||

|

Operating revenues: |

||||||||||||||||

|

License revenue |

$ | - | $ | - | $ | - | $ | 500 | ||||||||

|

Operating expenses: |

||||||||||||||||

|

Research and development |

1,728 | 3,206 | 2,577 | 3,071 | ||||||||||||

|

General and administrative |

598 | 1,313 | 941 | 2,073 | ||||||||||||

|

Total operating expenses |

2,326 | 4,519 | 3,518 | 5,144 | ||||||||||||

|

Loss from operations |

(2,326 | ) | (4,519 | ) | (3,518 | ) | (4,644 | ) | ||||||||

|

Other (income) expense |

||||||||||||||||

|

Governmental assistance - research incentives |

- | (244 | ) | (244 | ) | (1,046 | ) | |||||||||

|

Other (income) expense |

82 | (6 | ) | 14 | 61 | |||||||||||

|

Change in fair value of warrant liability |

(188 | ) | (9 | ) | 208 | 39 | ||||||||||

|

Total other (income) expense |

(106 | ) | (259 | ) | (22 | ) | (946 | ) | ||||||||

|

Loss before income tax |

(2,220 | ) | (4,260 | ) | (3,496 | ) | (3,698 | ) | ||||||||

|

Income tax |

- | - | - | 74 | ||||||||||||

|

Net loss & comprehensive loss |

$ | (2,220 | ) | $ | (4,260 | ) | $ | (3,496 | ) | $ | (3,772 | ) | ||||

|

Loss per share, basic and diluted |

$ | (0.47 | ) | $ | (0.72 | ) | $ | (0.60 | ) | $ | (0.51 | ) | ||||

|

Weighted average number of shares outstanding: |

||||||||||||||||

|

Basic and diluted |

4,735,751 | 5,935,790 | 5,848,178 | 7,406,378 | ||||||||||||

|

Consolidated Balance Sheet Data: |

||||||||||||||||

|

As of December 31, |

As of |

|||||||||||||||

|

2016 |

2017 |

September 30, 2018 |

||||||||||||||

|

Actual |

Actual |

Actual |

As Adjusted |

|||||||||||||

|

(unaudited) |

||||||||||||||||

|

Cash |

$ | 1,736 | $ | 1,353 | $ | 3,898 | $ | |||||||||

|

Working capital |

1,092 | 491 | 3,748 | |||||||||||||

|

Total assets |

1,875 | 1,802 | 5,463 | |||||||||||||

|

Total current liabilities |

764 | 1,003 | 1,353 | |||||||||||||

|

Total stockholders' equity |

1,111 | 799 | 4,110 | |||||||||||||

10

RISK FACTORS

An investment in our common shares involves a high degree of risk and should be considered speculative. An investment in our common shares should only be undertaken by those persons who can afford the total loss of their investment. You should consider carefully the risks and uncertainties described below, as well as other information contained in this prospectus, including our consolidated financial statements and the related notes. The risks and uncertainties below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we believe to be immaterial may also adversely affect our business. If any of the following risks occur, our business, financial condition, and results of operations could be seriously harmed and you could lose all or part of your investment. Further, if we fail to meet the expectations of the public market in any given period, the market price of our common shares could decline.

Risks Related to Our Financial Position and Need for Additional Capital

We have incurred substantial losses since our inception and expect to incur future losses and may never become profitable.

We are a clinical stage biopharmaceutical company focused on the development of novel recombinant proteins. Investment in biopharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that a product candidate will fail to prove effective, gain regulatory approval or become commercially viable. We do not have any products approved by regulatory authorities and have not generated any revenues from collaboration and licensing agreements or product sales to date, and have incurred significant research, development and other expenses related to our ongoing operations and expect to continue to incur such expenses. As a result, we have not been profitable and have incurred significant operating losses in every reporting period since our inception. For the nine months ended September 30, 2018, we incurred a net loss of $3.8 million and for the years ended December 31, 2017 and 2016, we incurred a net loss of $4.3 million and $2.2 million, respectively. As of September 30, 2018, we had an accumulated deficit of $44.0 million. Our operating losses are expected to increase in the near term as we continue our product development efforts and are expected to continue until such time as any future product sales, royalty payments, licensing fees, and/or milestone payments are sufficient to generate revenues to fund our continuing operations. In addition, we expect to our operating expenses to increase compared to last year as a result of our U.S. public reporting company status. We are unable to predict the extent of any future losses or when we will become profitable, if ever. Even if we do achieve profitability, we may not be able to sustain or increase profitability on an ongoing basis.

We currently have no product revenue and will not be able to maintain our operations and research and development activities without additional funding.

To date, we have primarily relied on equity financing to fund our working capital requirements and drug development activities. A substantial amount of additional capital is needed to develop our product candidate, DM199, or any future product candidates to a point where they may be commercially sold. Our future operations are dependent upon our ability to generate product sales, negotiate collaboration or license agreements, obtain research grant funding, defer expenditures or other strategic alternatives, and/or secure additional funds. While we are striving to achieve these plans, there is no assurance these and other strategies will be achieved or that such sources of funds will be available or obtained on favorable terms or obtained at all. Our ability to continue as a going concern is dependent on our ability to continue obtaining sufficient funds to conduct our research and development (“R&D”) activities and to successfully commercialize our product candidates.

We will require additional funds to finance our operations, which may not be available to us on acceptable terms, or at all. As a result, we may not complete the development and commercialization of our current product candidate or develop new product candidates.

We require significant additional funds for further R&D activities, planned clinical trials and the regulatory approval process. We expect the net proceeds of this offering to be sufficient to allow us to complete our current Phase II Remedy trial in patients with acute ischemic stroke and a Phase 1b and Phase II study in patients with chronic kidney disease. We do not expect the net proceeds of this offering to be sufficient to fund, and we expect to require additional funding to complete, the development of DM199 through regulatory approval and commercialization, which we may seek through public or private equity or debt financings or through collaborations with other biotechnology companies or other sources. We may raise additional funds for these purposes through public or private equity or debt financing, or through collaborations with other biotechnology companies, or financing from other sources may be undertaken. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our shareholders will be diluted. Debt financing, if available, may involve agreements that include conversion discounts or covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through government or other third-party funding, marketing and distribution arrangements or other collaborations, or strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or grant licenses on terms that may not be favorable to us. It is possible that financing will not be available or, if available, may not be on favorable terms. The availability of financing will be affected by the results of scientific and clinical research; the ability to attain regulatory approvals; market acceptance of our product candidates; the state of the capital markets generally with particular reference to pharmaceutical, biotechnology, and medical companies; the status of strategic alliance agreements; and other relevant commercial considerations. If adequate funding is not available, we may be required to implement cost reduction strategies; delay, reduce, or eliminate one or more of our product development programs; relinquish significant rights to product candidates or obtain funds on less favorable terms than we would otherwise accept; and/or divest assets through a merger, sale, or liquidation of our company.

There is substantial doubt about our ability to continue as a going concern.

The report of our independent registered public accounting firm on our December 31, 2017 audited consolidated financial statements includes an explanatory paragraph referring to our ability to continue as a going concern. As of December 31, 2017 and September 30, 2018, we had cash balances of approximately $1.4 million and $3.9 million, respectively. In addition, we had outstanding accounts payable and accrued liabilities of $919,000 and $1.4 million as of December 31, 2017 and September 30, 2018, respectively. On March 29, 2018, we completed, in two tranches, a brokered and non-brokered private placement of 1,322,965 units at a price of $4.90 per unit for aggregate gross proceeds of approximately $6.3 million. Each unit consisted of one common share and one half of one common share purchase warrant. Each whole warrant entitles the holder to purchase one common share at a price of $7.00 at any time prior to March 19, 2020 and March 29, 2020 for the first and second tranches, respectively, subject to earlier expiration under certain conditions. Additional funding will be required to continue our R&D and other operating activities as we have not reached successful commercialization of our product candidates. These circumstances cast significant doubt as to our ability to continue as a going concern.

We are exposed to the financial risk related to the fluctuation of foreign exchange rates and the degrees of volatility of those rates.

We may be adversely affected by foreign currency fluctuations. To date, we have been primarily funded through issuances of equity and proceeds from the exercise of warrants and stock options, which are denominated both in Canadian and U.S. dollars. Currently, the majority of our expenditures are in U.S. dollars, however, significant costs are also incurred in Canadian dollars, British pounds, and Australian dollars; and, therefore, we are subject to foreign currency fluctuations which may, from time to time, impact our financial position and results of operations.

Risks Related to our Business and our Industry

We are an early stage company with no approved products and no revenue from commercialization of our products.

We are at an early stage of development of our product candidate, DM199, for the treatment of AIS and CKD. We have not completed the development of any product candidate and, accordingly, have not begun to commercialize, any product candidate or generate any product revenues from any product candidate. DM199 requires significant additional clinical testing and investment prior to seeking marketing approval. A commitment of substantial resources by ourselves and potential partners to continue to conduct clinical trials for DM199 will be required to meet applicable regulatory standards, obtain required regulatory approvals, and to successfully commercialize this product candidate. DM199 is not expected to be commercially available for several years, if at all.

Our prospects depend on the success of our product candidate, DM199, which is at an early stage of development, and we may not generate revenue for several years, if at all, from this product candidate or any future product candidates.

We are highly dependent on the success of DM199 and we may not be able to successfully obtain regulatory or marketing approval for, or successfully commercialize, this product candidate. To date, we have expended significant time, resources and effort on the development of DM199, including conducting preclinical and clinical trials, for the treatment of acute ischemic stroke and chronic kidney disease. Although we intend to study the use of DM199 to treat multiple diseases, we have no other product candidates in our current clinical development pipeline. Our ability to generate product revenues and to achieve commercial success in the near term will initially depend almost entirely on our ability to successfully develop, obtain regulatory approval for and then successfully commercialize DM199. Prior to commercialization of any potential product, significant additional investments will be necessary to complete the development of DM199 or any future product candidates. Preclinical and clinical trial work must be completed before DM199 or any future product candidate could be ready for use within the markets that we have identified. We may fail to develop any products, to obtain regulatory approvals, to enter clinical trials, or to commercialize any products. Competitors may develop alternative products and methodologies to diagnose and treat the disease indications we are pursuing, thus reducing our competitive advantages. We do not know whether any of our product development efforts will prove to be effective, meet applicable regulatory standards, obtain the requisite regulatory approvals, be capable of being manufactured at a reasonable cost, or successfully marketed. The product candidate we are currently developing is not expected to be commercially viable for several years. In addition, our product candidate may cause undesirable side effects. Results of early preclinical research may not be indicative of the results that will be obtained in later stages of preclinical or clinical research. If regulatory authorities do not approve our product candidate or any future product candidates or if we fail to maintain regulatory compliance, we would have limited ability to commercialize our product candidate or any future product candidates, and our business and results of operations would be harmed. If we do succeed in developing viable products from our product candidates, we will face many potential obstacles such as the need to develop or obtain manufacturing, marketing, and distribution capabilities.

We rely and will continue to rely on third parties to plan, conduct, and monitor our preclinical and clinical trials, and their failure to perform as required could cause substantial harm to our business.

We rely and will continue to rely on third parties to conduct a significant portion of our preclinical and clinical development activities. Preclinical activities include in vivo studies providing access to specific disease models, pharmacology and toxicology studies, and assay development. Clinical development activities include trial design, regulatory submissions, clinical patient recruitment, clinical trial monitoring, clinical data management and analysis, safety monitoring, and project management. If there is any dispute or disruption in our relationship with third parties, or if they are unable to provide quality services in a timely manner and at a feasible cost, our active development programs may face delays. Further, if any of these third parties fails to perform as we expect or if their work fails to meet regulatory requirements, our testing could be delayed, cancelled, or rendered ineffective.

We rely on a contract manufacturer over whom we have limited control. If we are subject to quality, cost, or delivery issues with the preclinical and clinical grade materials supplied by this or future contract manufacturers, our business operations could suffer significant harm.

We rely on a contract manufacturing organization (“CMO”) to manufacture our product candidate, DM199, for our preclinical studies and clinical trials. We rely on this CMO for manufacturing, filling, packaging, storing, and shipping of drug product in compliance with current good manufacturing practices (“GMP”) regulations applicable to our product candidate. The U.S. Food and Drug Administration (“FDA”) ensures the quality of drug products by carefully monitoring drug manufacturers’ compliance with “GMP” regulations. The “GMP” regulations for drugs contain minimum requirements for the methods, facilities, and controls used in manufacturing, processing, and packing of a drug product.

There can be no assurances that this CMO will be able to meet our timetable and requirements. If we are unable to arrange for alternative third-party manufacturing sources on commercially reasonable terms or in a timely manner, we may be delayed in the development of DM199 and any future product candidates. Further, CMOs must operate in compliance with GMP regulations and failure to do so could result in, among other things, the disruption of product supplies. Our dependence upon this CMO and any future third parties for the manufacture of our product candidates may adversely affect our ability to develop our product candidates on a timely and competitive basis and, if we are able to commercialize our product candidates, may adversely affect our profit margins.

If clinical trials of our product candidates fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities or do not otherwise produce positive results, we would incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our product candidates.

Before obtaining marketing approval from regulatory authorities for the sale of our product candidates, we must conduct preclinical studies in animals and extensive clinical trials in humans to demonstrate the safety and efficacy of our product candidates. Clinical testing is expensive and difficult to design and implement, can take many years to complete, and has uncertain outcomes. The outcome of preclinical studies and early clinical trials may not predict the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials due to lack of efficacy or unacceptable safety profiles, notwithstanding promising results in earlier trials. We do not know whether the clinical trials we may conduct will demonstrate adequate efficacy and safety to result in regulatory approval to market any of our product candidates in any jurisdiction. A product candidate may fail for safety or efficacy reasons at any stage of the testing process. A major risk we face is the possibility that neither our current or future product candidates will successfully gain market approval from the FDA or other regulatory authorities, resulting in us being unable to derive any commercial revenue from them after investing significant amounts of capital in multiple stages of preclinical and clinical testing.

If we experience delays in clinical testing, we will be delayed in commercializing our product candidates, and our business may be substantially harmed.

We cannot predict whether any clinical trials will begin as planned, will need to be restructured, or will be completed on schedule, or at all. Our product development costs will increase if we experience delays in clinical testing. Significant clinical trial delays could shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before us, which would impair our ability to successfully commercialize our product candidates and may harm our financial condition, results of operations and prospects. The commencement and completion of clinical trials for our product candidates may be delayed for a number of reasons, including delays related, but not limited, to:

|

● |

failure by regulatory authorities to grant permission to proceed or placing the clinical trial on hold; |

|

● |

patients failing to enroll or remain in our trials at the rate we expect; |

|

● |

suspension or termination of clinical trials by regulators for many reasons, including concerns about patient safety or failure of our contract manufacturers to comply with GMP requirements; |

|

● |

any changes to our manufacturing process that may be necessary or desired; |

|

● |

delays or failure to obtain clinical supply from contract manufacturers of our product candidates necessary to conduct clinical trials; |

|

● |

product candidates demonstrating a lack of safety or efficacy during clinical trials; |

|

● |

patients choosing an alternative treatment for the indications for which we are developing any of our product candidates or participating in competing clinical trials; |

|

● |

patients failing to complete clinical trials due to dissatisfaction with the treatment, side effects, or other reasons; |

|

● |

reports of clinical testing on similar technologies and products raising safety and/or efficacy concerns; |

|

● |

competing clinical trials and scheduling conflicts with participating clinicians; |

|

● |

clinical investigators not performing our clinical trials on their anticipated schedule, dropping out of a trial, or employing methods not consistent with the clinical trial protocol, regulatory requirements or other third parties not performing data collection and analysis in a timely or accurate manner; |

|

● |

failure of our contract research organizations (“CROs”) to satisfy their contractual duties or meet expected deadlines; |

|

● |

inspections of clinical trial sites by regulatory authorities, Institutional Review Boards (“IRBs”) or ethics committees finding regulatory violations that require us to undertake corrective action, resulting in suspension or termination of one or more sites or the imposition of a clinical hold on the entire study; |

|

● |

one or more IRBs or ethics committees rejecting, suspending or terminating the study at an investigational site, precluding enrollment of additional subjects, or withdrawing its approval of the trial; or |

|

● |

failure to reach agreement on acceptable terms with prospective clinical trial sites. |

Our product development costs will increase if we experience delays in testing or approval or if we need to perform more or larger clinical trials than planned. Additionally, changes in regulatory requirements and policies may occur, and we may need to amend study protocols to reflect these changes. Amendments may require us to resubmit our study protocols to regulatory authorities or IRBs or ethics committees for re-examination, which may impact the cost, timing or successful completion of that trial. Delays or increased product development costs may have a material adverse effect on our business, financial condition, and prospects.

Even if we complete the necessary preclinical studies and clinical trials, the regulatory approval process is expensive, time-consuming and uncertain and may prevent us or any future collaborators from obtaining approvals for the commercialization of some or all of our product candidates. As a result, we cannot predict when or if, and in which territories, we, or any future collaborators, will obtain marketing approval to commercialize a product candidate.

The process of obtaining marketing approvals, both in the United States and abroad, is expensive and may take many years, if approval is obtained at all, and can vary substantially based upon a variety of factors, including the type, complexity and novelty of the product candidates involved.

Our current product candidate and the activities associated with its development and commercialization, including design, research, testing, manufacture, safety, efficacy, quality control, recordkeeping, labeling, packaging, storage, approval, advertising, promotion, sale, distribution, import, export, and reporting of safety and other post-market information, are subject to comprehensive regulation by the FDA, the European Medicines Agency (“EMA”) and other foreign regulatory agencies. Failure to obtain marketing approval for a product candidate will prevent us from commercializing the product candidate. We have only limited experience in filing and supporting the applications necessary to gain marketing approvals and expect to rely on third-parties to assist us in this process. Securing marketing approval requires the submission of extensive preclinical and clinical data and supporting information to regulatory authorities for each therapeutic indication to establish the product candidate's safety and efficacy. Securing marketing approval also requires the submission of information about the product manufacturing process to, and inspection of manufacturing facilities by, the regulatory authorities. The FDA, EMA or other regulatory authorities may determine that our product candidates may not be effective, may be only moderately effective or may prove to have undesirable or unintended side effects, toxicities or other characteristics that may preclude our obtaining marketing approval or prevent or limit commercial use. As a result, any marketing approval we ultimately obtain may be limited or subject to restrictions or post-approval commitments that render the approved product not commercially viable.

In addition, changes in marketing approval policies during the development period, changes in or the enactment of additional statutes or regulations, or changes in regulatory review for each submitted product application, may cause delays in the approval or rejection of an application. Regulatory authorities have substantial discretion in the approval process and may refuse to accept any application or may decide that our data is insufficient for approval and require additional preclinical, clinical or other studies. In addition, varying interpretations of the data obtained from preclinical and clinical testing could delay, limit or prevent marketing approval of a product candidate.

We are in litigation with Pharmaceutical Research Associates Group B.V., a contract research organization, seeking to compel them to comply with the terms of a clinical trial research agreement and their failure to perform as required could adversely affect our ability to obtain regulatory approval for DM199.

In March 2013, we entered into a clinical research agreement with Pharmaceutical Research Associates Group B.V. (“PRA”) to perform a double-blinded, placebo-controlled, single-dose and multiple-dose study to evaluate the safety, tolerability, pharmacokinetics, pharmacodynamics and proof of concept of DM199 in healthy subjects and in patients with Type 2 diabetes mellitus. In one arm of this study, we enrolled 36 patients with Type 2 diabetes who were treated with two SC dose levels of DM199 over a 28-day period. This study achieved its primary endpoint and demonstrated that DM199 was well tolerated. The secondary endpoints for this study, however, were not met. We believe there were significant execution errors in Part D of the study that were caused by protocol deviations occurring at the clinical trial site that were unable to be reconciled. We believe these included dosing errors and sample mix-ups. These errors undermined our ability to interpret the secondary endpoints. To date, we have been unable to obtain the complete study records from PRA for the arm of the study which included 36 patients with Type 2 diabetes and was intended to measure primary endpoints (safety, tolerability) and secondary endpoints (blood glucose concentration, insulin levels, glucose tolerance test and a variety of experimental biomarkers). Without these records and given our inability to reconcile the protocol deviations, we have been unable to generate a final study report. Due in part to these confounded secondary endpoints, we are not currently continuing the clinical study of DM199 for Type 2 diabetes. We believe that the consistently positive safety and tolerability demonstrated in our studies to date will allow us to pursue approval for the clinical study of DM199 in the treatment of CKD patients in the United States; however, the lack of a final study report may delay or prevent our ability to obtain the acceptance of an Investigational New Drug (“IND”) which would delay or prevent us from conducting clinical development or obtaining approval in the United States. We have initiated litigation with PRA to compel them to comply with the terms of the clinical research agreement, including providing full study records, and to recover damages. Litigation distracts the attention of our management from our business, is expensive and the outcome is uncertain.

We may not be able to obtain FDA acceptance of INDs to commence clinical trials in the United States on the timelines we expect, and even if we are able to, the FDA may not permit us to proceed in a timely manner, or at all.

Prior to commencing clinical trials in the United States for our current or any future product candidates, we will likely be required to have an accepted IND for each product candidate and for each targeted indication. We have not yet filed an IND to initiate a clinical trial for DM199 in the United States. However, submission of an IND may not result in the FDA allowing further clinical trials to begin and, once begun, issues may arise that will require us to suspend or terminate such clinical trials. Additionally, even if relevant regulatory authorities agree with the design and implementation of the clinical trials set forth in an IND, these regulatory authorities may change their requirements in the future. Failure to submit or have effective INDs and commence clinical programs will significantly limit our opportunity to generate revenue.

If we have difficulty enrolling patients in clinical trials, the completion of the trials may be delayed or not completed at all.

As DM199 and any future product candidates advance from preclinical testing to clinical testing, and then through progressively larger and more complex clinical trials, we will need to enroll an increasing number of patients that meet our eligibility criteria. There is significant competition for recruiting patients in clinical trials, and we may be unable to enroll the patients we need to complete clinical trials on a timely basis or at all. The factors that affect our ability to enroll patients are largely uncontrollable and include, but are not limited to, the following:

|

● |

size and nature of the patient population; |

|

● |

eligibility and exclusion criteria for the trial; |

|

● |

design of the study protocol; |

|

● |

competition with other companies for clinical sites or patients; |

|

● |

the perceived risks and benefits of the product candidate under study; |

|

● |

the patient referral practices of physicians; and |

|

● |

the number, availability, location, and accessibility of clinical trial sites. |

We may not be able to reproduce the results of previously conducted clinical studies and/or comparisons to other forms of KLK1, including Kailikang®, thereby displacing other forms of KLK1, including Kailikang®.

While there have been numerous studies demonstrating the efficacy of Kailikang®, we rely on the scientific and clinical knowledge and experience of other biotechnology and pharmaceutical companies and organizations in conducting those clinical studies. No assurance can be given that in our clinical trials involving DM199 we will be able to reproduce results of previously conducted studies or displace other forms of KLK1 in the market.

Negative results from clinical trials or studies of others and adverse safety events involving the targets of our product candidates may have an adverse impact on our future commercialization efforts.

From time to time, studies or clinical trials on various aspects of biopharmaceutical products are conducted by academic researchers, competitors, or others. The results of these studies or trials, when published, may have a significant effect on the market for the biopharmaceutical product that is the subject of the study. The publication of negative results of studies or clinical trials or adverse safety events related to our product candidates, or the therapeutic areas in which our product candidates compete, could adversely affect our share price and our ability to finance future development of our product candidates, and our business and financial results could be materially and adversely affected.

We may be required to suspend, repeat or terminate our clinical trials if they are not conducted in accordance with regulatory requirements, the results are negative or inconclusive, or the trials are not well designed.