SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

________________________________________________

DIAMEDICA THERAPEUTICS INC.

(Name of Registrant as Specified In Its Charter)

________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) |

Title of each class of securities to which transaction applies: ............................................................ |

|

(2) |

Aggregate number of securities to which transaction applies: ............................................................ |

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ............................................................ |

|

(4) |

Proposed maximum aggregate value of transaction: ............................................................ |

|

(5) |

Total fee paid: ............................................................ |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

Amount Previously Paid: ............................................................ |

|

(2) |

Form, Schedule or Registration Statement No.: ............................................................ |

|

(3) |

Filing Party: ............................................................ |

|

(4) |

Date Filed: ............................................................ |

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

May 22, 2019

The Annual General and Special Meeting of Shareholders of DiaMedica Therapeutics Inc., a corporation existing under the federal laws of Canada, will be held at the offices of Fox Rothschild LLP located at 222 South Ninth Street, Suite 2000, Minneapolis, Minnesota 55402, beginning at 2:30 p.m., Central Daylight Savings Time, on Wednesday, May 22, 2019, for the following purposes:

|

1. |

To receive the audited financial statements of DiaMedica Therapeutics Inc. for the financial year ended December 31, 2018 and accompanying report of the independent registered public accounting firm (for discussion only). |

|

2. |

To elect five persons to serve as directors until our next annual general meeting of shareholders or until their respective successors are elected and qualified (Voting Proposal One). |

|

3. |

To consider a proposal to approve the DiaMedica Therapeutics Inc. 2019 Omnibus Incentive Plan (Voting Proposal Two). |

|

4. |

To consider a proposal to approve the continuance of DiaMedica Therapeutics Inc. out of the Canadian federal jurisdiction under the Canada Business Corporations Act and into British Columbia under the Business Corporation Act (Voting Proposal Three). |

|

5. |

To consider a proposal to appoint Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019 and to authorize the Board of Directors to fix our independent registered public accounting firm’s remuneration (Voting Proposal Four). |

|

6. |

To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

The Canada Business Corporations Act provides that a registered shareholder who properly dissents from the continuance resolutions (Voting Proposal Three) is entitled to be paid the fair value of the shareholder’s shares in accordance with Section 190 of the Canada Business Corporations Act if the continuance is completed. This right is described in detail in the accompanying proxy statement under the heading “Rights of Dissent in Respect of the Continuance Proposal.” Failure to strictly comply with the requirements of Section 190 of the Canada Business Corporations Act may result in the loss of any right to dissent.

Only those shareholders of record at the close of business on March 28, 2019 will be entitled to notice of, and to vote at, the meeting and any adjournments thereof. A shareholder list will be available at our corporate offices beginning April 8, 2019 during normal business hours for examination by any shareholder registered on our common share ledger as of the record date, March 28, 2019, for any purpose germane to the meeting.

| By Order of the Board of Directors, | |

| /s/ Scott Kellen | |

| Scott Kellen | |

| Corporate Secretary |

April 8, 2019

Minneapolis, Minnesota

| Important: Whether or not you expect to attend the meeting in person, please vote by the Internet or telephone, or request a paper proxy card to sign, date and return by mail so that your shares may be voted. A prompt response is helpful and your cooperation is appreciated. |

TABLE OF CONTENTS

________________

Page

|

INTERNET AVAILABILITY OF PROXY MATERIALS |

3 |

|

GENERAL INFORMATION ABOUT THE ANNUAL GENERAL AND SPECIAL MEETING AND VOTING |

4 |

|

Date, Time, Place and Purposes of Meeting |

4 |

|

Who Can Vote |

4 |

|

How You Can Vote |

4 |

|

How Does the Board of Directors Recommend that You Vote |

6 |

|

How You May Change Your Vote or Revoke Your Proxy |

6 |

|

Quorum Requirement |

6 |

|

Vote Required |

6 |

|

Appointment of Proxyholders |

7 |

|

Other Business |

8 |

|

Procedures at the Meeting |

8 |

|

Householding of Meeting Materials |

8 |

|

Proxy Solicitation Costs |

8 |

|

VOTING PROPOSAL ONE—ELECTION OF DIRECTORS |

9 |

|

Board Size and Structure |

9 |

|

Information about Current Directors and Board Nominees |

9 |

|

Additional Information about Current Directors and Board Nominees |

9 |

|

Penalties or Sanctions |

12 |

|

Corporate Cease Trade Orders or Bankruptcies |

12 |

|

Board Recommendation |

12 |

|

VOTING PROPOSAL TWO— APPROVAL OF DIAMEDICA THERAPEUTICS INC. 2019 OMNIBUS INCENTIVE PLAN |

13 |

|

Background |

13 |

|

Summary of Sound Governance Features of the 2019 Plan |

13 |

|

Summary of the 2019 Plan Features |

14 |

|

U.S. Federal Income Tax Information |

20 |

|

New Plan Benefits |

22 |

|

Board of Directors Recommendation |

22 |

|

VOTING PROPOSAL THREE— CONTINUANCE OF DIAMEDICA THERAPEUTICS INC. FROM THE CANADA BUSINESS CORPORATIONS ACT TO BRITISH COLUMBIA’S BUSINESS CORPORATION ACT |

23 |

|

Introduction |

23 |

|

Continuance Process |

23 |

|

Effect of Continuance |

24 |

|

Comparison of CBCA and BCBCA |

24 |

|

Board of Directors |

25 |

|

Charter Documents |

25 |

|

Changes to Charter Documents |

25 |

|

Shareholder Proposals and Shareholder Requisitions |

26 |

|

Comparison of Rights of Dissent and Appraisal |

26 |

|

Oppression Remedies |

27 |

|

Shareholder Derivative Actions |

27 |

|

Place of Meetings |

28 |

|

Flexibility in Structuring Transactions |

28 |

|

Constitutional Jurisdiction |

28 |

|

Comparison of New Articles to Current By-Laws |

29 |

|

Continuance Resolution |

30 |

|

Rights of Dissent in Respect of the Continuance Proposal |

31 |

|

Board Recommendation |

33 |

|

PROPOSAL FOUR—APPOINTMENT OF BAKER TILLY VIRCHOW KRAUSE, LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AND AUTHORIZATION TO THE BOARD OF DIRECTORS TO FIX THE AUDITORS’ REMUNERATION |

34 |

|

Appointment of Independent Registered Public Accounting Firm |

34 |

|

Change in Independent Auditor for Canadian Federal Securities Law Purposes |

34 |

|

Audit, Audit-Related, Tax and Other Fees |

35 |

|

Audit Committee Pre-Approval Policies and Procedures |

35 |

|

Board Recommendation |

35 |

|

STOCK OWNERSHIP |

36 |

|

Security Ownership of Certain Beneficial Owners |

36 |

|

Security Ownership of Management |

37 |

|

Section 16(a) Beneficial Ownership Reporting Compliance |

38 |

|

Securities Authorized for Issuance Under Equity Compensation Plans |

39 |

|

CORPORATE GOVERNANCE |

40 |

|

Management by Board of Directors |

40 |

|

Corporate Governance Guidelines |

40 |

|

Board Leadership Structure |

41 |

|

Director Independence |

42 |

|

Board and Committee Meetings and Attendance |

42 |

|

Board Committees |

42 |

|

Audit Committee |

43 |

|

Compensation Committee |

45 |

|

Nominating and Corporate Governance Committee |

46 |

|

Board Diversity |

47 |

|

Role of Board in Risk Oversight Process |

48 |

|

Code of Business Conduct and Ethics |

48 |

|

Policy Regarding Director Attendance at Annual General Meetings of Shareholders |

49 |

|

Complaint Procedures |

49 |

|

Process Regarding Shareholder Communications with Board of Directors |

49 |

|

DIRECTOR COMPENSATION |

50 |

|

Non-Employee Director Compensation |

50 |

|

Non-Employee Director Compensation Program |

50 |

|

Limitation of Liability and Indemnification Matters |

51 |

|

EXECUTIVE COMPENSATION |

52 |

|

Executive Compensation Overview |

52 |

|

Indemnification Agreements |

56 |

|

Summary Compensation Table |

57 |

|

Outstanding Equity Awards at Fiscal Year-End |

58 |

|

Employee Benefit and Stock Plans |

59 |

|

RELATED PERSON RELATIONSHIPS AND TRANSACTIONS |

61 |

|

Introduction |

61 |

|

Description of Related Party Transactions |

61 |

|

Policies and Procedures for Related Party Transactions |

63 |

|

SHAREHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR 2020 ANNUAL GENERAL MEETING OF SHAREHOLDERS |

65 |

|

Shareholder Proposals for 2020 Meeting |

65 |

|

Director Nominations for 2020 Annual General Meeting |

65 |

|

COPIES OF FISCAL 2018 ANNUAL REPORT AND ADDITIONAL INFORMATION |

66 |

| APPENDIX A DIAMEDICA THERAPEUTICS INC. 2019 OMNIBUS INCENTIVE PLAN | A-1 |

| APPENDIX B PROPOSED ARTICLES | B-1 |

| APPENDIX C DISSENTER’S RIGHTS PROVISIONS | C-1 |

| APPENDIX D CHANGE IN AUDITOR REPORTING PACKAGE | D-1 |

INTERNET AVAILABILITY OF PROXY MATERIALS

________________

Instead of mailing a printed copy of our proxy materials, including our Annual Report to Shareholders, to each shareholder of record, we have provided access to these materials in a fast and efficient manner via the Internet. We believe that this process expedites your receipt of our proxy materials, lowers the costs of our meeting and reduces the environmental impact of our meeting. On or about April 8, 2019, we expect to begin mailing a Notice of Internet Availability of Proxy Materials to shareholders of record as of March 28, 2019 and post our proxy materials on the website referenced in the Notice of Internet Availability of Proxy Materials (www.proxyvote.com). As more fully described in the Notice of Internet Availability of Proxy Materials, shareholders may choose to access our proxy materials at www.proxyvote.com or may request proxy materials in printed or electronic form. In addition, the Notice of Internet Availability of Proxy Materials and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. For those who previously requested printed proxy materials or electronic materials on an ongoing basis, you will receive those materials as you requested.

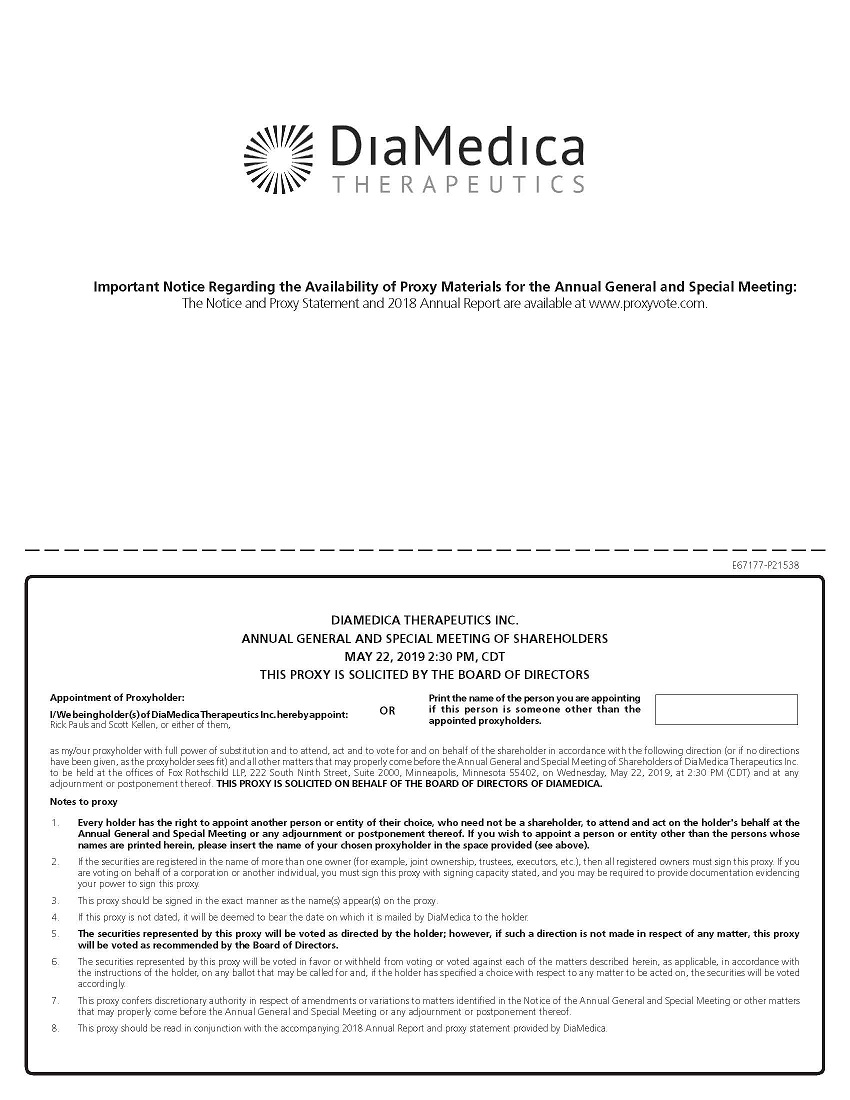

Important Notice Regarding the Availability of Proxy Materials

for the Annual General and Special Meeting of Shareholders to be Held on May 22, 2019:

The Notice of Annual General and Special Meeting of Shareholders and Proxy Statement and

Annual Report to Shareholders, including our Annual Report on Form 10-K

for the fiscal year ended December 31, 2018, are available at www.proxyvote.com.

2 Carlson Parkway, Suite 260, Minneapolis, Minnesota 55447

____________________________________

PROXY STATEMENT FOR

ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

May 22, 2019

____________________________________

The Board of Directors of DiaMedica Therapeutics Inc. is soliciting your proxy for use at the 2019 Annual General and Special Meeting of Shareholders to be held on Wednesday, May 22, 2019. The Board of Directors expects to make available to our shareholders beginning on or about April 8, 2019 the Notice of Annual General and Special Meeting of Shareholders, this proxy statement and a form of proxy on the Internet or has sent these materials to shareholders of DiaMedica upon their request.

GENERAL INFORMATION ABOUT THE ANNUAL GENERAL AND

SPECIAL MEETING AND VOTING

________________

Date, Time, Place and Purposes of Meeting

The Annual General and Special Meeting of Shareholders of DiaMedica Therapeutics Inc. (sometimes referred to as “DiaMedica,” “we,” “our” or “us” in this proxy statement) will be held on Wednesday, May 22, 2019, at 2:30 p.m., Central Daylight Savings Time, at the offices of Fox Rothschild LLP located at 222 South Ninth Street, Suite 2000, Minneapolis, Minnesota 55402, for the purposes set forth in the Notice of Annual General and Special Meeting of Shareholders.

Who Can Vote

Shareholders of record at the close of business on March 28, 2019 will be entitled to notice of and to vote at the Annual General and Special Meeting or any adjournment thereof. As of that date, there were 11,956,874 of our voting common shares (common shares or shares) outstanding. Each common share is entitled to one vote on each matter to be voted on at the Annual General and Special Meeting (meeting). Shareholders are not entitled to cumulate voting rights.

How You Can Vote

Your vote is important. Whether you hold shares directly as a shareholder of record or beneficially in “street name” (through a broker, bank or other nominee), you may vote your shares without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker, bank or other nominee.

If you are a registered shareholder whose shares are registered in your name, you may vote your shares in person at the meeting or by one of the three following methods:

|

● |

Vote by Internet, by going to the website address http://www.proxyvote.com and following the instructions for Internet voting shown on the Notice of Internet Availability of Proxy Materials or on your proxy card. |

|

● |

Vote by Telephone, by dialing 1-800-690-6903 and following the instructions for telephone voting shown on the Notice of Internet Availability of Proxy Materials or on your proxy card. |

|

● |

Vote by Proxy Card, by completing, signing, dating and mailing the enclosed proxy card in the envelope provided if you received a paper copy of these proxy materials. |

If you vote by Internet or telephone, please do not mail your proxy card.

If your shares are held in “street name” (through a broker, bank or other nominee), you may receive a separate voting instruction form with this proxy statement or you may need to contact your broker, bank or other nominee to determine whether you will be able to vote electronically using the Internet or telephone.

The deadline for voting by telephone or by using the Internet is 11:59 p.m., Eastern Daylight Savings Time (10:59 p.m., Central Daylight Savings Time), on the day before the date of the meeting or any adjournments thereof. Please see the Notice of Internet Availability of Proxy Materials, your proxy card or the information your bank, broker, or other holder of record provided to you for more information on your options for voting.

If you return your signed proxy card or use Internet or telephone voting before the meeting, the named proxies will vote your shares as you direct. You have multiple choices on each matter to be voted on as follows:

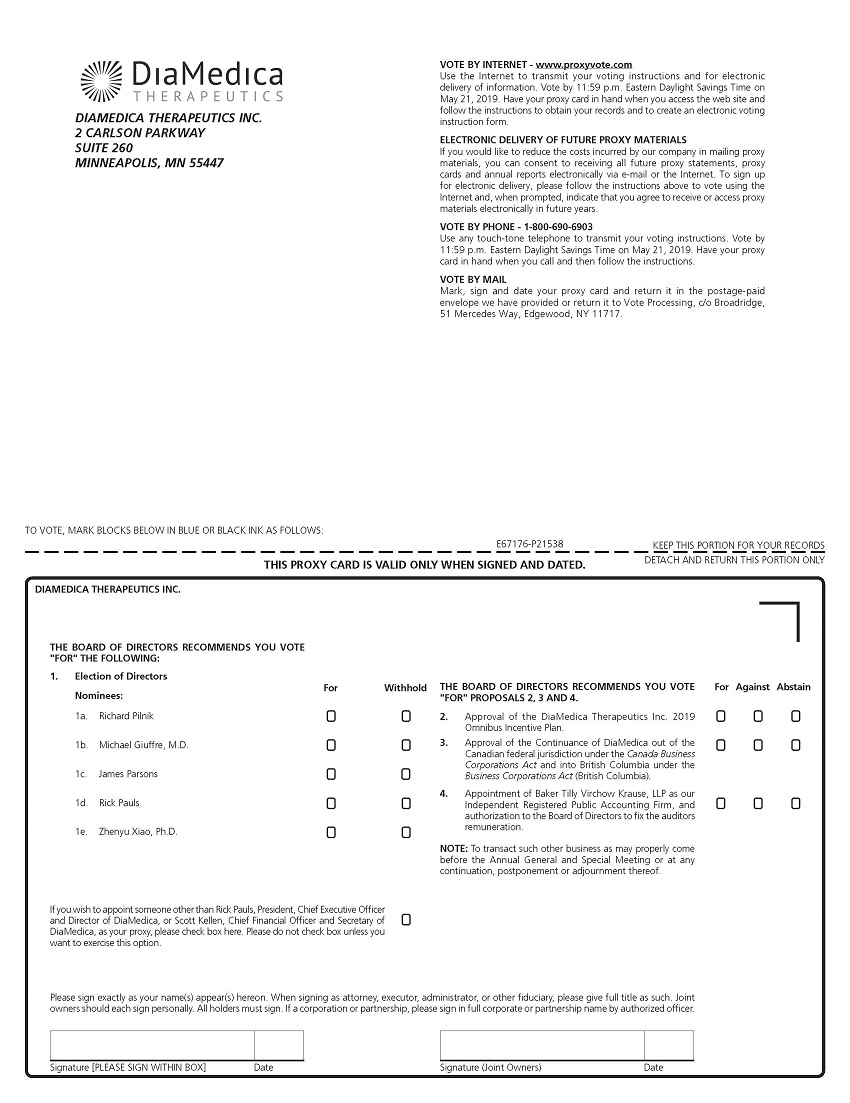

For Voting Proposal One—Election of Directors, you may:

|

● |

Vote FOR all five nominees for director, |

|

● |

WITHHOLD your vote from one or more of the five nominees for director. |

For each of the other voting proposals, you may:

|

● |

Vote FOR the proposal, |

|

● |

Vote AGAINST the proposal or |

|

● |

ABSTAIN from voting on the proposal. |

If you send in your proxy card or use Internet or telephone voting, but do not specify how you want to vote your shares, the proxies will vote your shares FOR all five of the nominees for election to the Board of Directors in Voting Proposal One—Election of Directors and FOR each of the other voting proposals.

How Does the Board of Directors Recommend that You Vote

The Board of Directors unanimously recommends that you vote:

|

● |

FOR all five of the nominees for election to the Board of Directors in Voting Proposal One—Election of Directors; |

|

● |

FOR Voting Proposal Two— Approval of the DiaMedica Therapeutics Inc. 2019 Omnibus Incentive Plan; |

|

● |

FOR Voting Proposal Three— Approval of the Continuance of DiaMedica from the Canada Business Corporations Act to British Columbia’s Business Corporation Act; and |

|

● |

FOR Voting Proposal Four—Appointment of Baker Tilly Virchow and Krause, LLP as our Independent Registered Public Accounting Firm, and authorization to the Board of Directors to fix the auditors’ remuneration (Voting Proposal Four). |

How You May Change Your Vote or Revoke Your Proxy

If you are a shareholder whose shares are registered in your name, you may revoke your proxy at any time before it is voted by one of the following methods:

|

● |

Submitting another proper proxy with a more recent date than that of the proxy first given by following the Internet or telephone voting instructions or completing, signing, dating and returning a proxy card to us; |

|

● |

Sending written notice of your revocation to our Corporate Secretary; or |

|

● |

Attending the meeting and voting by ballot. |

Quorum Requirement

The presence at the meeting of at least two persons, present in person or by proxy, holding or representing by proxy not less than one-third (1/3) of our outstanding share (3,981,640 common shares) as of the record date will constitute a quorum for the transaction of business at the meeting. In general, our common shares represented by proxies marked “For,” “Against,” “Abstain” or “Withheld” are counted in determining whether a quorum is present. In addition, a “broker non-vote” is counted in determining whether a quorum is present. A “broker non-vote” is a proxy returned by a broker on behalf of its beneficial owner customer that is not voted on a particular matter because voting instructions have not been received by the broker from the customer and the broker has no discretionary authority to vote on behalf of such customer on such matter.

Vote Required

If your shares are held in “street name” and you do not indicate how you wish to vote, your broker is permitted to exercise its discretion to vote your shares only on certain “routine” matters. Voting Proposal One—Election of Directors, Voting Proposal Two— Approval of the DiaMedica Therapeutics Inc. 2019 Omnibus Incentive Plan and Voting Proposal Three— Approval of the Continuance of DiaMedica from the Canada Business Corporations Act to British Columbia’s Business Corporation Act are not “routine” matters. Accordingly, if you do not direct your broker how to vote, your broker may not exercise discretion and may not vote your shares on either of these three proposals. This is called a “broker non-vote” and although your shares will be considered to be represented by proxy at the meeting, they will not be considered to be shares “entitled to vote” or “votes cast” at the meeting and will not be counted as having been voted on the applicable proposal. Voting Proposal Four—Appointment of Baker Tilly Virchow Krause, LLP as our Independent Registered Public Accounting Firm and authorization to the Board of Directors to fix the auditors’ remuneration is a “routine” matter and, as such, your broker is permitted to exercise its discretion to vote your shares for or against the proposal in the absence of your instruction.

The table below indicates the vote required for each voting proposal, the effect of votes withheld or abstentions and the effect of any broker non-votes.

|

Voting Proposal |

Votes Required |

Effect of Votes Withheld / Abstentions |

Effect of Broker Non-Votes |

|||

|

Voting Proposal One: Election of Directors |

Affirmative vote of a majority of votes cast on the voting proposal. |

Abstentions will have no effect. |

Broker non-votes will have no effect. |

|||

|

Voting Proposal Two: Approval of the DiaMedica Therapeutics Inc. 2019 Omnibus Incentive Plan |

Affirmative vote of a majority of votes cast on the voting proposal. |

Abstentions will have no effect. |

Broker non-votes will have no effect. |

|||

|

Voting Proposal Three: Approval of the Continuance from the Canada Business Corporations Act to British Columbia’s Business Corporation Act |

Affirmative vote of at least two-thirds of the votes cast on the voting proposal. |

Abstentions will have no effect. |

Broker non-votes will have no effect. |

|||

|

Voting Proposal Four: Appointment of Independent Registered Public Accounting Firm and Auditors’ Remuneration |

Affirmative vote of a majority of votes cast on the voting proposal. |

Abstentions will have no effect. |

We do not expect any broker non-votes on this proposal. |

Appointment of Proxyholders

The persons named in the accompanying proxy card are officers of DiaMedica.

A shareholder has the right to appoint a person or company to attend and act for the shareholder and on that shareholder’s behalf at the meeting other than the persons designated in the enclosed proxy card. A shareholder wishing to exercise this right should strike out the names now designated in the enclosed proxy card and insert the name of the desired person or company in the blank space provided. The desired person need not be a shareholder of DiaMedica.

Only a registered shareholder at the close of business on March 28, 2019 will be entitled to vote, or grant proxies to vote, his, her or its common shares, as applicable, at the meeting.

If your common shares are registered in your name, then you are a registered shareholder. However, if, like most shareholders, you keep your common shares in a brokerage account, then you are a beneficial shareholder. The process for voting is different for registered shareholders and beneficial shareholders. Registered shareholders and beneficial shareholders should carefully read the instructions herein if they wish to vote their common shares at the meeting.

Other Business

Our management does not intend to present other items of business and knows of no items of business that are likely to be brought before the meeting, except those described in this proxy statement. However, if any other matters should properly come before the meeting, the persons named on the proxy card will have discretionary authority to vote such proxy in accordance with their best judgment on the matters.

Procedures at the Meeting

The presiding officer at the meeting will determine how business at the meeting will be conducted. Only matters brought before the meeting in accordance with our By-laws will be considered.

Only a natural person present at the meeting who is either one of our shareholders, or is acting on behalf of one of our shareholders, may make a motion or second a motion. A person acting on behalf of a shareholder must present a written statement executed by the shareholder or the duly-authorized representative of the shareholder on whose behalf the person purports to act.

Householding of Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements, annual reports and the Notice of Internet Availability of Proxy Materials. This means that only one copy of this proxy statement, our Annual Report to Shareholders or the Notice of Internet Availability of Proxy Materials may have been sent to each household even though multiple shareholders are present in the household. We will promptly deliver a separate copy of any of these documents to any shareholder upon written or oral request to Corporate Secretary, DiaMedica Therapeutics Inc., 2 Carlson Parkway, Suite 260, Minneapolis, Minnesota 55417, telephone: (763) 312-6755. Any shareholder who wants to receive separate copies of this proxy statement, our Annual Report to Shareholders or the Notice of Internet Availability of Proxy Materials in the future, or any shareholder who is receiving multiple copies and would like to receive only one copy per household, should contact the shareholder’s bank, broker or other nominee record holder, or the shareholder may contact us at the above address and telephone number.

Proxy Solicitation Costs

The cost of soliciting proxies, including the preparation, assembly, electronic availability and mailing of proxies and soliciting material, as well as the cost of making available or forwarding this material to the beneficial owners of our common shares will be borne by DiaMedica. Our directors, officers and regular employees may, without compensation other than their regular compensation, solicit proxies by telephone, e-mail, facsimile or personal conversation. We may reimburse brokerage firms and others for expenses in making available or forwarding solicitation materials to the beneficial owners of our common shares.

VOTING PROPOSAL ONE—ELECTION OF DIRECTORS

________________

Board Size and Structure

Our By-laws provide that the Board of Directors will consist of at least three members and not more than 10 members. The Board of Directors has fixed the number of directors at five. Pursuant to the Canada Business Corporations Act and our By-laws, at least 25% of our directors must be resident Canadians.

Information about Current Directors and Board Nominees

The Board of Directors has nominated the following five individuals to serve as our directors until the next annual general meeting of shareholders or until their respective successors are elected and qualified. All of the nominees named below are current members of the Board of Directors.

The following table sets forth as of March 31, 2019 the name, age and position of each current director and each individual who has been nominated by the Board of Directors to serve as a director of our company:

|

Name |

Age |

Position |

||

|

Richard Pilnik(1)(2)(3)(4) |

62 |

Chairman of the Board |

||

|

Michael Giuffre, M.D.(1)(2)(3)(4) |

63 |

Director |

||

|

James Parsons(1)(2)(3)(4) |

53 |

Director |

||

|

Rick Pauls |

47 |

President and Chief Executive Officer, Director |

||

|

Zhenyu Xiao, Ph.D.(1) |

45 |

Director |

|

(1) |

Independent Director |

|

(2) |

Member of the Audit Committee |

|

(3) |

Member of the Compensation Committee |

|

(4) |

Member of the Nominating and Corporate Governance Committee |

The present principal occupations and recent employment history of each of our directors are set forth below.

Additional Information about Current Directors and Board Nominees

The following paragraphs provide information about each current director and nominee for director, including all positions held, principal occupation and business experience for the past five years, and the names of other publicly-held companies of which the director or nominee currently serves as a director or has served as a director during the past five years. We believe that all of our directors and nominees display personal and professional integrity; satisfactory levels of education and/or business experience; broad-based business acumen; an appropriate level of understanding of our business and its industry and other industries relevant to our business; the ability and willingness to devote adequate time to the work of the Board of Directors and its committees; a fit of skills and personality with those of our other directors that helps build a board that is effective, collegial and responsive to the needs of our company; strategic thinking and a willingness to share ideas; a diversity of experiences, expertise and background; and the ability to represent the interests of all of our shareholders. The information presented below regarding each director and nominee also sets forth specific experience, qualifications, attributes and skills that led the Board of Directors to the conclusion that such individual should serve as a director in light of our business and structure.

Richard Pilnik has served as a member of the board of directors since May 2009. Mr. Pilnik serves as our Chairman of the Board. Mr. Pilnik has served as the President and member of the board of directors of Vigor Medical Services, Inc., a medical device company, since May 2017. From December 2015 to November 2017, Mr. Pilnik served as a member of the board of directors of Chiltern International Limited, a private leading mid-tier Clinical Research Organization, and was Chairman of the Board from April 2016 to November 2017. Mr. Pilnik has a 30-year career in healthcare at Eli Lilly and Company, a pharmaceutical company, and Quintiles Transnational Corp., a global pioneer in pharmaceutical services. From April 2009 to June 2014, Mr. Pilnik served as Executive Vice President and President of Quintiles Commercial Solutions, an outsourcing business to over 70 pharma and biotech companies. Prior to that, he spent 25 years at Eli Lilly and Company where he held several leadership positions, most recently as Group Vice President and Chief Marketing Officer from May 2006 to July 2008. Mr. Pilnik was directly responsible for commercial strategy, market research, new product planning and the medical marketing interaction. From December 2000 to May 2006, Mr. Pilnik served as President of Eli Lilly Europe, Middle East and Africa and the Commonwealth of Independent States, a regional organization of former Soviet Republics, and oversaw 50 countries and positioned Eli Lilly as the fastest growing pharmaceutical company in the region. Mr. Pilnik also held several marketing and sales management positions in the United States, Europe and Latin America. Mr. Pilnik currently serves on the board of directors of Vigor Medical Systems, Inc., NuSirt, an early-stage biopharma, and the Duke University Fuqua School of Business. Mr. Pilnik previously served on the board of directors of Elan Pharmaceuticals, Chiltern International, the largest mid-size Clinical Research Organization, and Certara, L.P., a private biotech company focused on drug development modeling and biosimulation. Mr. Pilnik holds a Bachelor of Arts in Economics from Duke University and an MBA from the Kellogg School of Management at Northwestern University. Mr. Pilnik is a resident of Florida, USA.

We believe that Mr. Pilnik’s deep experience in the industry and his history and knowledge of our company enable him to make valuable contributions to the Board of Directors.

Michael Giuffre, M.D. has served as a member of the Board of Directors since August 2010. Since July 2009, Dr. Giuffre has served as a Clinical Professor of Cardiac Sciences and Pediatrics at the University of Calgary and has had an extensive portfolio of clinical practice, cardiovascular research and university teaching. Dr. Giuffre is actively involved in health care delivery, medical leadership and in the biotechnology business sector. Since 2012, Dr. Giuffre has served as the Chief Scientific Officer and a member of the board of directors of FoodChek Systems Inc. and in November 2017, he became Chairman of the Board. Dr. Giuffre also serves as President of FoodChek Laboratories Inc. Dr. Giuffre previously served on the board of directors of the Canadian Medical Association (CMA), Unicef Canada, the Alberta Medical Association (AMA), Can-Cal Resources Ltd, Vacci-Test Corporation, IC2E International Inc., MedMira Inc. and Brightsquid Dental, Inc. Dr. Giuffre has received a Certified and Registered Appointment and a Distinguished Fellow appointment by the American Academy of Cardiology (FACC). In 2005, he was awarded Physician of the Year by the Calgary Medical Society and in 2017 was “Mentor of the Year” for the Royal College of Physicians and Surgeons of Canada. Dr. Giuffre was also a former President of the AMA and the Calgary and Area Physicians Association and also a past representative to the board of the Calgary Health Region. Dr. Giuffre holds a Bachelor of Science in cellular and microbial biology, a Ph.D. candidacy in molecular virology, an M.D. and an M.B.A. He is Canadian Royal College board certified in specialties that include Pediatrics and Pediatric Cardiology and has a subspecialty in Pediatric Cardiac Electrophysiology. Dr. Giuffre is a member of the board of directors of Avenue Living, a private real estate company in Calgary, Alberta, Canada and its affiliates, Avondale Real Estate Capital Ltd. and AgriSelect Land Capital, Ltd., both private real estate companies in Calgary, Alberta Canada. Dr. Giuffre is a resident of Canada. Dr. Giuffre is a resident of Alberta, Canada.

We believe that Dr. Giuffre’s medical experience, including as a practicing physician and professor, enable him to make valuable contributions to the Board of Directors.

James Parsons has served as a member of the Board of Directors since October 2015. Previously, Mr. Parsons served as our Vice President of Finance from October 2010 until May 2014. Since August 2011, Mr. Parsons has served as Chief Financial Officer and Corporate Secretary of Trillium Therapeutics Inc., a Nasdaq-listed immuno-oncology company. Mr. Parsons serves as a member of the board of directors and audit committee chair of Sernova Corp., which is listed on the TSX Venture Exchange. Mr. Parsons has been a Chief Financial Officer in the life sciences industry since 2000 with experience in therapeutics, diagnostics and devices. Mr. Parsons has a Master of Accounting degree from the University of Waterloo and is a Chartered Professional Accountant and Chartered Accountant. Mr. Parsons is a resident of Ontario, Canada.

We believe that Mr. Parsons’ financial experience, including his history and knowledge of our company, enable him to make valuable contributions to the Board of Directors.

Rick Pauls was appointed our President and Chief Executive Officer in January 2010. Mr. Pauls has served as a member of the Board of Directors since April 2005 and the Chairman of the Board from April 2008 to July 2014. Prior to joining DiaMedica, Mr. Pauls was the Co-Founder and Managing Director of CentreStone Ventures Inc., a life sciences venture capital fund, from February 2002 until January 2010. Mr. Pauls was an analyst for Centara Corporation, another early stage venture capital fund, from January 2000 until January 2002. From June 1997 until November 1999, Mr. Pauls worked for General Motors Acceptation Corporation specializing in asset-backed securitization and structured finance. Mr. Pauls previously served as an independent member of the board of directors of LED Medical Diagnostics, Inc. Mr. Pauls received his Bachelor of Arts in Economics from the University of Manitoba and his M.B.A. in Finance from the University of North Dakota. Mr. Pauls is a resident of Minnesota, USA.

We believe that Mr. Pauls’s experience in the biopharmaceutical industry as an executive and investor and his extensive knowledge of all aspects of our company, business, industry, and day-to-day operations as a result of his role as our President and Chief Executive Officer enable him to make valuable contributions to the Board of Directors. In addition, as a result of his role as President and Chief Executive Officer, Mr. Pauls provides unique insight into our future strategies, opportunities and challenges, and serves as the unifying element between the leadership and strategic direction provided by the Board of Directors and the implementation of our business strategies by management.

Zhenyu Xiao, Ph.D. has served as a member of the Board of Directors since November 2016. Dr. Xiao was elected to the Board of Directors as a designee of Hermeda Industrial Co., Limited under an investment agreement which is described in more detail under “Related Persons Relationships and Transactions— Relationship with Hermeda Industrial Co., Limited.” Dr. Xiao has been the Chief Executive Officer of Hermed Equity Investment Management (Shanghai) Co., Ltd., a private equity fund. From June 2008 to November 2014, Dr. Xiao was the Associate General Manager of Shanghai Fosun Pharmaceutical Group Co Ltd., a pharmaceutical manufacturing company, where he was the deputy chief of the IPO team for the Fosun Pharma Listing in Hong Kong Exchange and the deputy director of Fosun Pharmaceutical Technological Center in charge of evaluating new technology and R&D and investment. Dr. Xiao has a Ph.D. degree in Pharmacology and conducted his postdoctoral research at University of Rochester (NY), co-founding a pharmaceutical company with Dr. Paul Okunieff and winning Small Business Technology Transfer support, a U.S. Small Business Administration program to facilitate joint venture opportunities between small businesses and non-profit research institutions. Mr. Xiao is a resident of Shanghai, China.

We believe that Dr. Xiao’s experience in the industry, including as an investor, enable him to make valuable contributions to the Board of Directors.

Penalties or Sanctions

To the knowledge of the Board of Directors and our management, none of our directors or director nominees as of the date of this proxy statement is or has been subject to:

|

● |

any penalties or sanctions imposed by a court relating to a securities legislation or by a securities regulatory authority or has entered in a settlement agreement with a securities regulatory authority; or |

|

● |

any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a director nominee. |

Corporate Cease Trade Orders or Bankruptcies

To the knowledge of the Board of Directors and our management, none of our directors or director nominees as of the date of this proxy statement is or has been, within 10 years before the date of this proxy statement, a director, chief executive officer or chief financial officer of any company (including DiaMedica) that, while that person was acting in that capacity:

|

● |

was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or |

|

● |

was subject to an event that resulted, after the director, chief executive officer or chief financial officer ceased to be a director, chief executive officer, or chief financial officer, in DiaMedica being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or |

|

● |

within a year after the director, chief executive officer, or chief financial officer ceased to be a director, chief executive officer or chief financial officer of DiaMedica, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement, or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets or the assets of the proposed director. |

Board Recommendation

The Board of Directors unanimously recommends a vote FOR the election of all of the five nominees named above.

|

The Board of Directors Recommends a Vote FOR Each Nominee for Director |

☑ |

VOTING PROPOSAL TWO— APPROVAL OF DIAMEDICA THERAPEUTICS INC.

2019 OMNIBUS INCENTIVE PLAN

________________

Background

On March 14, 2019, the Board of Directors adopted the DiaMedica Therapeutics Inc. 2019 Omnibus Incentive Plan (2019 Plan), subject to approval by our shareholders. The purpose of the 2019 Plan is to advance the interests of DiaMedica and our shareholders by enabling us to attract and retain qualified individuals to perform services, provide incentive compensation for such individuals in a form that is linked to the growth and profitability of our company and increases in shareholder value. As such, the 2019 Plan provides opportunities for equity participation that align the interests of recipients with those of our shareholders.

The 2019 Plan will permit the Board of Directors, or a committee or subcommittee thereof, to grant to our eligible employees, non-employee directors and consultants non-statutory and incentive stock options, stock appreciation rights (SARs), restricted stock awards, restricted stock units (RSUs), deferred stock units, performance awards, non-employee director awards, and other stock-based awards. Subject to adjustment, the maximum number of our common shares to be authorized for issuance under the 2019 Plan is 2,000,000 common shares, which represents approximately 17% of our outstanding common shares.

The Board of Directors is asking our shareholders to approve the 2019 Plan in order to qualify stock options for treatment as incentive stock options for purposes of Section 422 of the United States Internal Revenue Code of 1986 (Code) and because Nasdaq Stock Market rules require shareholder approval of the 2019 Plan.

Summary of Sound Governance Features of the 2019 Plan

The Board of Directors believes that the 2019 Plan contains several features that are consistent with protecting the interests of our shareholders and sound corporate governance practices, including the following:

No automatic share replenishment or “evergreen” provision. The number of common shares available for issuance under the 2019 Plan is fixed and will not adjust based upon the number of our outstanding common shares.

Will not be excessively dilutive to our shareholders. The number of common shares authorized for issuance under the 2019 Plan represents approximately 17% of our outstanding common shares. We believe that the number of common shares authorized for issuance under the 2019 Plan is appropriate, standard, and customary for a company of our size and not excessively dilutive to our shareholders. We chose this number of authorized shares since we believe it will allow the 2019 Plan to cover anticipated new hire and annual equity award grants for at least three to five years. In light of the significant increase in the number of our employees over the past couple of years, we do not believe that our historical burn rates are meaningful or indicative of our anticipated future burn rates.

No re-pricing of “underwater” stock options or SARs without shareholder approval. The 2019 Plan prohibits the re-pricing of outstanding stock options or SARs without shareholder approval, except in connection with certain corporate transactions, such as a recapitalization or stock split, as may be necessary in order to prevent dilution or enlargement of the rights of participants. The 2019 Plan defines “re-pricing” broadly to include amendments or modifications to the terms of outstanding stock options or SARs to lower the exercise or grant price, canceling “underwater” stock options or SARs in exchange for cash, replacement awards having a lower exercise price or other awards, or repurchasing “underwater” stock options or SARs and granting new awards.

No liberal share counting or “recycling” of shares from exercised stock options, SARs, or other stock-based awards. Shares withheld to satisfy tax withholding obligations on awards or to pay the exercise or grant price of stock options, SARs, or other stock-based awards and any shares not issued or delivered as a result of a “net exercise” of a stock option will not become available for issuance as future award grants under the 2019 Plan. In addition, shares purchased by us on the open market using proceeds from the exercise of stock options or other awards will not become available for issuance as future award grants under the 2019 Plan. The full number of shares subject to a SAR or other stock-based award that is settled by the issuance of shares will be counted against the shares authorized for issuance under the 2019 Plan, regardless of the number of shares actually issued upon settlement of the SAR or other stock-based award.

No reload stock options or SARs. The 2019 Plan does not authorize reload stock options or SARs. Reload stock options and SARs are awards that automatically provide for an additional grant of awards of the same type upon the exercise of the award.

No discounted stock options or SARs. The 2019 Plan prohibits granting stock options with exercise prices and SARs with grant prices lower than the fair market value of a share of our common shares on the grant date.

No dividends on certain and unvested awards. Stock options, SARs and unvested performance awards are not entitled to dividend equivalent rights and no dividends will be paid on unvested awards. Stock option, SAR and unvested performance award holders have no rights as shareholders with respect to the shares underlying their awards until such awards are exercised or vested and shares are issued.

No tax gross-ups. The 2019 Plan does not provide for any tax gross-ups.

“Clawback” provisions. The 2019 Plan contains certain “clawback” provisions that require a participant to reimburse DiaMedica for any awards received after an accounting restatement and allow DiaMedica under certain circumstances to terminate outstanding awards and require a participant to return to DiaMedica any shares received, any profits or any other economic value realized by the participant in connection with any awards or any shares issued upon the exercise or vesting of any awards.

Limit on non-employee director awards. The 2019 Plan contains a meaningful annual limit on the number of common shares subject to awards granted to non-employee directors.

Summary of the 2019 Plan Features

The major features of the 2019 Plan are summarized below. The summary is qualified in its entirety by reference to the full text of the 2019 Plan, a copy of which may be obtained upon request to our Corporate Secretary at 2 Carlson Parkway, Suite 260, Minneapolis, Minnesota 55447, or by telephone at (763) 312-6755. A copy of the 2019 Plan has also been filed electronically with the SEC as Appendix A to this proxy statement and is available through the SEC’s website at www.sec.gov.

Purpose. The purpose of the 2019 Plan is to advance the interests of DiaMedica and our shareholders by enabling DiaMedica and our subsidiaries to attract and retain qualified individuals to perform services, provide incentive compensation for such individuals in a form that is linked to the growth and profitability of DiaMedica and increases in shareholder value. As such, the 2019 Plan provides opportunities for equity participation that align the interests of recipients with those of our shareholders.

Plan Administration. The 2019 Plan will be administered by the Board of Directors or if the Board of Directors so delegates, the Compensation Committee of the Board or a subcommittee thereof, or any other committee delegated authority by the Board of Directors to administer the 2019 Plan. We expect both the Board of Directors and the Compensation Committee of the Board to administer the 2019 Plan. The Board of Directors or the committee administering the 2019 Plan is referred to as the “Committee.” The Committee may be comprised solely of directors designated by the Board of Directors who are (a) “non-employee directors” within the meaning of Rule 16b-3 under the Securities and Exchange Act of 1934, as amended, and (b) “independent directors” within the meaning of the rules of the Nasdaq Stock Market (or other applicable exchange or market on which our common shares may be traded or quoted. Subject to certain limitations, the Committee will have broad authority under the terms of the 2019 Plan to take certain actions under the plan.

Delegation. To the extent permitted by applicable law, the Board of Directors may delegate to one or more of its members or to one or more officers of DiaMedica such administrative duties or powers, as it may deem advisable. The Board of Directors may authorize one or more directors or officers of DiaMedica to designate employees, other than officers, non-employee directors, or 10% shareholders of DiaMedica, to receive awards under the plan and determine the size of any such awards, subject to certain limitations.

No Re-pricing. The Board of Directors may not, without prior approval of our shareholders, effect any re-pricing of any previously granted “underwater” option or SAR by: (i) amending or modifying the terms of the option or SAR to lower the exercise price or grant price; (ii) canceling the underwater option or SAR in exchange for (A) cash; (B) replacement options or SARs having a lower exercise price or grant price; or (C) other awards; or (iii) repurchasing the underwater options or SARs and granting new awards under the 2019 Plan. An option or SAR will be deemed to be “underwater” at any time when the fair market value of the common shares is less than the exercise price of the option or the grant price of the SAR.

Shares Authorized. Subject to adjustment (as described below), the maximum number of our common shares authorized for issuance under the 2019 Plan is 2,000,000 shares. No more than 2,000,000 shares may be granted as incentive stock options and no more than 100,000 shares may be granted to any non-employee director in any one year (other than shares received in lieu of any annual cash retainer or meeting fees).

Shares that are issued under the 2019 Plan or that are subject to outstanding awards will be applied to reduce the maximum number of shares remaining available for issuance under the 2019 Plan only to the extent they are used; provided, however, that the full number of shares subject to a stock-settled SAR or other stock-based award will be counted against the shares authorized for issuance under the 2019 Plan, regardless of the number of shares actually issued upon settlement of such SAR or other stock-based award. Any shares withheld to satisfy tax withholding obligations on awards issued under the 2019 Plan, any shares withheld to pay the exercise price or grant price of awards under the 2019 Plan, and any shares not issued or delivered as a result of the “net exercise” of an outstanding option or settlement of a SAR in shares will be counted against the shares authorized for issuance under the 2019 Plan and will not be available again for grant under the 2019 Plan. Shares subject to awards settled in cash will again be available for issuance pursuant to awards granted under the 2019 Plan. Any shares related to awards granted under the 2019 Plan that terminate by expiration, forfeiture, cancellation, or otherwise without the issuance of the shares will be available again for grant under the 2019 Plan. Any shares repurchased by DiaMedica on the open market using the proceeds from the exercise of an award will not increase the number of shares available for future grant of awards. To the extent permitted by applicable law, shares issued in assumption of, or in substitution for, any outstanding awards of any entity acquired in any form of combination by DiaMedica or a subsidiary or otherwise will not be counted against shares available for issuance pursuant to the 2019 Plan. The shares available for issuance under the 2019 Plan may be authorized and unissued shares or treasury shares.

Adjustments. In the event of any reorganization, merger, consolidation, recapitalization, liquidation, reclassification, stock dividend, stock split, combination of shares, rights offering, divestiture, or extraordinary dividend (including a spin off) or other similar change in the corporate structure or our common shares, the Board of Directors will make the appropriate adjustment or substitution in order to prevent dilution or enlargement of the rights of participants. These adjustments or substitutions may be to the number and kind of securities and property that may be available for issuance under the 2019 Plan. In order to prevent dilution or enlargement of the rights of participants, the Board of Directors may also adjust the number, kind, and exercise price of securities or other property subject to outstanding awards.

Eligible Participants. Awards may be granted to employees, non-employee directors and consultants of DiaMedica or any of our subsidiaries. A “consultant” for purposes of the 2019 Plan is one who renders services to DiaMedica or its subsidiaries that are not in connection with the offer and sale of our securities in a capital raising transaction and do not directly or indirectly promote or maintain a market for our securities. As of April 1, 2019, 10 employees and four non-employee directors would have been eligible to participate in the 2019 Plan had it been approved by our shareholders at such time.

Types of Awards. The 2019 Plan will permit us to grant non-statutory and incentive stock options, stock appreciation rights, restricted stock awards, restricted stock units, deferred stock units, performance awards, non-employee director awards, and other stock based awards. Awards may be granted either alone or in addition to or in tandem with any other type of award.

Stock Options. Stock options entitle the holder to purchase a specified number of our common shares at a specified price, which is called the exercise price, subject to the terms and conditions of the stock option grant. The 2019 Plan permits the grant of both non-statutory and incentive stock options. Incentive stock options may be granted solely to eligible employees of DiaMedica or its subsidiary. Each stock option granted under the 2019 Plan must be evidenced by an award agreement that specifies the exercise price, the term, the number of shares underlying the stock option, the vesting and any other conditions. The exercise price of each stock option granted under the 2019 Plan must be at least 100% of the fair market value of a share of our common shares as of the date the award is granted to a participant. Fair market value under the 2019 Plan means the closing price of our common shares, as reported on the Nasdaq Stock Market, as of the end of a regular trading session on such date, or, if no shares were traded on such date, as of the next preceding date on which there was such a trade. The closing price of our common shares, as reported on the Nasdaq Stock Market, on April 1, 2019, was $4.37 per share. The Board of Directors will fix the terms and conditions of each stock option, subject to certain restrictions, such as a ten-year maximum term.

Stock Appreciation Rights. A stock appreciation right, or SAR, is a right granted to receive payment of cash, common shares, or a combination of both, equal to the difference between the fair market value of our common shares and the grant price of such shares. Each SAR granted must be evidenced by an award agreement that specifies the grant price, the term, and such other provisions as the Board of Directors may determine. The grant price of a SAR must be at least 100% of the fair market value of our common shares on the date of grant. The Board of Directors will fix the term of each SAR, but SARs granted under the 2019 Plan will not be exercisable more than 10 years after the date the SAR is granted.

Restricted Stock Awards, Restricted Stock Units, and Deferred Stock Units. Restricted stock awards, restricted stock units, or RSUs, and/or deferred stock units may be granted under the 2019 Plan. A restricted stock award is an award of common shares that is subject to restrictions on transfer and risk of forfeiture upon certain events, typically including termination of service. RSUs or deferred stock units are similar to restricted stock awards except that no shares are actually awarded to the participant on the grant date. Deferred stock units permit the holder to receive shares of common shares or the equivalent value in cash or other property at a future time as determined by the Board of Directors. The Board of Directors will determine, and set forth in an award agreement, the period of restriction, the number of shares subject to a restricted stock award or the number of RSUs or deferred stock units granted, the time of payment for deferred stock units, and other such conditions or restrictions.

Performance Awards. Performance awards, in the form of cash, shares of common shares, or other awards (or in a combination thereof) may be granted under the 2019 Plan in such amounts and upon such terms as the Board of Directors may determine. The Board of Directors shall determine, and set forth in an award agreement, the amount of cash and/or number of shares or other awards, the performance goals, the performance periods, and other terms and conditions. The extent to which the participant achieves his or her performance goals during the applicable performance period will determine the amount of cash and/or number of shares or other awards earned by the participant.

Non-Employee Director Awards. The Committee at any time and from time to time may approve resolutions providing for the automatic grant to non-employee directors of non-employee director awards, including non-statutory stock options. The Committee may also at any time and from time to time grant to non-employee directors such discretionary non-employee director awards as determined by the Committee in its sole discretion. In either case, such awards may be granted singly, in combination, or in tandem and may be granted pursuant to such terms, conditions, and limitations as the Committee may establish in its sole discretion consistent with the provisions of the 2019 Plan. The Committee may permit non-employee directors to elect to receive all or any portion of their annual retainers, meeting fees, or other fees in restricted stock, RSUs, deferred stock units, or other stock-based awards in lieu of cash.

Other Stock-Based Awards. Consistent with the terms of the plan, other stock-based awards may be granted to participants in such amounts and upon such terms as the Board of Directors may determine.

Dividend Equivalents. With the exception of stock options, SARs, and unvested performance awards, awards under the 2019 Plan may, in the discretion of the Board of Directors, earn dividend equivalents with respect to the cash or stock dividends or other distributions that would have been paid on the common shares covered by such award had such shares been issued and outstanding on the dividend payment date. However, no dividends may be paid on unvested awards. Such dividend equivalents will be converted to cash or additional common shares by such formula and at such time and subject to such limitations as determined by the Board of Directors.

Termination of Employment or Other Service. The 2019 Plan provides for certain default rules in the event of a termination of a participant’s employment or other service. These default rules may be modified in an award agreement or an individual agreement between DiaMedica and a participant. If a participant’s employment or other service with DiaMedica is terminated for cause, then all outstanding awards held by such participant will be terminated and forfeited. In the event a participant’s employment or other service with DiaMedica is terminated by reason of death, disability, or retirement, then:

|

● |

All outstanding stock options (excluding non-employee director options in the case of retirement) and SARs held by the participant will, to the extent exercisable, remain exercisable for a period of one year after such termination, but not later than the date the stock options or SARs would otherwise expire; |

|

● |

All outstanding stock options and SARs that are not exercisable and all outstanding restricted stock will be terminated and forfeited; and |

|

● |

All outstanding unvested RSUs, performance awards, and other stock-based awards held by the participant will terminate and be forfeited. However, with respect to any awards that vest based on the achievement of performance goals, if a participant’s employment or other service with DiaMedica or any subsidiary is terminated prior to the end of the performance period of such award, but after the conclusion of a portion of the performance period (but in no event less than one year), the Board of Directors may, in its sole discretion, cause shares to be delivered or payment made with respect to the participant’s award, but only if otherwise earned for the entire performance period and only with respect to the portion of the applicable performance period completed at the date of such event, with proration based on the number of months or years that the participant was employed or performed services during the performance period. |

In the event a participant’s employment or other service with DiaMedica is terminated by reason other than for cause, death, disability, or retirement, then:

|

● |

All outstanding stock options (including non-employee director options) and SARs held by the participant that then are exercisable will remain exercisable for three months after the date of such termination, but will not be exercisable later than the date the stock options or SARs would otherwise expire; |

|

● |

All outstanding restricted stock will be terminated and forfeited; and |

|

● |

All outstanding unvested RSUs, performance awards and other stock-based awards will be terminated and forfeited. However, with respect to any awards that vest based on the achievement of performance goals, if a participant’s employment or other service with DiaMedica or any subsidiary is terminated prior to the end of the performance period of such award, but after the conclusion of a portion of the performance period (but in no event less than one year), the Board of Directors may, in its sole discretion, cause shares to be delivered or payment made with respect to the participant’s award, but only if otherwise earned for the entire performance period and only with respect to the portion of the applicable performance period completed at the date of such event, with proration based on the number of months or years that the participant was employed or performed services during the performance period. |

Modification of Rights upon Termination. Upon a participant’s termination of employment or other service with DiaMedica or any subsidiary, the Board of Directors may, in its sole discretion (which may be exercised at any time on or after the grant date, including following such termination) cause stock options or SARs (or any part thereof) held by such participant as of the effective date of such termination to terminate, become or continue to become exercisable or remain exercisable following such termination of employment or service, and restricted stock, RSUs, performance awards, non-employee director awards, and other stock-based awards held by such participant as of the effective date of such termination to terminate, vest, or become free of restrictions and conditions to payment, as the case may be, following such termination of employment or service, in each case in the manner determined by the Board of Directors; provided, however, that no stock option or SAR may remain exercisable beyond its expiration date any such action by the Board of Directors adversely affecting any outstanding award will not be effective without the consent of the affected participant, except to the extent the Board of Directors is authorized by the 2019 Plan to take such action.

Forfeiture and Recoupment. If a participant is determined by the Board of Directors to have taken any action while providing services to DiaMedica or within one year after termination of such services, that would constitute “cause” or an “adverse action,” as such terms are defined in the 2019 Plan, all rights of the participant under the 2019 Plan and any agreements evidencing an award then held by the participant will terminate and be forfeited. The Board of Directors has the authority to rescind the exercise, vesting, issuance, or payment in respect of any awards of the participant that were exercised, vested, issued, or paid and require the participant to pay to DiaMedica, within 10 days of receipt of notice, any amount received or the amount gained as a result of any such rescinded exercise, vesting, issuance, or payment. DiaMedica may defer the exercise of any stock option or SAR for up to six months after receipt of notice of exercise in order for the Board of Directors to determine whether “cause” or “adverse action” exists. DiaMedica is entitled to withhold and deduct future wages to collect any amount due.

In addition, if DiaMedica is required to prepare an accounting restatement due to material noncompliance, as a result of misconduct, with any financial reporting requirement under the securities laws, then any participant who is one of the individuals subject to automatic forfeiture under Section 304 of the Sarbanes-Oxley Act of 2002 will reimburse DiaMedica for the amount of any award received by such individual under the 2019 Plan during the 12 month period following the first public issuance or filing with the SEC, as the case may be, of the financial document embodying such financial reporting requirement. DiaMedica also may seek to recover any award made as required by the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act or any other clawback, forfeiture, or recoupment provision required by applicable law or under the requirements of any stock exchange or market upon which our common shares is then listed or traded or any policy adopted by DiaMedica.

Effect of Change in Control. Generally, a change in control will mean:

|

● |

The acquisition, other than from DiaMedica, by any individual, entity, or group of beneficial ownership of 50% or more of the then outstanding shares of common shares of DiaMedica; |

|

● |

The consummation of a reorganization, merger, or consolidation of DiaMedica with respect to which all or substantially all of the individuals or entities who were the beneficial owners of common shares immediately prior to the transaction do not, following the transaction, beneficially own more than 50% of the outstanding shares of common shares of the corporation resulting from the transaction; or |

|

● |

A complete liquidation or dissolution of DiaMedica or the sale or other disposition of all or substantially all of the assets of DiaMedica. |

Subject to the terms of the applicable award agreement or an individual agreement between DiaMedica and a participant, upon a change in control, the Board of Directors may, in its discretion, determine whether some or all outstanding options and stock appreciation rights shall become exercisable in full or in part, whether the restriction period and performance period applicable to some or all outstanding restricted stock awards and RSUs shall lapse in full or in part and whether the performance measures applicable to some or all outstanding awards shall be deemed to be satisfied. The Board of Directors may further require that shares of stock of the corporation resulting from such a change in control, or a parent corporation thereof, be substituted for some or all of our shares of common shares subject to an outstanding award and that any outstanding awards, in whole or in part, be surrendered to us by the holder, to be immediately cancelled by us, in exchange for a cash payment, shares of capital stock of the corporation resulting from or succeeding us or a combination of both cash and such shares of stock.

Term, Termination and Amendment. Unless sooner terminated by the Board of Directors, the 2019 Plan will terminate at midnight on May 21, 2029. No award will be granted after termination of the 2019 Plan, but awards outstanding upon termination of the 2019 Plan will remain outstanding in accordance with their applicable terms and conditions and the terms and conditions of the 2019 Plan.

Subject to certain exceptions, the Board of Directors has the authority to terminate and the Board of Directors has the authority to amend the 2019 Plan or any outstanding award agreement at any time and from time to time. No amendments to the 2019 Plan will be effective without approval of DiaMedica’s shareholders if: (a) shareholder approval of the amendment is then required pursuant to Section 422 of the Code, the rules of the primary stock exchange on which the common shares is then traded, applicable U.S. state and federal laws or regulations, and the applicable laws of any foreign country or jurisdiction where awards are, or will be, granted under the 2019 Plan; or (b) such amendment would: (i) materially increase benefits accruing to participants; (ii) increase the aggregate number of shares of common shares issued or issuable under the 2019 Plan; (iii) increase any limitation set forth in the 2019 Plan on the number of shares of common shares which may be issued or the aggregate value of awards which may be made, in respect of any type of award to any single participant during any specified period; or (iv) modify the eligibility requirements for participants in the 2019 Plan. No termination or amendment of the 2019 Plan or an award agreement shall adversely affect in any material way any award previously granted under the 2019 Plan without the written consent of the participant holding such award.

U.S. Federal Income Tax Information

The following is a general summary, as of the date of this proxy statement, of the U.S. federal income tax consequences to participants and DiaMedica of transactions under the 2019 Plan. This summary is intended for the information of shareholders considering how to vote at the meeting and not as tax guidance to participants in the 2019 Plan, as the consequences may vary with the types of grants made, the identity of the participant, and the method of payment or settlement. The summary does not address the effects of other U.S. federal taxes or taxes imposed under state, local, or foreign tax laws. Participants are encouraged to seek the advice of a qualified tax advisor regarding the tax consequences of participation in the 2019 Plan.

Incentive Stock Options. With respect to incentive stock options, generally, the stock option holder is not taxed, and we are not entitled to a deduction, on either the grant or the exercise of an incentive stock option so long as the requirements of Section 422 of the Code continue to be met. If the stock option holder meets the employment requirements and does not dispose of the common shares acquired upon exercise of an incentive stock option until at least one year after date of the exercise of the stock option and at least two years after the date the stock option was granted, gain or loss realized on sale of the shares will be treated as long-term capital gain or loss. If the common shares are disposed of before those periods expire, which is called a disqualifying disposition, the stock option holder will be required to recognize ordinary income in an amount equal to the lesser of (i) the excess, if any, of the fair market value of our common shares on the date of exercise over the exercise price, or (ii) if the disposition is a taxable sale or exchange, the amount of gain realized. Upon a disqualifying disposition, we will generally be entitled, in the same tax year, to a deduction equal to the amount of ordinary income recognized by the stock option holder, assuming that a deduction is allowed under Section 162(m) of the Code.

Non-Statutory Stock Options. The grant of a stock option that does not qualify for treatment as an incentive stock option, which is generally referred to as a non-statutory stock option, is generally not a taxable event for the stock option holder. Upon exercise of the stock option, the stock option holder will generally be required to recognize ordinary income in an amount equal to the excess of the fair market value of our common shares acquired upon exercise (determined as of the date of exercise) over the exercise price of the stock option, and we will be entitled to a deduction in an equal amount in the same tax year, assuming that a deduction is allowed under Section 162(m) of the Code. At the time of a subsequent sale or disposition of shares obtained upon exercise of a non-statutory stock option, any gain or loss will be a capital gain or loss, which will be either a long-term or short-term capital gain or loss, depending on how long the shares have been held.

SARs. The grant of an SAR will not cause the participant to recognize ordinary income or entitle us to a deduction for federal income tax purposes. Upon the exercise of an SAR, the participant will recognize ordinary income in the amount of the cash or the value of shares payable to the participant (before reduction for any withholding taxes), and we will receive a corresponding deduction in an amount equal to the ordinary income recognized by the participant, assuming that a deduction is allowed under Section 162(m) of the Code.

Restricted Stock, RSUs, Deferred Stock Units and Other Stock-Based Awards. The federal income tax consequences with respect to restricted stock, RSUs, deferred stock units, performance shares and performance stock units, and other stock unit and stock-based awards depend on the facts and circumstances of each award, including, in particular, the nature of any restrictions imposed with respect to the awards. In general, if an award of stock granted to the participant is subject to a “substantial risk of forfeiture” (e.g., the award is conditioned upon the future performance of substantial services by the participant) and is nontransferable, a taxable event occurs when the risk of forfeiture ceases or the awards become transferable, whichever first occurs. At such time, the participant will recognize ordinary income to the extent of the excess of the fair market value of the stock on such date over the participant’s cost for such stock (if any), and the same amount is deductible by us, assuming that a deduction is allowed under Section 162(m) of the Code. Under certain circumstances, the participant, by making an election under Section 83(b) of the Code, can accelerate federal income tax recognition with respect to an award of stock that is subject to a substantial risk of forfeiture and transferability restrictions, in which event the ordinary income amount and our deduction, assuming that a deduction is allowed under Section 162(m) of the Code, will be measured and timed as of the grant date of the award. If the stock award granted to the participant is not subject to a substantial risk of forfeiture or transferability restrictions, the participant will recognize ordinary income with respect to the award to the extent of the excess of the fair market value of the stock at the time of grant over the participant’s cost, if any, and the same amount is deductible by us, assuming that a deduction is allowed under Section 162(m) of the Code. If a stock unit award or other stock-based award is granted but no stock is actually issued to the participant at the time the award is granted, the participant will recognize ordinary income at the time the participant receives the stock free of any substantial risk of forfeiture (or receives cash in lieu of such stock) and the amount of such income will be equal to the fair market value of the stock at such time over the participant’s cost, if any, and the same amount is then deductible by us, assuming that a deduction is allowed under Section 162(m) of the Code.