UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-Q

(Mark one)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2019

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to __________________.

Commission File Number: 001-11038

____________________

DIAMEDICA THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

|

British Columbia (State or other jurisdiction of incorporation or organization) |

Not Applicable (I.R.S. Employer Identification No.) |

|

2 Carlson Parkway, Suite 260 Minneapolis, Minnesota 55447 (Address of principal executive offices) (Zip code) |

|

(763) 312-6755

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

|

Voting common shares, no par value per share |

DMAC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of November 6, 2019, there were 12,006,874 voting common shares of the registrant outstanding.

DiaMedica Therapeutics Inc.

FORM 10-Q

September 30, 2019

TABLE OF CONTENTS

| Description | Page | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 1 | |

| PART I. | FINANCIAL INFORMATION | |

| Item 1. | Financial Statements | 2 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 22 |

| Item 4. | Controls and Procedures | 22 |

| PART II. | OTHER INFORMATION | |

| Item 1. | Legal Proceedings | 23 |

| Item 1A. | Risk Factors | 23 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

23 |

| Item 3. | Defaults Upon Senior Securities | 24 |

| Item 4. | Mine Safety Disclosures | 24 |

| Item 5. | Other Information | 24 |

| Item 6. | Exhibits | 24 |

| SIGNATURE PAGE | 25 | |

____________________

This quarterly report on Form 10-Q contains certain forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended, that are subject to the safe harbor created by those sections. For more information, see “Cautionary Note Regarding Forward-Looking Statements.”

As used in this report, references to “DiaMedica,” the “Company,” “we,” “our” or “us,” unless the context otherwise requires, refer to DiaMedica Therapeutics Inc. and its subsidiaries, all of which are consolidated in DiaMedica’s condensed consolidated financial statements. References in this report to “common shares” mean our voting common shares, no par value per share.

We own various unregistered trademarks and service marks, including our corporate logo. Solely for convenience, the trademarks and trade names in this report are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that the owner of such trademarks and trade names will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this report that are not descriptions of historical facts are forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 that are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition and share price. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” “will,” “would,” the negative of these terms or other comparable terminology, and the use of future dates. The forward-looking statements in this report include, among other things, statements about:

|

● |

our plans to develop, obtain regulatory approval for and commercialize our DM199 product candidate for the treatment of chronic kidney disease and acute ischemic stroke and our expectations regarding the benefits of our DM199 product candidate; |

|

● |

our ability to conduct successful clinical testing of our DM199 product candidate for chronic kidney disease and acute ischemic stroke; |

|

● |

our ability to obtain required regulatory approvals of our DM199 product candidate for chronic kidney disease and acute ischemic stroke; |

|

● |

the perceived benefits of our DM199 product candidate over existing treatment options for chronic kidney disease and acute ischemic stroke; |

|

● |

the potential size of the markets for our DM199 product candidate and our ability to serve those markets; |

|

● |

the rate and degree of market acceptance, both in the United States and internationally, of our DM199 product candidate for chronic kidney disease and acute ischemic stroke; |

|

● |

our ability to partner with and generate revenue from biopharmaceutical or pharmaceutical partners to develop, obtain regulatory approval for and commercialize our DM199 product candidate for chronic kidney disease and acute ischemic stroke and any adverse ramifications as a result of our termination of a license and collaboration agreement with Ahon Pharmaceutical Co., Ltd.; |

|

● |

the success, cost and timing of planned clinical trials, as well as our reliance on collaboration with third parties to conduct our clinical trials; |

|

● |

expectations regarding federal, state, and foreign regulatory requirements and developments, such as potential United States Food and Drug Administration (“FDA”) regulation of our DM199 product candidate for chronic kidney disease and acute ischemic stroke; |

|

● |

our ability to obtain funding for our operations, including funding necessary to complete planned clinical trials and obtain regulatory approvals for our DM199 product candidate for chronic kidney disease and acute ischemic stroke; |

|

● |

our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

|

● |

our expectations regarding our ability to obtain and maintain intellectual property protection for our DM199 product candidate; and |

|

● |

our anticipated use of the net proceeds from our December 2018 initial public offering. |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under “Part I. Item 1A. Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2018. Moreover, we operate in a very competitive and rapidly-changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Except as required by law, including the securities laws of the United States, we do not intend to update any forward-looking statements to conform these statements to actual results or to changes in our expectations.

PART I - FINANCIAL INFORMATION

|

ITEM 1. |

FINANCIAL STATEMENTS |

Diamedica Therapeutics Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

|

September 30, 2019 |

December 31, 2018 |

|||||||

|

(unaudited) |

||||||||

|

ASSETS |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 4,741 | $ | 16,823 | ||||

|

Marketable securities |

5,002 | — | ||||||

|

Amounts receivable |

664 | 780 | ||||||

|

Deposits |

310 | — | ||||||

|

Prepaid expenses and other assets |

89 | 369 | ||||||

|

Total current assets |

10,806 | 17,972 | ||||||

|

Non-current assets: |

||||||||

|

Operating lease right-of-use asset |

165 | — | ||||||

|

Property and equipment, net |

68 | 96 | ||||||

|

Deposits |

— | 271 | ||||||

|

Total non-current assets |

233 | 367 | ||||||

|

Total assets |

$ | 11,039 | $ | 18,339 | ||||

|

LIABILITIES AND EQUITY |

||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ | 312 | $ | 483 | ||||

|

Accrued liabilities |

837 | 808 | ||||||

|

Finance lease obligation |

5 | 5 | ||||||

|

Operating lease obligation |

51 | — | ||||||

|

Total current liabilities |

1,205 | 1,296 | ||||||

|

Non-current liabilities: |

||||||||

|

Finance lease obligation, non-current |

14 | 18 | ||||||

|

Operating lease obligation, non-current |

120 | — | ||||||

|

Total non-current liabilities |

134 | 18 | ||||||

|

Shareholders’ equity: |

||||||||

|

Common shares, no par value; unlimited authorized; 12,006,874 and 11,956,874 shares issued and outstanding, as of September 30, 2019 and December 31, 2018, respectively |

— | — | ||||||

|

Additional paid-in capital |

63,831 | 62,993 | ||||||

|

Accumulated other comprehensive income |

6 | — | ||||||

|

Accumulated deficit |

(54,137 | ) | (45,968 | ) | ||||

|

Total shareholders’ equity |

9,700 | 17,025 | ||||||

|

Total liabilities and shareholders’ equity |

$ | 11,039 | $ | 18,339 | ||||

See accompanying notes to the condensed consolidated financial statements.

Diamedica Therapeutics Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2019 |

2018 |

2019 |

2018 |

|||||||||||||

|

Operating revenues: |

||||||||||||||||

|

License revenues |

$ | — | $ | 500 | $ | — | $ | 500 | ||||||||

|

Operating expenses: |

||||||||||||||||

|

Research and development |

1,617 | 1,210 | 6,098 | 3,071 | ||||||||||||

|

General and administrative |

1,044 | 777 | 2,725 | 2,073 | ||||||||||||

|

Operating loss |

(2,661 |

) |

(1,487 |

) |

(8,823 |

) |

(4,644 |

) |

||||||||

|

Other (income) expense: |

||||||||||||||||

|

Governmental assistance - research incentives |

(263 |

) |

(196 |

) |

(663 |

) |

(1,046 |

) |

||||||||

|

Other (income) expense, net |

38 | 39 | (20 |

) |

61 | |||||||||||

|

Change in fair value of warrant liability |

— | — | — | 39 | ||||||||||||

|

Total other (income) expense |

(225 |

) |

(157 |

) |

(683 |

) |

(946 |

) |

||||||||

|

Loss before income tax expense |

(2,436 |

) |

(1,330 |

) |

(8,140 |

) |

(3,698 |

) |

||||||||

|

Income tax expense |

12 | 57 | 29 | 74 | ||||||||||||

|

Net loss |

(2,448 |

) |

(1,387 |

) |

(8,169 |

) |

(3,772 |

) |

||||||||

|

Other comprehensive income |

||||||||||||||||

|

Unrealized (gain) loss on marketable securities |

5 | — | (6 |

) |

— | |||||||||||

|

Net loss and comprehensive loss |

$ | (2,453 |

) |

$ | (1,387 |

) |

$ | (8,163 |

) |

$ | (3,772 |

) |

||||

|

Basic and diluted net loss per share |

$ | (0.20 |

) |

$ | (0.18 |

) |

$ | (0.68 |

) |

$ | (0.51 |

) |

||||

|

Weighted average shares outstanding – basic and diluted |

12,006,874 | 7,836,683 | 11,981,233 | 7,406,378 | ||||||||||||

See accompanying notes to the condensed consolidated financial statements.

Diamedica Therapeutics Inc.

Condensed Consolidated Statements of Shareholders’ Equity

(In thousands, except share and per share amounts)

(Unaudited)

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2019 |

2018 |

2019 |

2018 |

|||||||||||||

|

Additional paid-in capital |

||||||||||||||||

|

Balance at beginning of period |

$ | 63,380 | $ | 47,974 | $ | 62,993 | $ | 41,033 | ||||||||

|

Issuance of common shares and warrants, net offering costs of $529 |

— | — | — | 5,840 | ||||||||||||

|

Exercise of common share purchase warrants |

— | 32 | — | 645 | ||||||||||||

|

Exercise of stock options |

— | — | 75 | 43 | ||||||||||||

|

Share-based compensation |

451 | 110 | 763 | 555 | ||||||||||||

|

Balance at end of period |

63,831 | 48,116 | 63,831 | 48,116 | ||||||||||||

|

Accumulated other comprehensive income |

||||||||||||||||

|

Balance at beginning of period |

11 | — | — | — | ||||||||||||

|

Unrealized gain (loss) on marketable securities |

(5 | ) | — | 6 | — | |||||||||||

|

Balance at end of period |

6 | — | 6 | — | ||||||||||||

|

Accumulated deficit |

||||||||||||||||

|

Balance at beginning of period |

(51,689 | ) | (42,619 | ) | (45,968 | ) | (40,234 | ) | ||||||||

|

Net loss |

(2,448 | ) | (1,387 | ) | (8,169 | ) | (3,772 | ) | ||||||||

|

Balance at end of period |

(54,137 | ) | (44,006 | ) | (54,137 | ) | (44,006 | ) | ||||||||

|

Total shareholders’ equity |

$ | 9,700 | $ | 4,110 | $ | 9,700 | $ | 4,110 | ||||||||

See accompanying notes to the condensed consolidated financial statements.

Diamedica Therapeutics Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

Nine Months Ended September 30, |

||||||||

|

2019 |

2018 |

|||||||

|

Cash flows from operating activities: |

||||||||

|

Net loss |

$ | (8,169 |

) |

$ | (3,772 |

) |

||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

|

Share-based compensation |

763 | 555 | ||||||

|

Amortization of discount on marketable securities |

(68 |

) |

— | |||||

|

Non-cash lease expense |

36 | — | ||||||

|

Depreciation |

16 | 10 | ||||||

|

Change in fair value of warrant liability |

— | 39 | ||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Amounts receivable |

116 | (963 |

) |

|||||

|

Prepaid expenses |

280 | (99 |

) |

|||||

|

Deposits |

(39 |

) |

— | |||||

|

Accounts payable |

(171 |

) |

(264 |

) |

||||

|

Accrued liabilities |

(1 |

) |

698 | |||||

|

Net cash used in operating activities |

(7,237 |

) |

(3,796 |

) |

||||

|

Cash flows from investing activities: |

||||||||

|

Purchase of marketable securities |

(10,928 |

) |

— | |||||

|

Maturities of marketable securities |

6,000 | — | ||||||

|

Disposition of property and equipment, net |

12 | — | ||||||

|

Purchase of property and equipment |

— | (63 |

) |

|||||

|

Net cash used in investing activities |

(4,916 |

) |

(63 |

) |

||||

|

Cash flows from financing activities: |

||||||||

|

Proceeds from the exercise of stock options |

75 | 43 | ||||||

|

Principal payments on finance lease obligations |

(4 |

) |

— | |||||

|

Proceeds from issuance of common shares and warrants, net of offering costs |

— | 5,840 | ||||||

|

Proceeds from the exercise of common share purchase warrants |

— | 521 | ||||||

|

Net cash provided by financing activities |

71 | 6,404 | ||||||

|

Net increase (decrease) in cash and cash equivalents |

(12,082 |

) |

2,545 | |||||

|

Cash and cash equivalents at beginning of period |

16,823 | 1,353 | ||||||

|

Cash and cash equivalents at end of period |

$ | 4,741 | $ | 3,898 | ||||

See accompanying notes to the condensed consolidated financial statements.

DiaMedica Therapeutics Inc.

Notes to the Condensed Consolidated Financial Statements

(Unaudited)

|

1. |

Business |

DiaMedica Therapeutics Inc. and its wholly-owned subsidiaries, DiaMedica USA, Inc. and DiaMedica Australia Pty Ltd. (collectively “we,” “us,” “our,” “DiaMedica” and the “Company”), exist for the primary purpose of advancing the clinical and commercial development of a proprietary recombinant, or synthetic, KLK1 protein for the treatment of kidney and neurological diseases with our primary focus on chronic kidney disease (“CKD”) and acute ischemic stroke (“AIS”). Our parent company is governed under the British Columbia Business Corporations Act and, commencing on December 7, 2018, our common shares are publicly traded on The Nasdaq Capital Market under the symbol “DMAC.” The Company’s shares were previously traded on the TSX Venture Exchange in Canada and on the OTCQB in the United States.

|

2. |

Risks, Uncertainties and Going Concern |

DiaMedica operates in a highly regulated and competitive environment. The development, manufacturing and marketing of pharmaceutical products require approval from, and are subject to ongoing oversight by, the Food and Drug Administration (“FDA”) in the United States, the European Medicines Agency (“EMA”) in the European Union, and comparable agencies in other countries. As a result, DiaMedica is subject to many risks and uncertainties, including those described in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2018 under “Part I. Item 1A. Risk Factors.” We are in the clinical stage of development of our initial product candidate, DM199, for the treatment of CKD and AIS. The Company has not completed the development of any product candidate and, accordingly, has not begun to commercialize any product candidate or generate any revenues from the sale of any product candidate. DM199 requires significant additional clinical testing and investment prior to seeking marketing approval and is not expected to be commercially available for at least three to five years, if at all. The Company’s future success is dependent upon the success of its development efforts, its ability to demonstrate clinical progress for its DM199 product candidate in the United States or other markets, its ability to obtain required governmental approvals of its product candidate, its ability to license or market and sell its DM199 product candidate, and its ability to obtain additional financing to fund these efforts.

As of September 30, 2019, we have incurred losses of $54.1 million since our inception in 2000. For the nine months ended September 30, 2019, we incurred a net loss of $8.2 million and negative cash flows from operating activities of $7.2 million. We expect to continue to incur operating losses until such time as any future product sales, royalty payments, licensing fees, and/or milestone payments generate revenue sufficient to fund our continuing operations. For the foreseeable future, we expect to incur significant operating losses as we continue the research, development and clinical trials of, and to seek regulatory approval for, our DM199 product candidate. As of September 30, 2019, DiaMedica had cash and cash equivalents of $4.7 million, marketable securities of $5.0 million, working capital of $9.6 million and shareholders’ equity of $9.7 million. Our principal source of cash has been net proceeds from the issuance of equity securities. Although the Company has previously been successful in obtaining financing through equity securities offerings, there is no assurance that we will be able to do so in the future. This is particularly true if our clinical data is not positive or economic and market conditions deteriorate.

We anticipate that we will need substantial additional capital to further our research and development activities, complete the required clinical trials, fund our regulatory activities and otherwise develop our product candidate, DM199, or any future product candidates, to a point where they may be commercially sold. We expect our current cash resources to be sufficient to allow us to complete our current ongoing Phase II REMEDY trial in patients with AIS and the first two cohorts in the Phase II study in patients with CKD and to otherwise fund our planned operations into the fourth quarter of 2020. However, the amount and timing of our future funding requirements will depend on many factors, including the timing and results of our ongoing development efforts, including enrollment in our clinical trials, the potential expansion of current development programs, potential new development programs, and related general and administrative support. We may require significant additional funds earlier than we currently expect and there is no assurance that we will not need or seek additional funding prior to such time.

The accompanying interim condensed consolidated financial statements have been prepared assuming that we will continue as a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business and do not include any adjustments relating to the recoverability or classification of assets or the amounts of liabilities that might result from the outcome of these uncertainties. Our ability to continue as a going concern, realize the carrying value of our assets and discharge our liabilities in the ordinary course of business is dependent upon a number of factors, including our ability to obtain additional financing, the success of our development efforts, our ability to obtain marketing approval for our initial product candidate, DM199, in the United States, the European Union or other markets, and ultimately our ability to license and/or market and sell our initial product candidate. These factors, among others, raise substantial doubt about our ability to continue operations as a going concern. See Note 3 titled “Liquidity and Management’s Plans.”

|

3. |

Liquidity and Management Plans |

As of December 31, 2018 and September 30, 2019, the Company had an accumulated deficit of $46.0 million and $54.1 million, respectively, and the Company has not generated positive cash flow from operations since its inception.

Additional funding will be required to continue the Company’s research and development and other operating activities. In the next 12 months, we will likely seek to raise additional funds through various sources, such as equity or debt financings, or through strategic collaborations and license agreements. We can give no assurances that we will be able to secure additional sources of funds to support our operations, or if such funds are available to us, that such additional financing will be sufficient to meet our needs or on terms acceptable to us. This risk would increase if our clinical data is not positive or economic and market conditions deteriorate.

There can be no assurances that we will be able to obtain additional financing on commercially reasonable terms, or at all. To the extent we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our shareholders will be diluted. Debt financing, if available, may involve agreements that include conversion discounts or covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through government or other third-party funding, marketing and distribution arrangements or other collaborations, or strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or grant licenses on terms that may not be favorable to us. The availability of financing may be affected by our clinical data and other results of scientific and clinical research; the ability to attain regulatory approvals; market acceptance of our product candidates; the state of the capital markets generally with particular reference to pharmaceutical, biotechnology, and medical companies; the status of strategic alliance agreements; and other relevant commercial considerations.

If adequate funding is not available when needed, we may be required to scale back our operations by taking actions that may include, among other things, reducing use of outside professional service providers, reducing the number of our employees or employee compensation, or implementing other cost reduction strategies; significantly modify or delay the development of our DM199 product candidate; license to third parties the rights to commercialize our DM199 product candidate for CKD, AIS or other indications that we would otherwise seek to pursue, or otherwise relinquish significant rights to our technologies, future revenue streams, research programs or product candidates or grant licenses on terms that may not be favorable to us; and/or divest assets or cease operations through a merger, sale, or liquidation of our company.

|

4. |

Summary of Significant Accounting Policies |

Interim financial statements

We have prepared the accompanying condensed consolidated financial statements in accordance with accounting principles generally accepted in the United States (“US GAAP”) for interim financial information and with the instructions to Form 10-Q and Regulation S-X of the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and footnotes required by US GAAP for complete financial statements. These condensed consolidated financial statements reflect all adjustments consisting of normal recurring accruals which, in the opinion of management, are necessary to present fairly our consolidated financial position, consolidated results of operations, consolidated statement of shareholders’ equity and consolidated cash flows for the periods and as of the dates presented. Our fiscal year ends on December 31. The condensed consolidated balance sheet as of December 31, 2018 was derived from audited consolidated financial statements. These condensed consolidated financial statements should be read in conjunction with the annual consolidated financial statements and the notes thereto. The nature of our business is such that the results of any interim period may not be indicative of the results to be expected for the entire year. Certain prior period amounts have been reclassified to conform to the current basis of presentation.

Cash and cash equivalents

The Company considers all bank deposits, including money market funds, and other investments, purchased with an original maturity to the Company of three months or less, to be cash and cash equivalents.

Concentration of credit risk

Financial instruments that potentially expose the Company to concentration of credit risk consist primarily of cash and cash equivalents and marketable securities.

The Company maintains its cash balances primarily with two financial institutions. These balances exceed federally insured limits. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant credit risk in cash and cash equivalents.

The Company believes that the credit risk related to marketable securities is limited due to the adherence to an investment policy focused on the preservation of principal.

Marketable securities

The Company’s marketable securities consist solely of available-for-sale securities and were valued in accordance with the fair value measurement guidance discussed below. Available-for-sale securities are carried at fair value with unrealized gains and losses reported as a component of shareholders’ equity in accumulated other comprehensive income (loss). Realized gains and losses, if any, are calculated on the specific identification method and are included in other income in the condensed consolidated statements of operations.

Available-for-sale securities are reviewed for possible impairment at least quarterly, or more frequently if circumstances arise that may indicate impairment. When the fair value of the securities declines below the amortized cost basis, impairment is indicated and it must be determined whether it is other than temporary. Impairment is considered to be other than temporary if the Company: (i) intends to sell the security, (ii) will more likely than not be forced to sell the security before recovering its cost, or (iii) does not expect to recover the security’s amortized cost basis. If the decline in fair value is considered other than temporary, the cost basis of the security is adjusted to its fair market value and the realized loss is reported in earnings. Subsequent increases or decreases in fair value are reported as a component of shareholders’ equity in accumulated other comprehensive income (loss).

Fair value measurements

Under the authoritative guidance for fair value measurements, fair value is defined as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. The authoritative guidance also establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use in valuing the asset or liability developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the factors market participants would use in valuing the asset or liability developed based upon the best information available in the circumstances. The categorization of financial assets and financial liabilities within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The hierarchy is broken down into three levels defined as follows:

Level 1 Inputs — quoted prices in active markets for identical assets and liabilities

Level 2 Inputs — observable inputs other than quoted prices in active markets for identical assets and liabilities

Level 3 Inputs — unobservable inputs

As of September 30, 2019, the Company believes that the carrying amounts of its other financial instruments, including amounts receivable, accounts payable and accrued liabilities, approximate their fair value due to the short-term maturities of these instruments. See Note 5, titled “Marketable Securities” for additional information.

Recently adopted accounting pronouncements

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2016-02, Leases. The guidance in ASU 2016-02 supersedes the lease recognition requirements in the Accounting Standards Codification Topic 840, Leases. ASU 2016-02 requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. The new standard requires the immediate recognition of all excess tax benefits and deficiencies in the statements of operations and requires classification of excess tax benefits as an operating activity as opposed to a financing activity in the statements of cash flows. This standard became effective for us on January 1, 2019.

The FASB has subsequently issued the following amendments to ASU 2016-02, which have the same effective date and transition date of January 1, 2019, and which we collectively refer to as the new leasing standards:

|

● |

ASU No. 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842, which permits an entity to elect an optional transition practical expedient to not evaluate under Topic 842 land easements that existed or expired prior to adoption of Topic 842 and that were not previously accounted for as leases under the prior standard, ASC 840, Leases. |

|

● |

ASU No. 2018-10, Codification Improvements to Topic 842, Leases, which amends certain narrow aspects of the guidance issued in ASU 2016-02. |

|

● |

ASU No. 2018-11, Leases (Topic 842): Targeted Improvements, which allows for a transition approach to initially apply ASU 2016-02 at the adoption date and recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption as well as an additional practical expedient for lessors to not separate non-lease components from the associated lease component. |

|

● |

ASU No. 2018-20, Narrow-Scope Improvements for Lessors, which contains certain narrow scope improvements to the guidance issued in ASU 2016-02. |

Additional information and disclosures required by this new standard are contained in Note 9, titled “Operating Lease.”

We adopted the new leasing standards on January 1, 2019, using a modified retrospective transition approach to be applied to leases existing as of, or entered into after, January 1, 2019; and, consequently, financial information will not be updated and the disclosures required under Topic 842 will not be provided for dates and periods prior to January 1, 2019. We have reviewed our existing lease contracts and the impact of the new leasing standards on our consolidated results of operations, financial position and disclosures. Upon adoption of the new leasing standards, we recognized a lease liability and related right-of-use asset on our condensed consolidated balance sheet of approximately $205,000.

In June 2018, the FASB issued ASU No. 2018-07, “Improvements to Nonemployee Share-Based Payment Accounting,” to simplify the accounting for share-based payments to nonemployees by aligning it with the accounting for share-based payments to employees, with certain exceptions. This ASU is effective for public entities for fiscal years beginning after December 15, 2018. Prior to the adoption of this ASU, share-based compensation awarded to non-employees was subject to revaluation over its vesting terms. Subsequent to the adoption of this ASU, non-employee share-based payment awards are measured on the date of grant, similar to share-based payment awards granted to employees. We adopted this standard on January 1, 2019 and the adoption of this ASU did not have a material impact on our financial position or our condensed consolidated statements of operations.

|

5. |

Marketable Securities |

The available-for-sale marketable securities are primarily comprised of investments in commercial paper, corporate bonds and government securities and consist of the following, measured at fair value on a recurring basis:

|

Fair Value Measurements as of September 30, 2019 Using Inputs Considered as |

||||||||||||||||

|

Fair Value |

Level 1 |

Level 2 |

Level 3 |

|||||||||||||

|

Commercial paper and corporate bonds |

$ | 2,000 | $ | — | $ | 2,000 | $ | — | ||||||||

|

Government securities |

3,002 | — | 3,002 | — | ||||||||||||

|

Total marketable securities |

$ | 5,002 | $ | — | $ | 5,002 | $ | — | ||||||||

Accrued interest receivable on available-for-sale securities was $25,000 as of September 30, 2019 and is included in amounts receivable.

There were no transfers of assets between Level 1 and Level 2 of the fair value measurement hierarchy during the nine months ended September 30, 2019.

Under the terms of the Company’s investment policy, purchases of marketable securities are limited to investment grade governmental and corporate obligations with a primary objective of principal preservation. Maturities of individual securities are less than one year and the amortized cost of all securities approximated fair value as of September 30, 2019.

|

6. |

Amounts Receivable |

Amounts receivable consisted of the following (in thousands):

|

September 30, 2019 |

December 31, 2018 |

|||||||

|

Research and development incentives |

$ | 600 | $ | 622 | ||||

|

Sales-based taxes receivable |

39 | 134 | ||||||

|

Other |

25 | 24 | ||||||

|

Total amounts receivable |

$ | 664 | $ | 780 | ||||

|

7. |

Deposits |

Deposits consisted of the following (in thousands):

|

September 30, 2019 |

December 31, 2018 |

|||||||

|

Advances to vendors - current |

$ | 310 | $ | — | ||||

|

Advances to vendors – non current |

$ | — | $ | 271 | ||||

We periodically advance funds to vendors engaged to support the performance of our clinical trials and related supporting activities. The funds advanced are held, interest free, for varying periods of time and may be recovered by DiaMedica through partial reductions of ongoing invoices, application against final study/project invoices or refunded upon completion of services to be provided. Deposits are classified as current or non-current based upon their expected recovery time.

|

8. |

Property and Equipment |

Property and equipment consisted of the following (in thousands):

|

September 30, 2019 |

December 31, 2018 |

|||||||

|

Furniture and equipment |

$ | 49 | $ | 49 | ||||

|

Computer equipment |

59 | 71 | ||||||

| 108 | 120 | |||||||

|

Less accumulated depreciation |

(40 | ) | (24 | ) | ||||

|

Property and equipment, net |

$ | 68 | $ | 96 | ||||

|

9. |

Operating Lease |

We lease certain office space under a non-cancelable operating lease. This lease does not have significant rent escalation holidays, concessions, leasehold improvement incentives or other build-out clauses. Further this lease does not contain contingent rent provisions. This lease terminates on August 31, 2022 and we do not have an option to renew. This lease does include both lease (e.g., fixed rent) and non-lease components (e.g., common-area and other maintenance costs). The non-lease components are deemed to be executory costs and are therefore excluded from the minimum lease payments used to determine the present value of the operating lease obligation and related right-of-use asset.

This lease does not provide an implicit rate and, due to the lack of a commercially salable product, we are generally considered unable to obtain commercial credit. Therefore, we estimated our incremental borrowing rate to be 9%, considering the quoted rates for the lowest investment-grade debt and the interest rates implicit in recent financing leases. We used our estimated incremental borrowing rate and other information available at the lease commencement date in determining the present value of the lease payments.

Our operating lease cost and variable lease costs were $49,000 and $40,000, respectively, for the nine months ended September 30, 2019. Variable lease costs consist primarily of common area maintenance costs, insurance and taxes which are paid based upon actual costs incurred by the lessor.

Maturities of our operating lease obligation are as follows as of September 30, 2019 (in thousands):

|

2019 |

$ | 16 | ||

|

2020 |

66 | |||

|

2021 |

68 | |||

|

2022 |

46 | |||

|

Total lease payments |

$ | 196 | ||

|

Less interest portion |

(25 | ) | ||

|

Present value of lease obligation |

$ | 171 |

|

10. |

Accrued Liabilities |

Accrued liabilities consisted of the following (in thousands):

|

September 30, 2019 |

December 31, 2018 |

|||||||

|

Accrued compensation and related |

$ | 299 | $ | 417 | ||||

|

Accrued clinical study costs |

327 | 292 | ||||||

|

Accrued research and other professional fees |

179 | 65 | ||||||

|

Accrued taxes and other liabilities |

32 | 34 | ||||||

|

Total accrued liabilities |

$ | 837 | $ | 808 | ||||

|

11. |

Shareholders’ Equity |

Authorized capital stock

The Company has authorized share capital of an unlimited number of voting common shares and the shares do not have a stated par value.

Common shareholders are entitled to receive dividends as declared by the Company, if any, and are entitled to one vote per share at the Company's annual general meeting and any special meeting.

Equity issued during the nine months ended September 30, 2019

During the nine months ended September 30, 2019, 50,000 common shares were issued on the exercise of options for gross proceeds of $75,000 and no warrants were exercised.

Equity issued during the nine months ended September 30, 2018

On March 29, 2018, the Company completed, in two tranches, a brokered and non-brokered private placement of 1,322,965 units at a price of $4.90 per unit for aggregate gross proceeds of approximately $6.3 million. Each unit consisted of one common share and one half of one common share purchase warrant. The Company issued 661,482 warrants. Each warrant entitles the holder to purchase one common share at a price of $7.00 at any time prior to expiry on March 19, 2020 and March 29, 2020 for Tranche 1 and Tranche 2, respectively. The warrants are subject to early expiry under certain conditions. The warrant expiry date can be accelerated at the option of the Company, in the event that the volume-weighted average trading price of the Company’s common shares exceeds $12.00 per common share for any 21 consecutive trading days. In connection with this offering, the Company paid aggregate finder’s fees of approximately $384,000 and issued an aggregate of 80,510 compensation warrants. Each compensation warrant entitles the holder to purchase one common share at $4.90 for a period of 2 years from the closing of the offering, subject to acceleration on the same terms as the common share purchase warrants.

During the nine months ended September 30, 2018, 128,594 common shares were issued on the exercise of warrants for gross proceeds of $521,000 and 16,954 common shares were issued on the exercise of options for gross proceeds of $43,000.

Shares reserved

Common shares reserved for future issuance are as follows:

|

September 30, 2019 |

||||

|

Stock options outstanding |

1,251,893 | |||

|

Deferred share units outstanding |

21,183 | |||

|

Shares available for grant under the DiaMedica Therapeutics Inc. Stock Option Plan |

1,372,675 | |||

|

Common shares issuable under common share purchase warrants |

807,563 | |||

|

Total |

3,453,314 | |||

|

12. |

Net Loss Per Share |

We compute net loss per share by dividing our net loss (the numerator) by the weighted-average number of common shares outstanding (the denominator) during the period. Shares issued during the period and shares reacquired during the period, if any, are weighted for the portion of the period that they were outstanding. The computation of diluted earnings per share, or EPS, is similar to the computation of basic EPS except that the denominator is increased to include the number of additional common shares that would have been outstanding if the dilutive potential common shares had been issued. Our diluted EPS is the same as basic EPS due to common equivalent shares being excluded from the calculation, as their effect is anti-dilutive.

The following table summarizes our calculation of net loss per common share for the periods (in thousands, except share and per share data):

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2019 |

2018 |

2019 |

2018 |

|||||||||||||

|

Net loss |

$ | (2,448 |

) |

$ | (1,387 |

) |

$ | (8,169 |

) |

$ | (3,772 |

) |

||||

|

Weighted average shares outstanding—basic and diluted |

12,006,874 | 7,836,683 | 11,981,233 | 7,406,378 | ||||||||||||

|

Basic and diluted net loss per share |

$ | (0.20 |

) |

$ | (0.18 |

) |

$ | (0.68 |

) |

$ | (0.51 |

) |

||||

The following outstanding potential common shares were not included in the diluted net loss per share calculations as their effects were not dilutive:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2019 |

2018 |

2019 |

2018 |

|||||||||||||

|

Employee and non-employee stock options |

1,251,893 | 639,360 | 1,251,893 | 639,360 | ||||||||||||

|

Common shares issuable under common share purchase warrants |

807,563 | 825,264 | 807,563 | 825,264 | ||||||||||||

|

Common shares issuable under deferred unit plan |

21,183 | 21,183 | 21,183 | 21,183 | ||||||||||||

|

13. |

Former License and Collaboration Agreement with Related Party |

On September 27, 2018, the Company entered into a license and collaboration agreement (the “License Agreement”) with Ahon Pharmaceutical Co Ltd. (“Ahon Pharma”), which granted Ahon Pharma exclusive rights to develop and commercialize DM199 for acute ischemic stroke in mainland China, Taiwan, Hong Kong S.A.R. and Macau S.A.R. Under the terms of the agreement, the Company received a non-refundable upfront payment of $500,000 upon signing the License Agreement and was entitled to receive an additional non-refundable payment of $4.5 million upon the earlier of regulatory clearance to initiate a clinical trial in China or July 1, 2019. The Company also had the potential to receive up to an additional $27.5 million in development and sales related milestones and up to approximately 10% royalties on net sales of DM199 in the licensed territories. All development, regulatory, sales, marketing, and commercial activities and associated costs in the licensed territories were the sole responsibility of Ahon Pharma. By its terms, the License Agreement could be terminated at any time by Ahon Pharma by providing 120 days written notice.

On August 12, 2019, after extensive good faith discussions between Ahon Pharma and the Company, the parties were unable to agree upon mutually acceptable revised terms to the agreement and we terminated the License Agreement for non-payment of the $4.5 million milestone due upon the earlier of regulatory clearance to initiate a clinical trial in China or July 1, 2019, thereby regaining worldwide rights for DM199 for acute ischemic stroke.

Ahon Pharma is a subsidiary of Shanghai Fosun Pharmaceutical (Group) co. Ltd. (“Fosun Pharma”) which, through its partnership with SK Group, a South Korea based company, is an investor in DiaMedica, holding approximately 8.4% of our common shares as of December 31, 2018. This investment was made in 2016.

|

14. |

Share-Based Compensation |

2019 Omnibus Incentive Plan

The DiaMedica Therapeutics Inc. 2019 Omnibus Incentive Plan (the “2019 Plan”) was adopted by the Board of Directors in March 2019 and approved by our shareholders at our annual general and special meeting of shareholders held on May 22, 2019. The 2019 Plan permits the Board, or a committee or subcommittee thereof, to grant to the Company’s eligible employees, non-employee directors and consultants non-statutory and incentive stock options, stock appreciation rights, restricted stock awards, restricted stock units, deferred stock units, performance awards, non-employee director awards and other stock-based awards. We grant options to purchase common shares under the 2019 Plan at no less than the fair market value of the underlying common shares as of the date of grant. Options granted to employees and non-employee directors have a maximum term of ten years and generally vest in approximately equal quarterly installments over one to three years. Options granted to non-employees have a maximum term of five years and generally vest in approximately equal quarterly installments over one year. Subject to adjustment as provided in the 2019 Plan, the maximum number of the Company’s common shares authorized for issuance under the 2019 Plan is 2,000,000 shares. As of September 30, 2019, options to purchase 627,325 common shares were outstanding under the 2019 Plan.

Stock option plan

The DiaMedica Therapeutics Inc. Stock Option Plan, Amended and Restated November 6, 2018 (the “Prior Plan”), was terminated by the Board of Directors in conjunction with the shareholder approval of the 2019 Plan. Awards outstanding under the Prior Plan remain outstanding in accordance with and pursuant to the terms thereof. Options granted under the Prior Plan have terms similar to those used under the 2019 Plan. As of September 30, 2019, options to purchase 624,568 common shares were outstanding under the Prior Plan.

As the TSX Venture Exchange was the principal trading market for the Company’s common shares, all options granted prior to December 31, 2018 under the Prior Plan were priced in Canadian dollars. Options granted after December 31, 2018 under the 2019 Plan and the Prior Plan have been priced in United States dollars.

Deferred share unit plan

The DiaMedica Therapeutics Inc. Amended and Restated Deferred Share Unit Plan (the “DSU Plan”) was terminated by the Board of Directors in conjunction with the shareholder approval of the 2019 Plan. Awards outstanding under the DSU Plan remain outstanding in accordance with and pursuant to the terms thereof. As of September 30, 2019, there were 21,183 common shares reserved for DSUs outstanding.

The aggregate number of common shares reserved for issuance for awards granted under the 2019 Plan, the Prior Plan and the DSU Plan as of September 30, 2019 was 1,273,076.

Share-based compensation expense for each of the periods presented is as follows (in thousands):

|

Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

|

2019 |

2018 |

2019 |

2018 |

|||||||||||||

|

Research and development |

$ | 151 | $ | 26 | $ | 276 | $ | 129 | ||||||||

|

General and administrative |

300 | 84 | 487 | 426 | ||||||||||||

|

Total share-based compensation |

$ | 451 | $ | 110 | $ | 763 | $ | 555 | ||||||||

We recognize share-based compensation based on the fair value of each award as estimated using the Black-Scholes option valuation model. Ultimately, the actual expense recognized over the vesting period will only be for those shares that actually vest.

A summary of option activity is as follows (in thousands except share and per share amounts):

|

Shares Underlying Options Outstanding |

Weighted Average Exercise Price Per Share |

Aggregate Intrinsic Value |

||||||||||

|

Balances at December 31, 2018 |

639,359 | $ | 5.95 | $ | — | |||||||

|

Granted |

675,825 | 4.56 | ||||||||||

|

Exercised |

(50,000 | ) | 1.50 | |||||||||

|

Expired/cancelled |

(7,186 | ) | 5.37 | |||||||||

|

Forfeited |

(6,105 | ) | 6.03 | |||||||||

|

Balances at September 30, 2019 |

1,251,893 | $ | 5.38 | $ | — | |||||||

Information about stock options outstanding, vested and expected to vest as of September 30, 2019, is as follows:

|

Outstanding, Vested and Expected to Vest |

Options Vested and Exercisable |

|||||||||||||||||||||

|

Per Share Exercise Price |

Shares |

Weighted Average Remaining Contractual Life (Years) |

Weighted Average Exercise Price |

Options Exercisable |

Weighted Average Remaining Contractual Life (Years) |

|||||||||||||||||

| $2.00 |

- |

$2.99 | 132,900 | 6.2 | $ | 2.29 | 132,067 | 6.2 | ||||||||||||||

| $3.00 |

- |

$3.99 | 122,905 | 7.2 | 3.91 | 115,093 | 7.2 | |||||||||||||||

| $4.00 |

- |

$4.99 | 764,971 | 9.5 | 4.60 | 161,193 | 8.9 | |||||||||||||||

| $7.00 |

- |

$26.00 | 231,117 | 7.4 | 10.51 | 125,067 | 6.4 | |||||||||||||||

| 1,251,893 | 8.5 | $ | 5.38 | 533,420 | 7.3 | |||||||||||||||||

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations is based upon accounting principles generally accepted in the United States of America and discusses the financial condition and results of operations for DiaMedica Therapeutics Inc. and its subsidiaries for the three and nine months ended September 30, 2019 and 2018.

This discussion should be read in conjunction with our condensed consolidated financial statements and related notes included elsewhere in this report. The following discussion contains forward-looking statements that involve numerous risks and uncertainties. Our actual results could differ materially from the forward-looking statements as a result of these risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for additional cautionary information.

Business Overview

We are a clinical stage biopharmaceutical company primarily focused on the development of novel recombinant proteins. Our goal is to use our patented and licensed technologies to establish our company as a leader in the development and commercialization of therapeutic treatments from novel recombinant proteins. Our current focus is on chronic kidney disease (“CKD”) and acute ischemic stroke (“AIS”). We plan to advance DM199, our lead drug candidate, through required clinical trials to create shareholder value by establishing its clinical and commercial potential as a therapy for CKD and AIS.

DM199 is a recombinant form of human tissue kallikrein-1 (“KLK1”). KLK1 is a serine protease (protein) produced primarily in the kidneys, pancreas and salivary glands, which plays a critical role in the regulation of local blood flow and vasodilation (the widening of blood vessels which decreases blood pressure) in the body, as well as an important role in inflammation and oxidative stress (an imbalance between potentially damaging reactive oxygen species, or free radicals, and antioxidants in your body). We believe DM199 has the potential to treat a variety of diseases where healthy functioning requires sufficient activity of KLK1 and its system, the kallikrein-kinin system (“KKS”).

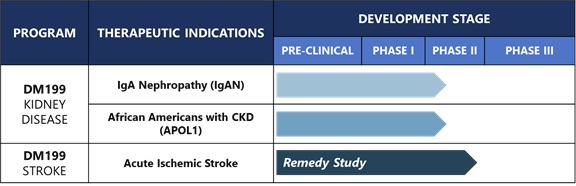

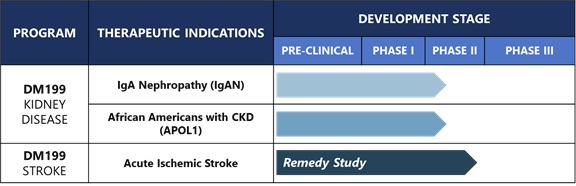

Our DM199 product candidate is in clinical development as follows:

In October 2019, the FDA accepted the protocol for our Phase II clinical trial in participants with CKD. The Phase II trial is designed to assess the safety and efficacy of DM199, at 3 µg/kg and 5 µg/kg dose levels, in the treatment of CKD in two cohorts: participants with CKD caused by IgA nephropathy (IgAN) and non-diabetic, hypertensive African Americans with CKD.

In December 2018, the FDA accepted our Investigational New Drug application for the initiation of a Phase Ib clinical trial of DM199 in participants with moderate or severe CKD caused by Type I or Type II diabetes. We initiated dosing patients in this study in February 2019 and completed enrollment in July 2019. The study was performed to assess the pharmacokinetics (“PK”) of three dose levels of DM199 (3, 5 and 8 µg/kg), administered in a single subcutaneous dose as well as the evaluation of safety, tolerability and secondary pharmacodynamic (“PD”) endpoints. As we announced in June 2019, interim results met primary and secondary endpoints. PK profiles, at the 3µg/kg dose level, were similar between moderate and severe CKD patients, and consistent with healthy subjects tested previously. Therefore, we do not believe dosing adjustment is warranted, based on the presence or severity of CKD and a full renal study will likely not be required. The results from this Phase Ib study were used to guide the design of our Phase II trial in patients suffering from rare and significant unmet causes of CKD.

In February 2018, we initiated treatment on the first patient in our Phase II REMEDY trial assessing the safety, tolerability and markers of therapeutic efficacy of DM199 in patients suffering from AIS. As of October 31, 2019, we reached our enrollment goal with 92 participants and enrollment has been closed.

In September 2018, we entered into a license and collaboration agreement with Ahon Pharma, which granted Ahon Pharma exclusive rights to develop and commercialize DM199 for acute ischemic stroke in mainland China, Taiwan, Hong Kong S.A.R. and Macau S.A.R. Under the terms of the agreement, we received an upfront payment of $500,000 on signing and were entitled to receive an additional payment of $4.5 million upon the earlier of regulatory clearance to initiate a clinical trial in China or July 1, 2019. On August 12, 2019, after extensive good faith discussions with Ahon Pharma, we were unable to agree upon mutually acceptable revised terms to the agreement and we terminated the agreement for non-payment of the $4.5 million milestone, thereby regaining worldwide rights for DM199 for acute ischemic stroke.

We have not generated any revenues from product sales. Since our inception, we have financed our operations from public and private sales of equity, the exercise of warrants and stock options, interest income on funds available for investment and government grants and tax credits. We have incurred losses in each year since our inception. Our net losses were $8.2 million and $3.8 million for the nine months ended September 30, 2019 and 2018, respectively. As of September 30, 2019, we had an accumulated deficit of $54.1 million. Substantially all of our operating losses resulted from expenses incurred in connection with our product candidate development programs, our primary research and development (“R&D”) activities, and general and administrative (“G&A”) support costs associated with our operations.

We expect to continue to incur significant expenses and increased operating losses for at least the next several years. In the near term, we anticipate that our expenses will increase as we:

|

● |

advance the ongoing clinical development of DM199; |

|

● |

provide G&A support for our operations; and |

|

● |

maintain, expand and protect our intellectual property portfolio. |

In addition, we expect our operating expenses to increase in 2019 compared to the comparable periods in 2018 as a result of our Nasdaq-listed U.S. public reporting company status obtained in December 2018.

While we expect our rate of future negative cash flow per month will vary due to the timing of expenses incurred, we expect our current cash resources to be sufficient to allow us to complete our current ongoing Phase II REMEDY trial in patients with AIS and the first two cohorts in the Phase II study in patients with CKD and to otherwise fund our planned operations into the fourth quarter of 2020. However, the amount and timing of future funding requirements will depend on many factors, including the timing and results of our ongoing development efforts, including enrollment in our clinical trials, the potential expansion of our current development programs, potential new development programs, and related G&A support. We may require significant additional funds earlier than we currently expect and there is no assurance that we will not need or seek additional funding prior to such time. We may elect to raise additional funds even before we need them if market conditions for raising additional capital are favorable.

From a strategic perspective, we continue to believe that strategic alternatives with respect to our DM199 product candidate, including licenses and business collaborations, with other regional and global pharmaceutical and biotechnology companies can be important in advancing the clinical development of DM199. Therefore, as a matter of course and from time to time, we continue to engage in discussions with third parties regarding these matters.

Financial Overview

Revenues

Since our inception, we have incurred losses while advancing the development of our therapeutic product candidates. We have not generated any revenues from product sales and do not expect to do so for a number of years. We may never generate sales revenues from our current DM199 product candidate as we may never succeed in obtaining regulatory approval or commercial sale of this product candidate. We received $500,000 in license revenue last year.

Research and Development Expenses

R&D expenses consist primarily of fees paid to external service providers such as contract research organizations and contract manufacturing organizations related to clinical trials; contractual obligations for clinical development, clinical sites, laboratory testing, preclinical trials; development of manufacturing processes, costs for production runs of DM199; salaries, benefits, share-based compensation and other R&D personnel costs.

At this time, due to the risks inherent in the clinical development process and the early stage of our product development programs, we are unable to estimate with any certainty the costs we will incur in the continued development of DM199 or any of our preclinical development programs. We expect that our R&D expenses will continue to increase if we are successful in advancing DM199, or any of our preclinical programs, into advanced stages of clinical development. The process of conducting clinical trials necessary to obtain regulatory approval and manufacturing scale-up to support expanded development and potential future commercialization is costly and time consuming. Any failure by us or delay in completing clinical trials, manufacturing scale-up or in obtaining regulatory approvals could lead to increased R&D expenses and, in turn, have a material adverse effect on our results of operations.

General and Administrative Expenses

G&A expenses consist primarily of salaries and related benefits, including share-based compensation related to our executive, finance, business development and support functions. Other G&A expenses include insurance, rent and utilities, travel expenses and professional fees for auditing, tax and legal services. We expect our G&A expenses will increase in the future as we expand our operating activities. In addition, our G&A expenses have increased in 2019 compared to comparable periods in 2018 due to increased costs associated with our listing on The Nasdaq Capital Market and U.S. public reporting company status, which commenced in December 2018.

Other (Income) Expense

Other (income) expense consists primarily of governmental assistance – research incentives, interest income and foreign currency exchange gains and losses.

Recently Adopted Accounting Pronouncements

In February 2016, the FASB issued Accounting Standards Update (“ASU”) No. 2016-02, Leases. The guidance in ASU 2016-02 supersedes the lease recognition requirements in the Accounting Standards Codification Topic 840, Leases. ASU 2016-02 requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. The new standard requires the immediate recognition of all excess tax benefits and deficiencies in the income statement and requires classification of excess tax benefits as an operating activity as opposed to a financing activity in the statements of cash flows. This standard became effective for us on January 1, 2019.

The FASB has subsequently issued the following amendments to ASU 2016-02, which have the same effective date and transition date of January 1, 2019, and which we collectively refer to as the new leasing standards:

|

● |

ASU No. 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842, which permits an entity to elect an optional transition practical expedient to not evaluate under Topic 842 land easements that existed or expired prior to adoption of Topic 842 and that were not previously accounted for as leases under the prior standard, ASC 840, Leases. |

|

● |

ASU No. 2018-10, Codification Improvements to Topic 842, Leases, which amends certain narrow aspects of the guidance issued in ASU 2016-02. |

|

● |

ASU No. 2018-11, Leases (Topic 842): Targeted Improvements, which allows for a transition approach to initially apply ASU 2016-02 at the adoption date and recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption as well as an additional practical expedient for lessors to not separate non-lease components from the associated lease component. |

|

● |

ASU No. 2018-20, Narrow-Scope Improvements for Lessors, which contains certain narrow scope improvements to the guidance issued in ASU 2016-02. |

We adopted the new leasing standards on January 1, 2019, using a modified retrospective transition approach to be applied to leases existing as of, or entered into after, January 1, 2019; and, consequently, financial information will not be updated and the disclosures required under Topic 842 will not be provided for dates and periods prior to January 1, 2019. We have reviewed our existing lease contracts and the impact of the new leasing standards on our consolidated results of operations, financial position and disclosures. Upon adoption of the new leasing standards, we recognized a lease liability and related right-of-use asset on our condensed consolidated balance sheet of approximately $205,000.

In June 2018, the FASB issued ASU No. 2018-07, “Improvements to Nonemployee Share-Based Payment Accounting,” to simplify the accounting for share-based payments to nonemployees by aligning it with the accounting for share-based payments to employees, with certain exceptions. This ASU is effective for public entities for fiscal years beginning after December 15, 2018, with early adoption permitted. Prior to the adoption of this ASU, share-based compensation awarded to non-employees was subject to revaluation over its vesting terms. Subsequent to the adoption of this ASU, non-employee share-based payment awards are measured on the date of grant, similar to share-based payment awards granted to employees. We adopted this standard on January 1, 2019 and the adoption of this ASU did not have a material impact on our financial position or our condensed consolidated statements of operations.

Results of Operations

Comparison of the Three and Nine Months Ended September 30, 2019 and 2018

The following table summarizes our unaudited results of operations for the three and nine months ended September 30, 2019 and 2018 (in thousands):

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2019 |

2018 |

2019 |

2018 |

|||||||||||||

|

Operating expenses: |

||||||||||||||||

|

Research and development |

$ | 1,617 | $ | 1,210 | $ | 6,098 | $ | 3,071 | ||||||||

|

General and administrative |

1,044 | 777 | 2,725 | 2,073 | ||||||||||||

|

Total other income, net |

225 | 157 | 683 | 946 | ||||||||||||

Research and Development Expenses

R&D expenses increased to $1.6 million for the three months ended September 30, 2019, up from $1.2 million for the three months ended September 30, 2018, an increase of $0.4 million. R&D expenses increased to $6.1 million for the nine months ended September 30, 2019, compared to $3.1 million for the nine months ended September 30, 2018, an increase of $3.0 million. The increase for the nine months ended September 30, 2019 was due to costs of approximately $1.4 million incurred for a new production run of the DM199 drug substance, as well as costs incurred in conjunction with the Phase Ib and Phase II clinical studies in CKD patients and related non-clinical testing. Increased personnel and non-cash share-based compensation costs also contributed to the increase. The increase for the three months ended September 30, 2019 was due to costs incurred in conjunction with the Phase Ib and Phase II CKD studies and non-cash share-based compensation costs, partially offset by a decline in costs incurred in conjunction with the Phase II REMEDY study in AIS patients.

General and Administrative Expenses

G&A expenses were $1.0 million for the three months ended September 30, 2019, compared to $777,000 for the three months ended September 30, 2018. G&A expenses increased to $2.7 million for the nine months ended September 30, 2019, up from $2.1 million for the nine months ended September 30, 2018. These increases were primarily due to costs associated with our status as a Nasdaq-listed U.S. public reporting company, which commenced in December 2018, including increased professional service, compliance and non-cash share-based compensation costs. Increased personnel costs also contributed to the increase on a year-to-date basis.

Total Other (Income) Expense

Total other income, net, increased to $225,000 for the three months ended September 30, 2019, up from $157,000 for the prior year period. Total other income, net, decreased to $683,000 for the nine months ended September 30, 2019, compared to $946,000 for the nine months ended September 30, 2018. The year-to-date decrease is primarily related to the initial recognition of R&D incentives from the Australian Government paid for qualifying research work performed by DiaMedica Australia Pty Ltd. during the nine months ended September 30, 2018. The increase in the quarterly comparison relates to increased study costs, compared to the prior year period, driving an increase in the eligible R&D incentive. The year-to-date decrease was partially offset by, and the current quarter increase was augmented by, increased interest income earned on marketable securities during the three and nine months ended September 30, 2019.

Liquidity and Capital Resources

The following tables summarize our liquidity and capital resources as of September 30, 2019 and December 31, 2018, and our sources and uses of cash for each of the nine month periods ended September 30, 2019 and 2018, and is intended to supplement the more detailed discussion that follows (in thousands):

|

Liquidity and Capital Resources |

September 30, 2019 |

December 31, 2018 |

||||||

|

Cash and cash equivalents |

$ | 4,741 | $ | 16,823 | ||||

|

Marketable securities |

5,002 | — | ||||||

|

Total assets |

11,039 | 18,339 | ||||||

|

Total current liabilities |

1,205 | 1,296 | ||||||

|

Total shareholders’ equity |

9,700 | 17,025 | ||||||

|

Working capital |

9,601 | 16,676 | ||||||

|

Nine Months Ended September 30, |

||||||||

|

Cash Flow Data |

2019 |

2018 |

||||||

|

Cash flow provided by (used in): |

||||||||

|

Operating activities |

$ | (7,237 | ) | $ | (3,796 | ) | ||

|

Investing activities |

(4,916 | ) | (63 | ) | ||||

|

Financing activities |

71 | 6,404 | ||||||

|

Net increase (decrease) in cash |

$ | (12,082 | ) | $ | 2,545 | |||

Working Capital

We had cash and cash equivalents of $4.7 million, marketable securities of $5.0 million, current liabilities of $1.1 million and working capital of $9.6 million as of September 30, 2019, compared $16.8 million in cash and cash equivalents, $1.3 million in current liabilities and $16.7 million in working capital as of December 31, 2018. The decreases in our combined cash and cash equivalents and marketable securities and in our working capital are due primarily to our operating loss incurred for the nine months ended September 30, 2019.

Cash Flows

Operating Activities

Net cash used in operating activities for the nine months ended September 30, 2019 was $7.2 million compared to $3.8 million for the nine months ended September 30, 2018. This increase relates primarily to the increase in the net loss, partially offset by the effects of the changes in operating assets and liabilities.

Investing Activities

Investing activities consist primarily of purchases of marketable securities and property and equipment during the respective periods. Net cash used in investing activities was $4.9 million for the nine months ended September 30, 2019 compared to $63,000 for the nine months ended September 30, 2018. This increase was due to the purchase of marketable securities during the current year period.

Financing Activities

Financing activities consist primarily of net proceeds from the sale of common shares and warrants and proceeds from the exercise of stock options and warrants, and in 2019, principal payments on financing lease obligations. Net cash provided by financing activities was $71,000 for the nine months ended September 30, 2019, compared to $6.4 million for the nine months ended September 30, 2018. Cash flows from financing activities for 2018 included net proceeds from our March 2018 private placements of our common shares and warrants to purchase common shares and the exercise of warrants to purchase common shares which expired in February 2018.

In December 2018, we completed an initial public offering of our common shares in the United States by issuing 4,100,000 common shares at an offering price of $4.00 per share, resulting in net proceeds to us of approximately $14.7 million, after deducting underwriting discounts and commissions and offering expenses.