SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

________________________________________________

DIAMEDICA THERAPEUTICS INC.

(Name of Registrant as Specified In Its Charter)

________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: ............................................................ |

|

|

(2) |

Aggregate number of securities to which transaction applies: ............................................................ |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ............................................................ |

|

|

(4) |

Proposed maximum aggregate value of transaction: ............................................................ |

|

|

(5) |

Total fee paid: ............................................................ |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: ............................................................ |

|

|

(2) |

Form, Schedule or Registration Statement No.: ............................................................ |

|

|

(3) |

Filing Party: ............................................................ |

|

|

(4) |

Date Filed: ............................................................ |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

June 2, 2020

The Annual General Meeting of Shareholders of DiaMedica Therapeutics Inc., a corporation existing under the laws of British Columbia, will be held at the offices of Fox Rothschild LLP* located at 222 South Ninth Street, Suite 2000, Minneapolis, Minnesota 55402 USA, beginning at 2:30 p.m., Central Daylight Savings Time, on Tuesday, June 2, 2020, for the following purposes:

| 1. | To receive the audited consolidated financial statements of DiaMedica Therapeutics Inc. for the financial year ended December 31, 2019 and accompanying report of the independent registered public accounting firm (for discussion only). |

|

2. |

To elect four persons to serve as directors until our next annual general meeting of shareholders or until their respective successors are elected and qualified (Voting Proposal One). |

|

3. |

To consider a proposal to appoint Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 and to authorize the Board of Directors to fix our independent registered public accounting firm’s remuneration (Voting Proposal Two). |

|

4. |

To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Only those shareholders of record at the close of business on April 9, 2020 will be entitled to notice of, and to vote at, the meeting and any adjournments thereof. A shareholder list will be available at our corporate offices beginning April 20, 2020 during normal business hours for examination by any shareholder registered on our common share ledger as of the record date, April 9, 2020, for any purpose germane to the meeting.

By Order of the Board of Directors,

Scott Kellen

Corporate Secretary

April 20, 2020

Minneapolis, Minnesota

| Important: Whether or not you expect to attend the meeting in person, please vote by the Internet or telephone, or request a paper proxy card to sign, date and return by mail so that your shares may be voted. A prompt response is helpful and your cooperation is appreciated. |

* As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the Annual General Meeting may be held at another place or solely by means of remote communication. If we take this step, we will publicly announce the decision to do so in advance, as well as details on the place, if applicable, and how to attend and participate. Such information will also be available at https://www.diamedica.com/proxy.

TABLE OF CONTENTS

________________

Page

|

PROXY STATEMENT SUMMARY |

1 |

|

GENERAL INFORMATION ABOUT THE ANNUAL GENERAL MEETING AND VOTING |

1 |

|

Date, Time, Place and Purposes of Meeting |

1 |

|

Who Can Vote |

1 |

|

How You Can Vote |

1 |

|

How Does the Board of Directors Recommend that You Vote |

3 |

|

How You May Change Your Vote or Revoke Your Proxy |

3 |

|

Quorum Requirement |

3 |

|

Vote Required |

3 |

|

Appointment of Proxyholders |

4 |

|

Other Business |

4 |

|

Procedures at the Meeting |

4 |

|

Householding of Meeting Materials |

5 |

|

Proxy Solicitation Costs |

5 |

|

VOTING PROPOSAL ONE—ELECTION OF DIRECTORS |

6 |

|

Board Size and Structure |

6 |

|

Information about Current Directors and Board Nominees |

6 |

|

Additional Information about Current Directors and Board Nominees |

6 |

|

Penalties or Sanctions |

9 |

|

Corporate Cease Trade Orders or Bankruptcies |

9 |

|

Board Recommendation |

9 |

|

VOTING PROPOSAL TWO—APPOINTMENT OF BAKER TILLY VIRCHOW KRAUSE, LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AND AUTHORIZATION TO FIX REMUNERATION |

10 |

|

Appointment of Independent Registered Public Accounting Firm |

10 |

|

Authorization to Board of Directors to Fix Remuneration |

10 |

|

Audit, Audit-Related, Tax and Other Fees |

10 |

|

Audit Committee Pre-Approval Policies and Procedures |

11 |

|

Board Recommendation |

11 |

|

STOCK OWNERSHIP |

12 |

|

Security Ownership of Significant Beneficial Owners |

12 |

|

Security Ownership of Management |

13 |

|

CORPORATE GOVERNANCE |

15 |

|

Management by Board of Directors |

15 |

|

Corporate Governance Guidelines |

15 |

|

Board Leadership Structure |

16 |

|

Director Independence |

17 |

|

Board Committees |

17 |

|

Audit Committee |

17 |

|

Compensation Committee |

19 |

|

Nominating and Corporate Governance Committee |

20 |

|

Director Qualifications and the Nomination Process |

21 |

|

Board Diversity |

22 |

|

Role of Board in Risk Oversight Process |

23 |

|

Code of Business Conduct and Ethics |

23 |

|

Board and Committee Meetings and Attendance |

24 |

|

Policy Regarding Director Attendance at Annual General Meetings of Shareholders |

24 |

|

Complaint Procedures |

24 |

|

Process Regarding Shareholder Communications with Board of Directors |

24 |

|

DIRECTOR COMPENSATION |

25 |

|

Non-Employee Director Compensation Program |

25 |

|

Director Compensation Table |

26 |

|

Indemnification |

26 |

|

EXECUTIVE COMPENSATION |

27 |

|

Executive Compensation Overview |

27 |

|

Summary Compensation Table |

34 |

|

Outstanding Equity Awards at Fiscal Year-End |

35 |

|

Employee Benefit and Stock Plans |

35 |

|

Anti-Hedging and Pledging Policy |

38 |

|

RELATED PERSON RELATIONSHIPS AND TRANSACTIONS |

39 |

|

Introduction |

39 |

|

Description of Related Party Transactions |

39 |

|

Policies and Procedures for Related Party Transactions |

40 |

|

SHAREHOLDER PROPOSALS FOR 2021 ANNUAL GENERAL MEETING OF SHAREHOLDERS |

42 |

|

COPIES OF FISCAL 2019 ANNUAL REPORT AND ADDITIONAL INFORMATION |

42 |

________________

DiaMedica Therapeutics Inc. is sometimes referred to as “DiaMedica,” “we,” “our” or “us” in this proxy statement.

The Annual General Meeting of Shareholders to be held on June 2, 2020 is sometimes referred to as the “Annual General Meeting” or “meeting” in this proxy statement.

Our voting common shares, no par value, are sometimes referred to as our “common shares” or “shares” in this proxy statement.

All dollar amounts in this proxy statement are expressed in United States currency unless otherwise noted.

PROXY STATEMENT SUMMARY

________________

This executive summary provides an overview of the information included in this proxy statement. We recommend that you review the entire proxy statement and our 2019 Annual Report to Shareholders before voting.

2020 ANNUAL GENERAL MEETING OF SHAREHOLDERS

| DATE AND TIME |

Proposal |

Board’s Vote Recommendation |

Page |

|

|

Tuesday, June 2, 2020 2:30 p.m. (Central Daylight Savings Time) |

Voting Proposal No. 1: Election of Directors |

FOR |

6 |

|

|

LOCATION*

Fox Rothschild LLP 222 South Ninth Street, #2000 Minneapolis, MN 55402 |

Voting Proposal No. 2: Appointment of Independent Registered Public Accounting Firm and Authorization to Fix Remuneration |

FOR |

10 |

RECORD DATE

|

April 9, 2020 |

Holders of record of our common shares at the close of business on April 9, 2020 are entitled to notice of, to attend, and to vote at the 2020 Annual General Meeting of Shareholders or any adjournment thereof |

* As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the Annual General Meeting may be held at another place or solely by means of remote communication. If we take this step, we will publicly announce the decision to do so in advance, as well as details on the place, if applicable, and how to attend and participate. Such information will also be available at https://www.diamedica.com/proxy.

INTERNET AVAILABILITY OF PROXY MATERIALS

Instead of mailing a printed copy of our proxy materials, including our Annual Report to Shareholders, to each shareholder of record, we have provided access to these materials in a fast and efficient manner via the Internet. We believe that this process expedites your receipt of our proxy materials, lowers the costs of our meeting and reduces the environmental impact of our meeting. On or about April 20, 2020, we expect to begin mailing a Notice of Internet Availability of Proxy Materials to shareholders of record as of April 9, 2020 and post our proxy materials on the website referenced in the Notice of Internet Availability of Proxy Materials (www.proxyvote.com). As more fully described in the Notice of Internet Availability of Proxy Materials, shareholders may choose to access our proxy materials at www.proxyvote.com or may request proxy materials in printed or electronic form. In addition, the Notice of Internet Availability of Proxy Materials and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. For those who previously requested printed proxy materials or electronic materials on an ongoing basis, you will receive those materials as you previously requested.

Important Notice Regarding the Availability of Proxy Materials

for the Annual General Meeting of Shareholders to be Held on June 2, 2020:

The Notice of Annual General Meeting of Shareholders and Proxy Statement and

Annual Report to Shareholders, including our Annual Report on Form 10-K

for the fiscal year ended December 31, 2019, are available at www.proxyvote.com

2020 BUSINESS HIGHLIGHTS

Below are highlights of our clinical, operational and financial achievements during 2019 and the beginning of 2020.

|

Clinical |

|

|

Commenced Phase II - CKD |

Commenced REDUX Phase II study of DM199 for the treatment of Chronic Kidney Disease (CKD). This study is designed to investigate the safety, tolerability and efficacy of DM199 for the treatment of CKD in African Americans with hypertension and CKD in individuals with IgA Nephropathy. |

|

Completed Phase 1b - CKD |

Completed Phase Ib study of DM199 in patients with moderate or severe CKD caused by Type I or Type II diabetes. These results, consistent with prior studies, demonstrated that DM199 continued to be safe and well tolerated with no treatment-related serious adverse events and pharmacokinetic data supported the determination of the dose range expected to normalize KLK1 levels in both moderate and severe CKD patients. |

|

Completed Phase II - AIS |

Completed enrollment in our Phase II REMEDY trial assessing the safety, tolerability and markers of therapeutic efficacy of DM199 in patients suffering from acute ischemic stroke (AIS). |

|

Operational |

|

|

Established World Class Scientific Advisory Board |

Established a world class scientific advisory board to advise us with respect to our Phase II clinical study for CKD, including Drs. Rajiv Agarwal, George Bakris, Glenn Chertow, Charles Herzog and Aldo Peixoto. |

|

Expanded Executive Team |

Hired a new Vice President, Regulatory Affairs and a Consulting Head of Manufacturing. |

|

Financial |

|

|

Improved Financial Position |

Raised $8.5 million in gross proceeds from a public underwritten offering of our common shares in February 2020. |

|

Obtained Litigation Financing |

Entered into a litigation funding agreement with LEGALIST FUND II, L.P. for the purpose of funding our currently pending lawsuit against Pharmaceutical Research Associates Group B.V. |

CORPORATE GOVERNANCE HIGHLIGHTS

|

✓ Annual election of directors |

✓ Regular executive sessions |

|

✓ Majority of independent directors |

✓ No conflicts of interest |

|

✓ Independent Board Chairman |

✓ Access to independent advisors |

|

✓ Three fully independent Board committees |

✓ Independent compensation consultant |

|

✓ Corporate governance guidelines |

✓ No guaranteed bonuses |

|

✓ Annual review of governance documents |

✓ No perquisites |

BOARD OF DIRECTORS NOMINEES

Below are the directors nominated for election by shareholders at the 2020 Annual General Meeting of Shareholders for a one-year term. All director nominees listed below served during the fiscal year ended December 31, 2019. Zhenyu Xiao, Ph.D., a current director, is not standing for re-election at the 2020 Annual General Meeting.

|

Director |

Age |

Serving Since |

Independent |

|

Richard Pilnik |

63 |

2009 |

Yes |

|

Michael Giuffre, M.D. |

64 |

2010 |

Yes |

|

James Parsons |

54 |

2015 |

Yes |

|

Rick Pauls |

48 |

2010 |

No |

The Board of Directors recommends a vote “FOR” each of these four nominees.

BOARD COMMITTEE COMPOSITION

The Board of Directors maintains a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

Below are our current directors and their Board committee memberships.

|

Director |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

Independent Director (Y/N) |

|

Richard Pilnik |

● |

● |

● |

Y |

|

Michael Giuffre, M.D. |

● |

● |

● |

Y |

|

James Parsons |

● |

● |

● |

Y |

|

Rick Pauls |

N |

|||

|

Zhenyu Xiao, Ph.D. |

Y |

KEY QUALIFICATIONS

The following are some key qualifications, skills, and experiences of our Board of Directors.

|

● Leadership/Management |

● Financial Expertise |

● Business Development Experience |

|

● Prior Board Experience |

● Regulatory Expertise |

● Biopharmaceutical Industry Expertise |

EXECUTIVE COMPENSATION BEST PRACTICES

Our compensation practices include many best practices that support our executive compensation objectives and principles and benefit our shareholders.

|

What We Do: |

What We Don’t Do: |

|

● Emphasize pay for performance |

● No guaranteed salary increases or bonuses |

|

● Structure our executive compensation so a significant portion of pay is at risk |

● No repricing of stock options unless approved by shareholders |

|

● Structure our executive compensation so a significant portion is paid in equity |

● No pledging or hedging of DiaMedica securities |

|

● Maintain competitive pay packages |

● No perquisites |

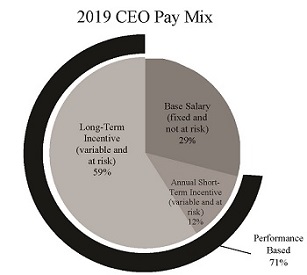

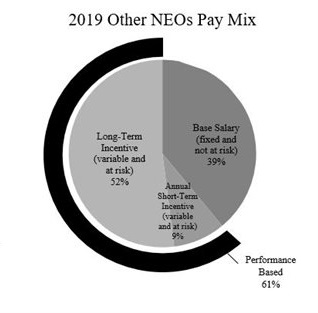

HOW WE PAY

Our executive compensation program consists of the following principal elements which are described in more detail below under “Executive Compensation—Compensation Philosophy—Elements of Our Executive Compensation Program:”

|

● |

Base salary – a fixed amount, paid in cash and reviewed annually and, if appropriate, adjusted. |

|

● |

Short-term incentive – a variable, short-term element that is payable in cash and is based on annual corporate performance objectives and, in some cases, individual performance objectives. |

|

● |

Long-term incentive – a variable, long-term element that is provided in stock options. |

2019 EXECUTIVE COMPENSATION ACTIONS

2019 compensation actions and incentive plan outcomes based on performance are summarized below:

|

Element |

Key 2019 Actions |

|

Base Salary |

Our named executive officers received increases between 13% and 29% over their respective 2018 base salaries to bring them closer to our target market positioning.

|

|

Short-Term Incentive |

Our named executive officers received short-term incentive cash bonuses equal to 80% of their respective target bonus opportunities based primarily on the achievement of corporate performance objectives and an additional discretionary adjustment as determined appropriate by the Compensation Committee.

|

|

Long-Term Incentive |

Our named executive officers received stock option awards, which vest quarterly over two years. Adopted a new shareholder-approved omnibus incentive plan.

|

|

Other Compensation |

No significant changes were made to other components of our executive compensation program.

|

Two Carlson Parkway, Suite 260, Minneapolis, Minnesota 55447

____________________________________

PROXY STATEMENT FOR

ANNUAL GENERAL MEETING OF SHAREHOLDERS

June 2, 2020

____________________________________

The Board of Directors of DiaMedica Therapeutics Inc. is soliciting your proxy for use at the 2020 Annual General Meeting of Shareholders to be held on Tuesday, June 2, 2020. The Board of Directors expects to make available to our shareholders beginning on or about April 20, 2020 the Notice of Annual General Meeting of Shareholders, this proxy statement and a form of proxy on the Internet or has sent these materials to shareholders of DiaMedica upon their request.

GENERAL INFORMATION ABOUT THE ANNUAL GENERAL MEETING AND VOTING

________________

Date, Time, Place and Purposes of Meeting

The Annual General Meeting of Shareholders of DiaMedica Therapeutics Inc. will be held on Tuesday, June 2, 2020, at 2:30 p.m., Central Daylight Savings Time, at the offices of Fox Rothschild LLP located at 222 South Ninth Street, Suite 2000, Minneapolis, Minnesota 55402, USA, for the purposes set forth in the Notice of Annual General Meeting of Shareholders.

As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the Annual General Meeting may be held at another place or solely by means of remote communication. If we take this step, we will publicly announce the decision to do so in advance, as well as details on the place, if applicable, and how to attend and participate. Such information will also be available at https://www.diamedica.com/proxy.

Who Can Vote

Shareholders of record at the close of business on April 9, 2020 will be entitled to notice of and to vote at the Annual General Meeting or any adjournment thereof. As of that date, there were 14,139,074 of our common shares outstanding. Each common share is entitled to one vote on each matter to be voted on at the Annual General Meeting. Shareholders are not entitled to cumulate voting rights.

How You Can Vote

Your vote is important. Whether you hold shares directly as a shareholder of record or beneficially in “street name” (through a broker, bank or other nominee), you may vote your shares without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker, bank or other nominee.

If you are a registered shareholder whose shares are registered in your name, you may vote your shares in person at the meeting or by one of the three following methods:

|

● |

Vote by Internet, by going to the website address http://www.proxyvote.com and following the instructions for Internet voting shown on the Notice of Internet Availability of Proxy Materials or on your proxy card. |

|

● |

Vote by Telephone, by dialing 1-800-690-6903 and following the instructions for telephone voting shown on the Notice of Internet Availability of Proxy Materials or on your proxy card. |

|

● |

Vote by Proxy Card, by completing, signing, dating and mailing the enclosed proxy card in the envelope provided if you received a paper copy of these proxy materials. |

If you vote by Internet or telephone, please do not mail your proxy card.

If your shares are held in “street name” (through a broker, bank or other nominee), you may receive a separate voting instruction form with this proxy statement or you may need to contact your broker, bank or other nominee to determine whether you will be able to vote electronically using the Internet or telephone.

The deadline for voting by telephone or by using the Internet is 11:59 p.m., Eastern Daylight Savings Time (10:59 p.m., Central Daylight Savings Time), on June 1, 2020, the day before the meeting. Please see the Notice of Internet Availability of Proxy Materials, your proxy card or the information your bank, broker or other nominee provided to you for more information on your options for voting.

If you return your signed proxy card or use Internet or telephone voting before the meeting, the named proxies will vote your shares as you direct. You have multiple choices on each matter to be voted on as follows:

For Voting Proposal One—Election of Directors, you may:

|

● |

Vote FOR all four nominees for director, |

|

● |

WITHHOLD your vote from one or more of the four nominees for director. |

For Voting Proposal Two—Appointment of Baker Tilly Virchow and Krause, LLP as our Independent Registered Public Accounting Firm and Authorization to Fix Remuneration, you may:

|

● |

Vote FOR the proposal, |

|

● |

Vote AGAINST the proposal or |

|

● |

ABSTAIN from voting on the proposal. |

If you send in your proxy card or use Internet or telephone voting, but do not specify how you want to vote your shares, the proxies will vote your shares FOR all four of the nominees for election to the Board of Directors in Voting Proposal One—Election of Directors and FOR Voting Proposal Two—Appointment of Baker Tilly Virchow and Krause, LLP as our Independent Registered Public Accounting Firm and Authorization to Fix Remuneration.

How Does the Board of Directors Recommend that You Vote

The Board of Directors unanimously recommends that you vote:

|

● |

FOR all four of the nominees for election to the Board of Directors in Voting Proposal One—Election of Directors; and |

|

● |

FOR Voting Proposal Two—Appointment of Baker Tilly Virchow and Krause, LLP as our Independent Registered Public Accounting Firm and Authorization to Fix Remuneration. |

How You May Change Your Vote or Revoke Your Proxy

If you are a shareholder whose shares are registered in your name, you may revoke your proxy at any time before it is voted by one of the following methods:

|

● |

Submitting another proper proxy with a more recent date than that of the proxy first given by following the Internet or telephone voting instructions or completing, signing, dating and returning a proxy card to us; |

|

● |

Sending written notice of your revocation to our Corporate Secretary; or |

|

● |

Attending the meeting and voting by ballot. |

Quorum Requirement

The quorum for the transaction of business at the meeting is any number of shareholders who, in the aggregate, hold at least 331/3% of our issued common shares entitled to be voted at the meeting or 4,713,025 common shares. In general, our common shares represented by proxies marked “For,” “Against,” “Abstain” or “Withheld” are counted in determining whether a quorum is present. In addition, a “broker non-vote” is counted in determining whether a quorum is present. A “broker non-vote” is a proxy returned by a broker on behalf of its beneficial owner customer that is not voted on a particular matter because voting instructions have not been received by the broker from the customer and the broker has no discretionary authority to vote on behalf of such customer on such matter.

Vote Required

If your shares are held in “street name” and you do not indicate how you wish to vote, your broker is permitted to exercise its discretion to vote your shares only on certain “routine” matters.

Voting Proposal One—Election of Directors is not a “routine” matter. Accordingly, if you do not direct your broker how to vote, your broker may not exercise discretion and may not vote your shares on this proposal. This is called a “broker non-vote” and although your shares will be considered to be represented by proxy at the meeting, they will not be considered to be “votes cast” at the meeting and will not be counted as having been voted on the proposal.

Voting Proposal Two—Appointment of Baker Tilly Virchow Krause, LLP as our Independent Registered Public Accounting Firm and Authorization to Fix Remuneration is a “routine” matter and, as such, your broker is permitted to exercise its discretion to vote your shares for or against the proposal in the absence of your instruction.

The table below indicates the vote required for each voting proposal, the effect of votes withheld or abstentions and the effect of any broker non-votes.

|

Voting Proposal |

Votes Required |

Effect of Votes Withheld / Abstentions |

Effect of Broker Non-Votes |

|||

|

Voting Proposal One: Election of Directors |

Affirmative vote of a majority of votes cast on the voting proposal. |

Abstentions will have no effect. |

Broker non-votes will have no effect. |

|||

|

Voting Proposal Two: Appointment of Independent Registered Public Accounting Firm and Authorization to Fix Remuneration |

Affirmative vote of a majority of votes cast on the voting proposal. |

Abstentions will have no effect. |

We do not expect any broker non-votes on this proposal. |

Appointment of Proxyholders

The persons named in the accompanying proxy card are officers of DiaMedica.

A shareholder has the right to appoint a person or company to attend and act for the shareholder and on that shareholder’s behalf at the meeting other than the persons designated in the enclosed proxy card. A shareholder wishing to exercise this right should strike out the names now designated in the enclosed proxy card and insert the name of the desired person or company in the blank space provided. The desired person need not be a shareholder of DiaMedica.

Only a registered shareholder at the close of business on April 9, 2020 will be entitled to vote, or grant proxies to vote, his, her or its common shares, as applicable, at the meeting.

If your common shares are registered in your name, then you are a registered shareholder. However, if, like most shareholders, you keep your common shares in a brokerage account, then you are a beneficial shareholder. The process for voting is different for registered shareholders and beneficial shareholders. Registered shareholders and beneficial shareholders should carefully read the instructions herein if they wish to vote their common shares at the meeting.

Other Business

Our management does not intend to present other items of business and knows of no items of business that are likely to be brought before the meeting, except those described in this proxy statement. However, if any other matters should properly come before the meeting, the persons named on the proxy card will have discretionary authority to vote such proxy in accordance with their best judgment on the matters.

Procedures at the Meeting

The presiding officer at the meeting will determine how business at the meeting will be conducted. Only matters brought before the meeting in accordance with our Articles will be considered.

Only a natural person present at the meeting who is either one of our shareholders, or is acting on behalf of one of our shareholders, may make a motion or second a motion. A person acting on behalf of a shareholder must present a written statement executed by the shareholder or the duly-authorized representative of the shareholder on whose behalf the person purports to act.

Householding of Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements, annual reports and the Notice of Internet Availability of Proxy Materials. This means that only one copy of this proxy statement, our Annual Report to Shareholders or the Notice of Internet Availability of Proxy Materials may have been sent to each household even though multiple shareholders are present in the household. We will promptly deliver a separate copy of any of these documents to any shareholder upon written or oral request to Corporate Secretary, DiaMedica Therapeutics Inc., Two Carlson Parkway, Suite 260, Minneapolis, Minnesota 55447, telephone: (763) 312-6755. Any shareholder who wants to receive separate copies of this proxy statement, our Annual Report to Shareholders or the Notice of Internet Availability of Proxy Materials in the future, or any shareholder who is receiving multiple copies and would like to receive only one copy per household, should contact the shareholder’s bank, broker or other nominee record holder, or the shareholder may contact us at the above address and telephone number.

Proxy Solicitation Costs

The cost of soliciting proxies, including the preparation, assembly, electronic availability and mailing of proxies and soliciting material, as well as the cost of making available or forwarding this material to the beneficial owners of our common shares will be borne by DiaMedica. Our directors, officers and regular employees may, without compensation other than their regular compensation, solicit proxies by telephone, e-mail, facsimile or personal conversation. We may reimburse brokerage firms and others for expenses in making available or forwarding solicitation materials to the beneficial owners of our common shares.

VOTING PROPOSAL ONE—ELECTION OF DIRECTORS

________________

Board Size and Structure

Our Articles provide that the Board of Directors will consist of at least three members. The Board of Directors currently consists of five directors. The Board of Directors has fixed the number of directors at four effective as of the date of the Annual General Meeting.

Information about Current Directors and Board Nominees

The Board of Directors has nominated the following four individuals to serve as our directors until the next annual general meeting of shareholders or until their respective successors are elected and qualified. All of the nominees named below are current members of the Board of Directors.

Zhenyu Xiao, a current member of the Board of Directors, is not standing re-election at the Annual General Meeting. Dr. Xiao will continue to serve as a director of our company until the Annual General Meeting. The Board of Directors thanks Dr. Xiao for his service to the Board of Directors.

The following table sets forth as of April 9, 2020 the name, age and position of each current director and each individual who has been nominated by the Board of Directors to serve as a director of our company:

|

Name |

Age |

Position |

||

|

Richard Pilnik(1)(2)(3)(4) |

63 |

Chairman of the Board |

||

|

Michael Giuffre, M.D.(1)(2)(3)(4) |

64 |

Director |

||

|

James Parsons(1)(2)(3)(4) |

54 |

Director |

||

|

Rick Pauls |

48 |

President and Chief Executive Officer, Director |

||

|

Zhenyu Xiao, Ph.D.(1) |

46 |

Director |

|

|

|

|

(1) |

Independent Director |

|

(2) |

Member of the Audit Committee |

|

(3) |

Member of the Compensation Committee |

|

(4) |

Member of the Nominating and Corporate Governance Committee |

The principal occupations and recent employment history of each of our directors are set forth below.

Additional Information about Current Directors and Board Nominees

The following paragraphs provide information about each current director and nominee for director, including all positions held, principal occupation and business experience for the past five years, and the names of other publicly-held companies of which the director or nominee currently serves as a director or has served as a director during the past five years. We believe that all of our directors and nominees display personal and professional integrity; satisfactory levels of education and/or business experience; broad-based business acumen; an appropriate level of understanding of our business and its industry and other industries relevant to our business; the ability and willingness to devote adequate time to the work of the Board of Directors and its committees; a fit of skills and personality with those of our other directors that helps build a board that is effective, collegial and responsive to the needs of our company; strategic thinking and a willingness to share ideas; a diversity of experiences, expertise and background; and the ability to represent the interests of all of our shareholders. The information presented below regarding each director and nominee also sets forth specific experience, qualifications, attributes and skills that led the Board of Directors to the conclusion that such individual should serve as a director in light of our business and structure.

Richard Pilnik has served as a member of the Board of Directors since May 2009. Mr. Pilnik serves as our Chairman of the Board. Mr. Pilnik has served as the President and member of the board of directors of Vigor Medical Services, Inc., a medical device company, since May 2017. From December 2015 to November 2017, he served as a member of the board of directors of Chiltern International Limited, a private leading mid-tier Clinical Research Organization, and was Chairman of the Board from April 2016 to November 2017. Mr. Pilnik has a 30-year career in healthcare at Eli Lilly and Company, a pharmaceutical company, and Quintiles Transnational Corp., a global pioneer in pharmaceutical services. From April 2009 to June 2014, he served as Executive Vice President and President of Quintiles Commercial Solutions, an outsourcing business to over 70 pharma and biotech companies. Prior to that, he spent 25 years at Eli Lilly and Company where he held several leadership positions, most recently as Group Vice President and Chief Marketing Officer from May 2006 to July 2008. He was directly responsible for commercial strategy, market research, new product planning and the medical marketing interaction. From December 2000 to May 2006, Mr. Pilnik served as President of Eli Lilly Europe, Middle East and Africa and the Commonwealth of Independent States, a regional organization of former Soviet Republics, and oversaw 50 countries and positioned Eli Lilly as the fastest growing pharmaceutical company in the region. Mr. Pilnik also held several marketing and sales management positions in the United States, Europe and Latin America. Mr. Pilnik currently serves on the board of directors of Vigor Medical Systems, Inc., NuSirt, an early-stage biopharma, and BIAL Farma, a Portuguese pharmaceutical company. Mr. Pilnik is an Emeritus Board Member of Duke University Fuqua School of Business. Mr. Pilnik previously served on the board of directors of Elan Pharmaceuticals, Chiltern International, the largest mid-size Clinical Research Organization, and Certara, L.P., a private biotech company focused on drug development modeling and biosimulation. Mr. Pilnik holds a Bachelor of Arts in Economics from Duke University and an MBA from the Kellogg School of Management at Northwestern University. Mr. Pilnik is a resident of Florida, USA.

We believe that Mr. Pilnik’s deep experience in the industry and his history and knowledge of our company enable him to make valuable contributions to the Board of Directors.

Michael Giuffre, M.D. has served as a member of the Board of Directors since August 2010. Since July 2009, Dr. Giuffre has served as a Clinical Professor of Cardiac Sciences and Pediatrics at the University of Calgary and has had an extensive portfolio of clinical practice, cardiovascular research and university teaching. Dr. Giuffre is actively involved in health care delivery, medical leadership and in the biotechnology business sector. From 2012 to October 2019, Dr. Giuffre served as Chief Scientific Officer and President of FoodChek Laboratory and also as a member of the board of directors of FoodChek Systems Inc. From November 2017 to October 2019, he served as FoodChek Systems Inc.'s Chairman of the Board. Dr. Giuffre previously served on the board of directors of the Canadian Medical Association (CMA), Unicef Canada, the Alberta Medical Association (AMA), Can-Cal Resources Ltd, Vacci-Test Corporation, IC2E International Inc., MedMira Inc. and Brightsquid Dental, Inc. Dr. Giuffre has received a Certified and Registered Appointment and a Distinguished Fellow appointment by the American Academy of Cardiology. In 2005, he was awarded Physician of the Year by the Calgary Medical Society and in 2017 was "Mentor of the Year" for the Royal College of Physicians and Surgeons of Canada. Dr. Giuffre was also a former President of the AMA and the Calgary and Area Physicians Association and also a past representative to the board of the Calgary Health Region. Dr. Giuffre holds a Bachelor of Science in cellular and microbial biology, a Ph.D. candidacy in molecular virology, an M.D. and an M.B.A. He is Canadian Royal College board certified FRCPS in specialties that include Pediatrics and Pediatric Cardiology and has a subspecialty in Pediatric Cardiac Electrophysiology. Dr. Giuffre is currently a member of the board of directors of Avenue Living (AL) Asset Management, a private real estate company in Alberta, Canada and its affiliates, AL Real Estate Opportunity Trust and AgriSelect Trust. Dr. Giuffre is currently a resident of Alberta, Canada.

We believe that Dr. Giuffre’s medical experience, including as a practicing physician and professor, enable him to make valuable contributions to the Board of Directors.

James Parsons has served as a member of the Board of Directors since October 2015. Previously, Mr. Parsons served as our Vice President of Finance from October 2010 until May 2014. Since August 2011, Mr. Parsons has served as Chief Financial Officer and Corporate Secretary of Trillium Therapeutics Inc., a Nasdaq-listed immuno-oncology company. Mr. Parsons serves as a member of the board of directors and audit committee chair of Sernova Corp., which is listed on the TSX Venture Exchange. Mr. Parsons has been a Chief Financial Officer in the life sciences industry since 2000 with experience in therapeutics, diagnostics and devices. Mr. Parsons has a Master of Accounting degree from the University of Waterloo and is a Chartered Professional Accountant and Chartered Accountant. Mr. Parsons is a resident of Ontario, Canada.

We believe that Mr. Parsons’ financial experience, including his history and knowledge of our company, enable him to make valuable contributions to the Board of Directors.

Rick Pauls was appointed our President and Chief Executive Officer in January 2010. Mr. Pauls has served as a member of the Board of Directors since April 2005 and the Chairman of the Board from April 2008 to July 2014. Prior to joining DiaMedica, Mr. Pauls was the Co-Founder and Managing Director of CentreStone Ventures Inc., a life sciences venture capital fund, from February 2002 until January 2010. Mr. Pauls was an analyst for Centara Corporation, another early stage venture capital fund, from January 2000 until January 2002. From June 1997 until November 1999, Mr. Pauls worked for General Motors Acceptation Corporation specializing in asset-backed securitization and structured finance. Mr. Pauls previously served as an independent member of the board of directors of LED Medical Diagnostics, Inc. Mr. Pauls received his Bachelor of Arts in Economics from the University of Manitoba and his M.B.A. in Finance from the University of North Dakota. Mr. Pauls is a resident of Minnesota, USA.

We believe that Mr. Pauls’ experience in the biopharmaceutical industry as an executive and investor and his extensive knowledge of all aspects of our company, business, industry, and day-to-day operations as a result of his role as our President and Chief Executive Officer enable him to make valuable contributions to the Board of Directors. In addition, as a result of his role as President and Chief Executive Officer, Mr. Pauls provides unique insight into our future strategies, opportunities and challenges, and serves as the unifying element between the leadership and strategic direction provided by the Board of Directors and the implementation of our business strategies by management.

Zhenyu Xiao, Ph.D. has served as a member of the Board of Directors since November 2016. Dr. Xiao is not standing for re-election as a director at the Annual General Meeting. Dr. Xiao was elected to the Board of Directors as a designee of Hermeda Industrial Co., Limited under an investment agreement which is described in more detail under “Related Persons Relationships and Transactions— Relationship with Hermeda Industrial Co., Limited.” Dr. Xiao has been the Chief Executive Officer of Hermed Equity Investment Management (Shanghai) Co., Ltd., a private equity fund managing firm. From June 2008 to November 2014, Dr. Xiao was the Associate General Manager of Shanghai Fosun Pharmaceutical Group Co Ltd., a pharmaceutical manufacturing company, where he was the deputy chief of the IPO team for the Fosun Pharma Listing in Hong Kong Exchange and the deputy director of Fosun Pharmaceutical Technological Center in charge of evaluating new technology and R&D and investment. Dr. Xiao has a Ph.D. degree in Pharmacology and conducted his postdoctoral research at University of Rochester (NY), co-founding a pharmaceutical company with Dr. Paul Okunieff and winning Small Business Technology Transfer support, a U.S. Small Business Administration program to facilitate joint venture opportunities between small businesses and non-profit research institutions. Dr. Xiao is a resident of China.

We believe that Dr. Xiao’s experience in the industry, including as an investor, enable him to make valuable contributions to the Board of Directors.

Penalties or Sanctions

To the knowledge of the Board of Directors and our management, none of our directors or director nominees as of the date of this proxy statement is or has been subject to:

|

● |

any penalties or sanctions imposed by a court relating to a securities legislation or by a securities regulatory authority or has entered in a settlement agreement with a securities regulatory authority; or |

|

● |

any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a director nominee. |

Corporate Cease Trade Orders or Bankruptcies

To the knowledge of the Board of Directors and our management, none of our directors or director nominees as of the date of this proxy statement is or has been, within 10 years before the date of this proxy statement, a director, chief executive officer or chief financial officer of any company (including DiaMedica) that, while that person was acting in that capacity:

|

● |

was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or |

|

● |

was subject to an event that resulted, after the director, chief executive officer or chief financial officer ceased to be a director, chief executive officer, or chief financial officer, in DiaMedica being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or |

|

● |

within a year after the director, chief executive officer, or chief financial officer ceased to be a director, chief executive officer or chief financial officer of DiaMedica, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement, or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets or the assets of the proposed director. |

Board Recommendation

The Board of Directors unanimously recommends a vote FOR the election of all of the four nominees named above.

|

The Board of Directors Recommends a Vote FOR Each Nominee for Director |

☑ |

VOTING PROPOSAL TWO—APPOINTMENT OF BAKER TILLY VIRCHOW KRAUSE, LLP

AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AND

AUTHORIZATION TO FIX REMUNERATION

_________________

Appointment of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors appoints our independent registered public accounting firm and fixes its remuneration. In this regard, the Audit Committee evaluates the qualifications, performance and independence of our independent registered public accounting firm and determines whether to re-engage our current independent registered public accounting firm. As part of its evaluation, the Audit Committee considers, among other factors, the quality and efficiency of the services provided by the firm, including the performance, technical expertise and industry knowledge of the lead audit partner and the audit team assigned to our account; the overall strength and reputation of the firm; its capabilities relative to our business; and its knowledge of our operations. Upon consideration of these and other factors, the Audit Committee has appointed Baker Tilly Virchow Krause, LLP (Baker Tilly) to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2020. Baker Tilly was first appointed as our auditor on April 27, 2018.

Representatives of Baker Tilly Virchow Krause, LLP will be present at the meeting to respond to appropriate questions. They also will have the opportunity to make a statement if they wish to do so.

Authorization to Board of Directors to Fix Remuneration

The approval of this proposal also constitutes authorization to the Board of Directors to fix the remuneration of Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm.

Audit, Audit-Related, Tax and Other Fees

The following table presents the aggregate fees billed to us by Baker Tilly Virchow Krause, LLP for the fiscal years ended December 31, 2019 and December 31, 2018.

|

Aggregate Amount Billed by Baker Tilly Virchow Krause, LLP ($) |

||||||||

|

Fiscal 2019 |

Fiscal 2018 |

|||||||

|

Audit Fees(1) |

$ | 106,500 | $ | 219,000 | ||||

|

Audit-Related Fees(2) |

6,500 | 61,635 | ||||||

|

Tax Fees |

— | — | ||||||

|

All Other Fees |

— | — | ||||||

|

(1) |

These fees consisted of the audit of our annual consolidated financial statements for fiscal 2019 and 2018, review of quarterly consolidated financial statements and other services normally provided in connection with statutory and regulatory filings or engagements. |

|

(2) |

These fees consisted of the review of our registration statements on Form S-8 and S-3 in 2019 and review of our registration statement on Form S-1 in connection with our initial public offering in 2018 and related services normally provided in connection with statutory and regulatory filings or engagements. |

Audit Committee Pre-Approval Policies and Procedures

All services rendered by Baker Tilly Virchow Krause, LLP to DiaMedica were permissible under applicable laws and regulations and all services provided to DiaMedica, other than de minimis non-audit services allowed under applicable law, were approved in advance by the Audit Committee. The Audit Committee’s formal written charter requires the Audit Committee to pre-approve all auditing services and permitted non-audit services, including fees for such services. The Audit Committee has not adopted any formal pre-approval policies and procedures.

Board Recommendation

The Board of Directors unanimously recommends that shareholders vote FOR the appointment of Baker Tilly Virchow Krause, LLP, as our independent registered public accounting firm for the fiscal year ending December 31, 2020 and authorization to the Board of Directors to fix the remuneration of our independent registered public accounting firm.

|

The Board of Directors Recommends a Vote FOR Voting Proposal Two |

☑ |

STOCK OWNERSHIP

________________

Security Ownership of Significant Beneficial Owners

The table below sets forth information as to entities that have reported to the Securities and Exchange Commission (SEC) or have otherwise advised us that they are a beneficial owner, as defined by the SEC’s rules and regulations, of more than five percent of our common shares.

|

Title of Class |

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class(1) |

|||||||

|

Common Shares |

Hermeda Industrial Co., Limited Level 54 Hopewell Centre 183 Queensroad East Hong Kong |

1,000,000(2) | 7.1% | |||||||

|

Common Shares |

Stonepine Capital Management, LLC 919 NW Bond Street, Suite 204 Bend, OR 97703-2767 |

800,000(3) | 5.7% | |||||||

|

Nantahala Capital Management |

||||||||||

|

(1) |

Percent of class is based on 14,139,074 shares outstanding as of our record date, April 9, 2020. |

|

(2) |

Based solely on information contained in a Schedule 13G of Hermeda Industrial Co., Limited filed with the SEC on January 24, 2019, reflecting beneficial ownership as of December 6, 2018. Zhenyu Xiao, Ph.D., the managing director of Hermeda Industrial Co., Limited, has sole voting and dispositive power over the common shares held by Hermeda Industrial Co., Limited. |

|

(3) |

Based solely on information contained in a Schedule 13G of Stonepine Capital Management, LLC filed with the SEC on February 12, 2020, reflecting beneficial ownership as of February 11, 2020. Stonepine Capital Management, LLC (GP) is the record owner of 800,000 shares. The GP is the general partner and investment advisor of investment funds, including Stonepine Capital, L.P. (LP), Jon M. Plexico and Timothy P. Lynch are the control persons of the GP. The GP, LP, Mr. Plexico and Mr. Lynch filed their Schedule 13G jointly, but not as members of a group, and each disclaims membership in a group. Each of the GP, LP, Mr. Plexico and Mr. Lynch disclaim beneficial ownership of these shares, except to the extent of that person’s pecuniary interest therein. |

Security Ownership of Management

The table below sets forth information known to us regarding the beneficial ownership of our common shares as of April 9, 2020, by:

|

● |

each of our current directors and director nominees; |

|

● |

each of the individuals named in the Summary Compensation Table under “Executive Compensation” on page 34; and |

|

● |

all of our current directors and executive officers as a group. |

To our knowledge, each person named in the table has sole voting and investment power with respect to all of the securities shown as beneficially owned by such person, as determined by the rules of the SEC, except as otherwise set forth in the notes to the table and subject to community property laws, where applicable. The SEC has defined “beneficial” ownership of a security to mean the possession, directly or indirectly, of voting power and/or investment power. A shareholder is also deemed to be, as of any date, the beneficial owner of all securities that such shareholder has the right to acquire within 60 days after that date through (i) the exercise of any option, warrant or right; (ii) the conversion of a security; (iii) the power to revoke a trust, discretionary account or similar arrangement; or (iv) the automatic termination of a trust, discretionary account or similar arrangement. However, such unissued shares of common shares are not deemed to be outstanding for calculating the percentage of common shares owned by any other person.

Unless otherwise indicated below, the address for each beneficial owner listed is c/o DiaMedica Therapeutics Inc., Two Carlson Parkway, Suite 260, Minneapolis, Minnesota 55447.

|

Title of Class |

Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership(1) |

Percent of Class(2) |

|||||||

|

Common Shares |

Richard Pilnik |

113,448 | * | |||||||

|

Common Shares |

Michael Giuffre, M.D. |

212,850 | (3) | 1.5 | % | |||||

|

Common Shares |

James Parsons |

35,546 | * | |||||||

|

Common Shares |

Zhenyu Xiao, Ph.D. |

1,019,546 | (4) | 7.2 | % | |||||

|

Common Shares |

Rick Pauls |

331,397 | 2.3 | % | ||||||

|

Common Shares |

Scott Kellen |

82,216 | * | |||||||

|

Common Shares |

Harry Alcorn, Jr., Pharm.D. |

67,635 | * | |||||||

|

Common Shares |

All current directors and executive officers as a group (8 persons) |

1,862,638 | 12.6 | % | ||||||

* Represents beneficial ownership of less than one percent.

|

(1) |

Includes for the persons listed below the following shares subject to options and warrants held by such persons that are currently exercisable or become exercisable within 60 days of April 9, 2020: |

|

Name |

Shares Underlying Stock Options |

Shares Underlying Warrants |

||||||

|

Directors |

||||||||

|

Richard Pilnik |

70,358 | — | ||||||

|

Michael Giuffre, M.D. |

39,546 | 11,225 | ||||||

|

James Parsons |

33,296 | — | ||||||

|

Rick Pauls |

300,292 | 2,050 | ||||||

|

Zhenyu Xiao, Ph.D. |

16,296 | — | ||||||

|

Name Executive Officers |

||||||||

|

Rick Pauls |

300,292 | 2,050 | ||||||

|

Scott Kellen |

70,906 | 1,020 | ||||||

|

Harry Alcorn, Jr., Pharm.D. |

59,375 | — | ||||||

|

All current directors and executive officers as a group (8 persons) |

590,069 | 14,295 | ||||||

Excludes the following common shares issuable upon the settlement of deferred share unit awards, which will be settled after the holder’s employment or service relationship with DiaMedica terminates: Mr. Pilnik (7,588 shares); Mr. Pauls (1,749 shares); Dr. Giuffre (4,146 shares); Mr. Parsons (3,850 shares); and Dr. Xiao (3,850 shares).

|

(2) |

Percent of class is based on 14,139,074 shares outstanding as of our record date, April 9, 2020. |

|

(3) |

Includes: (i) 5,165 shares held by 424822 Alberta Ltd, over which Dr. Giuffre has sole voting and dispositive power , (ii) 36,498 shares Dr. Giuffre and his wife hold jointly, (iii) 54,186 shares held by Dr. Giuffre’s sons and daughters, (iv) 21,070 common shares held by Dr. Giuffre’s wife and (v) 45,160 shares held directly by Dr. Giuffre. |

|

(4) |

Includes 1,000,000 shares held by Hermeda Industrial Co., Limited. Dr. Xiao is the managing director of Hermeda Industrial Co., Limited and has sole voting and dispositive power over the shares held by Hermeda Industrial Co., Limited. |

CORPORATE GOVERNANCE

________________

Management by Board of Directors

The Board of Directors is responsible for overseeing the management of DiaMedica and for the conduct of our affairs generally. Each director is elected annually by the shareholders and serves for a term that will end at the next annual general meeting of shareholders.

The Board of Directors facilitates its exercise of independent supervision over the management of DiaMedica through a combination of formal meetings of the Board of Directors and informal discussions amongst Board members. Due to the small size of the Board of Directors, and with a majority of independent directors, the Board of Directors manages governance matters both directly and through its Board committees, which are described in more detail below. The Board of Directors looks to management of DiaMedica to keep it apprised of all significant developments affecting the company and its operations. All major acquisitions, dispositions, investments, contracts and other significant matters outside the ordinary course of our business are subject to approval by the Board of Directors.

Corporate Governance Guidelines

The Board of Directors has established Corporate Governance Guidelines that describes our basic approach to corporate governance. A copy of these Corporate Governance Guidelines can be found on the “Investors & Media—Governance” section of our corporate website www.diamedica.com. Among the topics addressed in our Corporate Governance Guidelines are:

|

● |

Board size and qualifications; |

|

● |

Selection of directors; |

|

● |

Board leadership; |

|

● |

Board committees; |

|

● |

Board and committee meetings; |

|

● |

Executive sessions of independent directors; |

|

● |

Meeting attendance by directors and non-directors; |

|

● |

Appropriate information and access; |

|

● |

Ability to retain advisors; |

|

● |

Conflicts of interest and director independence; |

|

● |

Board interaction with corporate constituencies; |

|

● |

Change of principal occupation; |

|

● |

Term limits; |

|

● |

Retirement and resignation policy; |

|

● |

Board compensation; |

|

● |

Stock ownership by directors ; |

|

● |

Loans to directors and executive officers; |

|

● |

CEO evaluation; |

|

● |

Board and committee evaluation; |

|

● |

Succession planning; and |

|

● |

Communications with directors. |

Board Leadership Structure

Under our Corporate Governance Guidelines, the Board of Directors may select from its members a Chairman of the Board. The office of Chairman of the Board and the office of President and Chief Executive Officer may be held by one person. The Board of Directors believes it is best not to have a fixed policy on this issue and that it should be free to make this determination based on what it believes is best in the circumstances. The Board of Directors, acting as a group or through the Nominating and Corporate Governance Committee, will periodically review the leadership structure of the Board of Directors to assess whether it is appropriate given the specific characteristics and circumstances of DiaMedica. However, the Board of Directors does strongly endorse the concept of independent directors being in a position of leadership. If at any time, the Chief Executive Officer and Chairman of the Board are the same, the Board of Directors shall elect an independent director to serve as the lead director. The lead director will have the following duties and responsibilities in addition to such other duties and responsibilities as may be determined by the Board of Directors from time to time.

|

● |

chairing the executive sessions of the independent directors and calling meetings of the independent directors; |

|

● |

determining the agenda for the executive sessions of the independent directors and participating with the Chairman of the Board in establishing the agenda for Board meetings; |

|

● |

coordinating feedback among the independent directors and the Chief Executive Officer; |

|

● |

overseeing the development of appropriate responses to communications from shareholders and other interested persons addressed to the independent directors as a group; |

|

● |

on behalf of the independent directors, retaining legal counsel or other advisors as they deem appropriate in the conduct of their duties and responsibilities; and |

|

● |

performing such other duties as the Board of Directors deems appropriate from time to time |

Mr. Pilnik currently serves as Chairman of the Board and Rick Pauls currently serves as President and Chief Executive Officer.

We currently believe this leadership structure is in the best interests of DiaMedica and our shareholders and strikes the appropriate balance between the President and Chief Executive Officer’s responsibility for the strategic direction, day-to day-leadership and performance of our company and the Chairman of our Board’s responsibility to guide overall strategic direction of our company and provide oversight of our corporate governance and guidance to our President and Chief Executive Officer and to set the agenda for and preside over board meetings. We recognize that different leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. We believe that our company is well-served by this leadership structure. We anticipate that the Board of Directors will periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Under our Corporate Governance Guidelines, our independent directors will meet with no company management present during a portion of or after Board meetings on a regular basis but not less than two times per year. After each such executive session, and as otherwise necessary, our Chairman of the Board provides our Chief Executive Officer with any actionable feedback from our independent directors. The Board of Directors met four times in executive session during the fiscal year ended December 31, 2019.

Director Independence

The Board of Directors has affirmatively determined that four of DiaMedica’s current five directors are “independent directors” under the Nasdaq Listing Rules. In making these affirmative determinations that such individuals are “independent directors,” the Board of Directors reviewed and discussed information provided by the directors and by DiaMedica with regard to each director’s business and personal activities as they may relate to DiaMedica and our management.

Board Committees

The Board of Directors has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Each of these committees has the composition described in the table below and the responsibilities described in the sections below. The Board of Directors has adopted a written charter for each committee of the Board of Directors which can be found on the “Investors & Media—Governance” section of our corporate website www.diamedica.com. The Board of Directors from time to time may establish other committees.

The following table summarizes the current membership of each of our three board committees.

|

Director |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

|||||||||

|

Rick Pauls |

— | — | — | |||||||||

|

Michael Giuffre, M.D. |

√ |

Chair |

√ |

|||||||||

|

James Parsons |

Chair |

√ |

√ |

|||||||||

|

Richard Pilnik |

√ |

√ |

Chair |

|||||||||

|

Zhenyu Xiao, Ph.D. |

— | — | — | |||||||||

Audit Committee

Responsibilities. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to our annual and quarterly financial statements filed with the SEC and any applicable securities regulatory authorities of the provinces and territories of Canada, our financial reporting process, our internal control over financial accounting and disclosure controls and procedures, the annual independent audit of our financial statements and the effectiveness of our legal compliance and ethics programs. The Audit Committee’s primary responsibilities include:

|

● |

overseeing our financial reporting process, internal control over financial reporting and disclosure controls and procedures on behalf of the Board of Directors; |

|

● |

having sole authority to appoint, oversee, evaluate, retain and terminate the engagement of our independent registered public accounting firm and establish the compensation to be paid to the firm; |

|

● |

reviewing and pre-approving all audit services and permissible non-audit services to be provided to us by our independent registered public accounting firm; |

|

● |

establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; and |

|

● |

overseeing our systems to monitor legal and ethical compliance programs, including the establishment and administration of (including the grant of any waiver from) a written code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. |

The Audit Committee has the authority to engage the services of outside experts and advisors as it deems necessary or appropriate to carry out its duties and responsibilities.

Composition. The current members of the Audit Committee are Dr. Giuffre, Mr. Parsons and Mr. Pilnik. Mr. Parsons is the Chair of the Audit Committee.

Each member of the Audit Committee qualifies as “independent” for purposes of membership on audit committees pursuant to the Nasdaq Listing Rules and the rules and regulations of the SEC and is “financially literate” as required by the Nasdaq Listing Rules. In addition, the Board of Directors has determined that Mr. Parsons qualifies as an “audit committee financial expert” as defined by the rules and regulations of the SEC and meets the qualifications of “financial sophistication” under the Nasdaq Listing Rules as a result of his extensive financial background and various financial positions he has held throughout his career. Shareholders should understand that these designations related to our Audit Committee members’ experience and understanding with respect to certain accounting and auditing matters do not impose upon any of them any duties, obligations or liabilities that are greater than those generally imposed on a member of the Audit Committee or of the Board of Directors.

Audit Committee Report. This report is furnished by the Audit Committee of the Board of Directors with respect to DiaMedica’s consolidated financial statements for the year ended December 31, 2019.

One of the purposes of the Audit Committee is to oversee DiaMedica’s accounting and financial reporting processes and the audit of DiaMedica’s annual consolidated financial statements. DiaMedica’s management is responsible for the preparation and presentation of complete and accurate financial statements. DiaMedica’s independent registered public accounting firm, Baker Tilly Virchow Krause, LLP, is responsible for performing an independent audit of DiaMedica’s annual consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and for issuing a report on their audit.

In performing its oversight role, the Audit Committee has reviewed and discussed DiaMedica’s audited consolidated financial statements for the year ended December 31, 2019 with DiaMedica’s management. Management represented to the Audit Committee that DiaMedica’s financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has discussed with Baker Tilly Virchow Krause, LLP the matters required to be discussed under Public Company Accounting Oversight Board standards. The Audit Committee has received the written disclosures and the letter from Baker Tilly Virchow Krause, LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding Baker Tilly Virchow Krause, LLP’s communications with the Audit Committee concerning independence. The Audit Committee has discussed with Baker Tilly Virchow Krause, LLP its independence and concluded that the independent registered public accounting firm is independent from DiaMedica and DiaMedica’s management.

Based on the review and discussions of the Audit Committee described above, in reliance on the unqualified opinion of Baker Tilly Virchow Krause, LLP regarding DiaMedica’s audited consolidated financial statements, and subject to the limitations on the role and responsibilities of the Audit Committee discussed above and in the Audit Committee’s charter, the Audit Committee recommended to the Board of Directors that DiaMedica’s audited consolidated financial statements for the fiscal year ended December 31, 2019 be included in its Annual Report on Form 10-K for the year ended December 31, 2019 for filing with the Securities and Exchange Commission.

This report is dated as of March 17, 2020.

Audit Committee

James Parsons, Chair

Michael Giuffre, M.D.

Richard Pilnik

Other Information. Additional information regarding the Audit Committee and our independent registered public accounting firm is disclosed under the “Voting Proposal Two—Appointment of Baker Tilly Virchow Krause, LLP as our Independent Registered Public Accounting Firm and Authorization to Fix Remuneration” section of this proxy statement.

Compensation Committee

Responsibilities. The Compensation Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to compensation of our Chief Executive Officer and other executive officers and administers our equity compensation plans. The Compensation Committee’s primary responsibilities include:

|

● |

determining all compensation for our Chief Executive Officer and other executive officers; |

|

● |

administering our equity-based compensation plans; |

|

● |

reviewing, assessing and approving overall strategies for attracting, developing, retaining and motivating our management and employees; |

|

● |

overseeing the development and implementation of succession plans for our Chief Executive Officer and other key executive officers and employees; |

|

● |

reviewing, assessing and approving overall compensation structure on an annual basis; and |

|

● |

recommending and leading a process for the determination of non-employee director compensation. |

The Compensation Committee has the authority to engage the services of outside experts and advisors as it deems necessary or appropriate to carry out its duties and responsibilities, and prior to doing so, assesses the independence of such experts and advisors from management.

Composition. The current members of the Compensation Committee are Dr. Giuffre, Mr. Parsons and Mr. Pilnik. Dr. Giuffre is the Chair of the Compensation Committee. The Board of Directors has determined that each of the members of the Compensation Committee is an “independent director” under the Nasdaq Listing Rules, a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act, and otherwise independent under the rules and regulations of the SEC.

Processes and Procedures for Consideration and Determination of Executive Compensation. As described in more detail above under “—Responsibilities,” the Board of Directors has delegated to the Compensation Committee the responsibility, among other things, to determine any and all compensation payable to our executive officers, including annual salaries, incentive compensation, long-term incentive compensation, perquisites and any and all other compensation, and to administer our equity-based compensation plans. The Compensation Committee has the full power and authority of the Board of Directors to perform these duties and to fulfill these responsibilities. Under the terms of its formal written charter, the Compensation Committee has the power and authority, to the extent permitted by applicable law, to delegate all or a portion of its duties and responsibilities to a subcommittee of the Compensation Committee. The Compensation Committee has not delegated any of its duties and responsibilities to subcommittees, but rather has taken such actions as a committee, as a whole.

In 2018, the Compensation Committee engaged the services of 21-Group, an independent compensation consultant, to assist the Compensation Committee in developing a comprehensive compensation strategy based upon compensation levels at benchmark companies for DiaMedica. The Compensation Committee used the information in this report, recommendations from the 21-Group and discussions with management, to establish a compensation strategy and set target compensation levels for officers and non-employee directors. In making final decisions regarding compensation to be paid to our executive officers, the Compensation Committee considers several factors, including the benchmarking information gathered by its compensation consultant, the achievement by DiaMedica of pre-established performance objectives, the general performance of DiaMedica and the individual officers, the performance of DiaMedica and other factors that may be relevant. The Compensation Committee did not retain 21-Group during 2019.

Final deliberations and decisions by the Compensation Committee regarding the form and amount of compensation to be paid to our executive officers are made by the Compensation Committee, without the presence of any executive officer of our company.