Filed Pursuant to Rule 424(b)(2)

Registration Statement No.: 333-289542

PROSPECTUS SUPPLEMENT

$100,000,000

Common Shares

We have entered into a sales agreement, dated August 12, 2025 (Sales Agreement), with TD Securities (USA) LLC (TD Cowen), relating to our common shares offered by this prospectus supplement. In accordance with the terms of the Sales Agreement, we may offer and sell our common shares having an aggregate offering price of up to $100,000,000 from time to time through TD Cowen. No common shares will be offered or sold pursuant to the Sales Agreement in Canada, to anyone known to be a resident of Canada or on or through the facilities of any exchange or trading market in Canada, and there will be no solicitations or advertising activities undertaken in Canada in connection with this offering.

Our common shares are listed on The Nasdaq Capital Market under the symbol “DMAC.” On August 19, 2025, the last reported sale price of our common shares on The Nasdaq Capital Market was $5.76 per share.

Sales of our common shares, if any, under this prospectus supplement and the accompanying prospectus will be made in negotiated transactions, including block trades or block sales, or by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended (Securities Act), including without limitation sales made through The Nasdaq Capital Market or on any other trading market for our common shares, or by any other method permitted by law. TD Cowen is not required to sell any specific amount of securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between TD Cowen and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation to TD Cowen for sales of common shares sold pursuant to the Sales Agreement will be an amount up to 3.0% of the gross proceeds of any common shares sold under the Sales Agreement. In connection with the sale of our common shares on our behalf, TD Cowen will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of TD Cowen will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to TD Cowen with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended (Exchange Act).

We are a “smaller reporting company” as defined under Rule 405 of the Securities Act and, as such, we have elected to comply with certain reduced public company reporting requirements.

Our business and an investment in our common shares involve significant risks. These risks are described under the caption “Risk Factors” beginning on page S-9 of this prospectus supplement, as well as those risk factors described in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

TD Cowen

August 22, 2025

TABLE OF CONTENTS

|

Page |

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT |

S-1 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

S-3 |

|

PROSPECTUS SUPPLEMENT SUMMARY |

S-5 |

|

THE OFFERING |

S-8 |

|

RISK FACTORS |

S-9 |

|

USE OF PROCEEDS |

S-12 |

|

DIVIDEND POLICY |

S-13 |

|

DILUTION |

S-14 |

|

PLAN OF DISTRIBUTION |

S-15 |

|

CERTAIN UNITED STATES INCOME TAX CONSIDERATIONS |

S-16 |

|

MATERIAL CANADIAN FEDERAL INCOME TAX CONSIDERATIONS |

S-23 |

|

LEGAL MATTERS |

S-25 |

|

EXPERTS |

S-26 |

|

WHERE YOU CAN FIND MORE INFORMATION |

S-27 |

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE |

S-28 |

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (SEC), using a “shelf” registration process. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference herein or therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date – for example, a document incorporated by reference in the accompanying prospectus – the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We have not, and TD Cowen has not, authorized any other person to provide any information other than that contained or incorporated by reference into this prospectus supplement, the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and TD Cowen take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should not assume that the information contained in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date of this prospectus supplement or the accompanying prospectus, or that information contained in any document incorporated or deemed to be incorporated by reference is accurate as of any date other than the date of that document. Our business, financial condition, results of operations and prospects may have changed since that date. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus supplement entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

We are offering to sell, and seeking offers to buy, our common shares only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the common shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common shares and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus supplement to “DiaMedica,” “DMAC,” “the Company,” “we,” “us,” and “our” or similar references mean DiaMedica Therapeutics Inc. and its subsidiaries. References in this prospectus supplement to “voting common shares” or “common shares” refer to our voting common shares, without par value per share. This prospectus supplement and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference herein are the property of their respective owners. Use or display by us of trademarks, service marks or trade names owned by others is not intended to and does not imply a relationship between us and, or endorsement or sponsorship by, the owners of the trademarks, service marks or trade names.

All references in this prospectus supplement to “$,” “U.S. Dollars” and “dollars” are to United States dollars.

In addition to the industry, market and competitive position data referenced in this prospectus supplement from our own internal estimates and research, some market data and other statistical information included in this prospectus supplement are based in part upon information obtained from third-party industry publications, research, surveys and studies, none of which we commissioned. Third-party industry publications, research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information.

We are responsible for all of the disclosure in this prospectus supplement and while we believe that each of the publications, research, surveys and studies included in this prospectus supplement are prepared by reputable sources, we have not, and TD Cowen has not, independently verified market and industry data from third-party sources. In addition, while we believe our internal company research and estimates are reliable, such research and estimates have not been verified by independent sources. Assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in or incorporated by reference into this prospectus supplement that are not descriptions of historical facts are forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 that are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition and common share price. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” “will,” “would,” the negative of these terms or other comparable terminology, and the use of future dates.

The forward-looking statements in or incorporated by reference into this prospectus supplement may include, among other things, statements about:

|

● |

our plans to develop, obtain an IND application for the clinical study of DM199 for PE and ultimately to obtain regulatory approval for and commercialize our DM199 product candidate for the treatment of PE and AIS; |

|

● |

our ability to conduct successful clinical testing of our DM199 product candidate for PE and AIS and meet certain anticipated or target milestones and dates thereof with respect to our clinical studies; |

|

● |

our expansion into PE and the ability of our physician collaborators to successfully complete the current Phase 2, proof-of-concept clinical trial of DM199 for the treatment of PE, our reliance on these physician collaborators to conduct the study, and our expectations related to the timing of Part 1a of this study and the ability of these physician collaborators to identify a suitable dose for use in Part 1b of this study; |

|

● |

our ability to meet anticipated site activations, enrollment and interim analysis timing with respect to our Phase 2/3 ReMEDy2 clinical trial of DM199 for the treatment of AIS, especially in the light of slower than expected site activations and enrollment which we believe are due, in part, to hospital and medical facility staffing shortages; inclusion/exclusion criteria in the study protocol; concerns managing logistics and protocol compliance for participants discharged from the hospital to an intermediate care facility; concerns regarding the prior clinically significant hypotension events and circumstances surrounding the clinical hold which was lifted in June 2023; use of artificial intelligence and telemedicine which have enabled smaller hospitals to retain AIS patients not eligible for mechanical thrombectomy instead of sending these patients to the larger stroke centers which are more likely to be sites in our trial; and competition for research staff and trial subjects due to other pending stroke and neurological clinical trials; |

|

● |

the success of the actions we are taking to mitigate the impact of the factors adversely affecting our ReMEDy2 trial site activations and enrollment rate, including significantly expanding our internal clinical team and bringing in-house certain trial activities, such as study site identification, qualification and activation, clinical site monitoring and overall program management; globally expanding the trial; and making additional changes to the study protocol; and risks associated with these mitigation actions; |

|

● |

uncertainties relating to regulatory applications and related filing and approval timelines, especially in light of recent changes in funding and staffing levels for the FDA and other government agencies; |

|

● |

the possible occurrence of future adverse events associated with or unfavorable results from the Phase 2 investigator-sponsored PE trial or our ReMEDy2 trial and their potential to adversely effect current of future trials; |

|

● |

the adaptive design of our ReMEDy2 trial, which is intended to enroll approximately 300 patients at up to 100 sites globally, and the possibility that the final sample size, which will be determined based upon the results of an interim analysis of 200 participants, may be up to 728 patients, according to a pre-determined statistical plan, other possible changes in the trial, including as a result of input from the FDA, and the results of the interim analysis as determined by our independent data safety monitoring board; |

|

● |

our expectations regarding the perceived benefits of our DM199 product candidate over existing treatment options for PE and AIS; |

|

● |

our ability to partner with and generate revenue from biopharmaceutical or pharmaceutical partners to develop, obtain regulatory approval for, and commercialize our DM199 product candidate for PE and AIS; |

|

● |

the potential size of the markets for our DM199 product candidate for PE and AIS and our or any future partner’s ability to serve those markets, the rate and degree of market acceptance of and ability to obtain coverage and adequate reimbursement for, our DM199 product candidate for PE and AIS both in the United States and internationally; |

|

● |

the success, cost and timing of our clinical trials, as well as our reliance on our key executives, clinical personnel, advisors and third parties in connection with our trials; |

|

● |

our or any future partner’s ability to commercialize, market and manufacture DM199; |

|

● |

expectations regarding U.S. federal, state and foreign regulatory requirements and developments affecting our pending and future clinical trials and regulatory approvals of our DM199 product candidate for PE and AIS and future commercialization and manufacturing of such products if required regulatory approvals are obtained; |

|

● |

our expectations regarding our ability to obtain and maintain intellectual property protection for our DM199 product candidate; |

|

● |

our plans to develop, obtain regulatory approval for and commercialize our DM199 product candidate for the treatment of PE and AIS; |

|

● |

expectations regarding competition and our ability to obtain data exclusivity for our DM199 product candidate for PE and AIS; and |

|

● |

our estimates regarding expenses, market opportunity for our product candidates, future revenue, and capital requirements; our anticipated use of the net proceeds of this offering of securities; how long our post-offering cash resources will last; and our need for and ability to obtain future additional financing to fund our operations, including funding necessary to complete our current clinical trials and obtain regulatory approvals for our DM199 product candidate for PE and/or AIS. |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under “Risk Factors” in this prospectus supplement and the documents incorporated herein (including in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q). Moreover, we operate in a very competitive and rapidly-changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus supplement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Forward-looking statements should not be relied upon as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Except as required by law, including the securities laws of the United States, we do not intend to update any forward-looking statements to conform these statements to actual results or to changes in our expectations.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and selected information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common shares. For a more complete understanding of the Company and this offering, we encourage you to read and consider the more detailed information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, including the information under the heading “Risk Factors” beginning on page S-9 of this prospectus supplement, as well as risk factors described in our most recent Annual Report on Form 10-K and in any subsequent Quarterly Reports on Form 10-Q, for a discussion of the factors you should carefully consider before deciding to purchase securities that may be offered by this prospectus supplement.

About DiaMedica Therapeutics Inc.

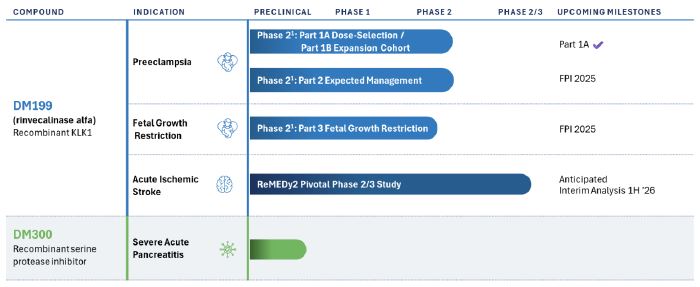

We are a clinical stage biopharmaceutical company committed to improving the lives of people suffering from preeclampsia (PE) and acute ischemic stroke (AIS). Our lead candidate DM199 (rinvecalinase alfa) is the first pharmaceutically active recombinant (synthetic) form of the human tissue kallikrein-1 (KLK1) protein (serine protease enzyme) to be clinically studied in patients. KLK1 is an established therapeutic modality in Asia, with human urinary KLK1 for the treatment of AIS and porcine KLK1 for the treatment of cardio renal disease, including hypertension. Our current focus is on the treatment of PE and AIS. We plan to advance DM199 through required clinical trials to create shareholder value by establishing its clinical and commercial potential as a therapy for PE and AIS. We have also produced a potential novel treatment for severe acute pancreatitis, DM300, which is currently in the early preclinical stage of development.

DM199 is a recombinant form of KLK1 (rhKLK1), which is a synthetic version of the naturally occurring protease enzyme kallikrein-1, and the first and only rhKLK1 undergoing global clinical development studies in both PE and AIS. DM199 has been granted Fast Track designation from the U.S. Food and Drug Administration (FDA) for the treatment of AIS. Naturally occurring KLK1 (extracted from human urine or porcine pancreas) has been an approved therapeutic agent in Asia for decades in the treatment of AIS and hypertension associated with cardiorenal disease. DM199 is produced using recombinant DNA technology without the need for extracted human or animal tissue sources and thereby eliminates risk of pathogen transmission.

KLK1 is a serine protease enzyme that plays an important role in the regulation of diverse physiological processes via a molecular mechanism that may enhance microcirculatory blood flow and tissue perfusion by increasing production of nitric oxide (NO), prostacyclin (PGI2) and endothelium-derived hyperpolarizing factor (EDHF). In preeclampsia, DM199 is intended to lower blood pressure, enhance endothelial health and improve perfusion to maternal organs and the placenta, potentially disease modifying outcomes improving both maternal and perinatal outcomes. In the case of AIS, DM199 is intended to enhance blood flow and boost neuronal survival in the ischemic penumbra by dilating arterioles surrounding the site of the vascular occlusion and inhibiting apoptosis (neuronal cell death) while also facilitating neuronal remodeling through the promotion of angiogenesis.

Our product development pipeline is as follows:

1. Investigator sponsored trial

We are developing DM199 to address two major critical unmet needs. In PE, there are currently no approved agents in any global market to safely lower maternal blood pressure and/or reduce the risk of fetal growth restriction. Historically, the major issue with potential PE treatments has been that traditional vasodilators commonly used to reduce essential hypertension (e.g., beta-blockers, angiotensin converting enzyme inhibitors (ACEi)) can readily cross the placental barrier and enter into the fetal circulation and cause harm to the developing fetus. We believe that DM199 is uniquely suited to treat PE since its molecular size, ~26 kilodaltons (KD), is typically too large to cross the placental barrier and therefore may reduce blood pressure and enhance microcirculatory perfusion to the maternal organs and placenta without entering fetal circulation. Additionally, we believe DM199 has the potential to not only address hypertension of PE, but also to confer disease modifying outcomes for both maternal and perinatal outcomes, including fetal growth restriction. In AIS, up to 80% of AIS patients are not eligible for treatment with currently approved clot-busting (thrombolytic) drugs or catheter-based clot removal procedures (mechanical thrombectomy). DM199 is intended to enhance collateral blood flow and boost neuronal survival in the ischemic penumbra by inhibiting neuronal cell death (apoptosis) and promoting neuronal remodeling and neoangiogenesis, and accordingly, offer a potential treatment option for AIS patients who otherwise have no therapeutic options.

Preeclampsia Program and Phase 2 Investigator-Sponsored Study

Our clinical development program in PE currently centers around an investigator-sponsored safety, tolerability and pharmacodynamic, proof-of-concept Phase 2 study in PE patients. This Phase 2 study consists of three studies in PE (Part 1a, dose-escalation; Part 1b, dose-expansion; and Part 2, expectant management) and a fourth study in fetal growth restriction (FGR, Part 3, expectant management). Part 1a topline study results are intended to identify a suitable dose for Parts 1b, 2, and 3. Up to 90 women with PE and potentially an additional 30 subjects with fetal growth restriction may be evaluated. The first subject in Part 1a was enrolled in the fourth quarter of 2024 and interim results from Part 1a of the study were released in July 2025. The interim results (N=28 subjects) demonstrate that DM199 appears safe and well-tolerated with clinically-relevant pharmacodynamic activity with no evidence of placental transfer. Additionally, subjects exhibited rapid, statistically significant reductions in blood pressure with duration of effect that was sustained up to 24 hours post-infusion compared to pre-treatment baseline, a durable effect extending up to 24 hours post-infusion. Preparations are underway to initiate Part 1b where up to 30 subjects with PE and expected delivery within 72 hours will be treated with a dose regimen identified from Part 1a.

Based in part upon these interim results, we believe DM199 has the potential to lower blood pressure, enhance endothelial health and improve perfusion to maternal organs and the placenta. We have completed studies on fertility, embryofetal development and pre- and post-natal development in animal models, which support the potential safety of DM199 in pregnant humans. Additionally, based on the strength of the interim results, DiaMedica plans to submit an Investigational New Drug (IND) application in the United States in the second half of 2025.

AIS Program and Phase 2/3 ReMEDy2 Trial

Our clinical program in AIS centers on our ReMEDy2 clinical trial of DM199 for the treatment of AIS. Our ReMEDy2 clinical trial is a Phase 2/3, adaptive design, randomized, double-blind, placebo-controlled trial intended to enroll approximately 300 participants at up to 100 sites globally. The adaptive design component includes an interim analysis by our independent data safety monitoring board to be conducted after the first 200 participants have completed the trial. Based on the results of the interim analysis, the study may be stopped for futility or the final sample size will be determined, ranging between 300 and 728 patients, according to a pre-determined statistical plan. As previously disclosed, we have experienced and are continuing to experience slower than expected site activations and enrollment in our ReMEDy2 trial. We believe these conditions may be due to hospital and medical facility staffing shortages; inclusion/exclusion criteria in the study protocol; concerns managing logistics and protocol compliance for participants discharged from the hospital to an intermediate care facility; concerns regarding the prior clinically significant hypotension events and circumstances surrounding the previous clinical hold; use of artificial intelligence and telemedicine which have enabled smaller hospitals to retain AIS patients not eligible for mechanical thrombectomy instead of sending these patients to the larger stroke centers which are more likely to be sites in our trial; and competition for research staff and trial subjects due to other pending stroke and neurological trials. We continue to reach out to current and potential study sites to understand the specific issues at each study site. In an effort to mitigate the impact of these factors, we have significantly expanded our internal clinical team and have brought in-house certain trial activities, including site identification, qualification and activation, clinical site monitoring and overall program management. We are currently conducting the trial in the United States and in the countries of Canada and Georgia. We are in the process of preparing regulatory filings and identifying and engaging study sites in an additional seven European countries and have submitted for approval of this study in the United Kingdom. We continue to work closely with our contract research organizations and other advisors to develop procedures to support both U.S. and global study sites and potential participants as needed. We intend to continue to monitor the results of these efforts and, if necessary, implement additional actions to enhance site activations and enrollment in our ReMEDy2 trial; however, no assurances can be provided as to the success of these actions and if or when these issues will resolve. Failure to resolve these issues may result in delays in our ReMEDy2 trial.

Company Information

Our principal executive offices are located at 301 Carlson Parkway, Suite 210, Minneapolis, Minnesota 55305. Our telephone number is (763) 496-5454, and our Internet website address is www.diamedica.com. We make available on our website free of charge a link to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports as soon as practicable after we electronically file such material with the SEC. Except for the documents specifically incorporated by reference into this prospectus supplement, information contained on our website or that can be accessed through our website does not constitute a part of this prospectus supplement. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

We are a corporation governed under the Business Corporations Act (British Columbia) (BCBCA). Our Company was initially incorporated under the name Diabex Inc. pursuant to The Corporations Act (Manitoba) by articles of incorporation dated January 21, 2000. Our articles were amended (i) on February 26, 2001 to change our corporate name to DiaMedica Inc., (ii) on April 11, 2016 to continue the Company from The Corporations Act (Manitoba) to the Canada Business Corporations Act (CBCA), (iii) on December 28, 2016 to change our corporate name to DiaMedica Therapeutics Inc., (iv) on September 24, 2018 to permit us to hold shareholder meetings in the U.S. and to permit our directors, between annual general meetings of our shareholders, to appoint one or more additional directors to serve until the next annual general meeting of shareholders; provided, however, that the number of additional directors shall not at any time exceed one-third of the number of directors who held office at the conclusion of the last meeting of shareholders, (v) on November 15, 2018 to effect a 1-for-20 consolidation of our common shares, and (vi) on May 31, 2019, to continue our existence from a corporation incorporated under the CBCA into British Columbia under the BCBCA. Our articles were subsequently amended and restated on May 17, 2023 to enhance procedural mechanics and disclosure requirements relating to director nominations made by our shareholders and to provide that only our Board of Directors may fix the number of directors of our Company.

THE OFFERING

|

Common shares offered by us |

Common shares having an aggregate offering price of up to $100,000,000. |

|

|

Common shares to be outstanding after the offering |

Up to 60,433,599 common shares, assuming sales of 17,361,111 common shares in this offering at an assumed offering price of $5.76 per common share, which was the last reported sale price of our common shares on August 19, 2025. The actual number of common shares issued in connection with this offering will vary depending on how many common shares we choose to sell and the prices at which such sales occur. |

|

|

Plan of Distribution |

“At-the-market offering” that may be made from time to time through or to our sales agent, TD Cowen. See “Plan of Distribution” beginning on page S-15 of this prospectus supplement. |

|

|

Use of proceeds |

We intend to use the net proceeds from this offering to continue our clinical and product development activities for DM199 in preeclampsia and general corporate purposes. See “Use of Proceeds” on page S-12 of this prospectus supplement. |

|

|

Risk factors |

Our business and an investment in our common shares involve significant risks. See “Risk Factors” beginning on page S-9 of this prospectus supplement and the other information included in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus for a discussion of factors that you should consider carefully before investing in our common shares. |

|

|

Nasdaq Capital Market symbol |

“DMAC” |

The number of our common shares to be outstanding after this offering is based on 43,072,488 common shares outstanding as of June 30, 2025, and excludes as of that date the following:

|

● |

5,721,194 common shares reserved for issuance upon the exercise of outstanding stock options under the DiaMedica Therapeutics Inc. Amended and Restated 2019 Omnibus Incentive Plan (2019 Plan), with a weighted average exercise price of $3.74 per share; |

|

● |

164,770 common shares reserved for issuance upon the settlement of deferred share units outstanding under the 2019 Plan; |

|

● |

7,607 common shares reserved for issuance upon the settlement of restricted share units outstanding under the 2019 Plan; |

|

● |

374,410 common shares reserved for issuance upon the exercise of outstanding stock options under the DiaMedica Therapeutics Inc. Stock Option Plan (Prior Plan), with a weighted average exercise price of $4.97 per share; |

|

● |

9,745 common shares reserved for issuance upon the settlement of deferred share units outstanding under the DiaMedica Therapeutics Inc. Deferred Share Unit Plan (Prior DSU Plan); |

|

● |

590,000 common shares reserved for issuance upon the exercise of outstanding stock options under the DiaMedica Therapeutics Inc. 2021 Employment Inducement Plan (2021 Plan), with a weighted average exercise price of $2.53 per share; |

|

● |

754,919 common shares reserved for future issuance in connection with future grants under the 2019 Plan; and |

|

● |

357,500 common shares reserved for future issuance in connection with future grants under the 2021 Plan. |

The number of our common shares to be outstanding after this offering also excludes 8,606,425 shares issued and 1,000,000 common shares reserved for future issuance in connection with future grants under the 2021 Plan subsequent to June 30, 2025 through August 20, 2025.

RISK FACTORS

An investment in our common shares involves a high degree of risk. Before making an investment decision, you should carefully consider the following risks and the risks described in the “Risk Factors” section of our most recent Annual Report on Form 10-K and in any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, together with all other information contained in this prospectus supplement, the accompanying prospectus and in our filings with the SEC that we have incorporated by reference in this prospectus supplement, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC. The occurrence of any of the events described below could have a material adverse effect on our business, financial condition, results of operations, cash flows, prospects or the value of our common shares. These risks are not the only ones that we face. Additional risks not currently known to us or that we currently deem immaterial also may impair our business. Please also read carefully the section below titled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to this Offering and Our Common Shares

The price of our common shares has been volatile and may continue to be volatile.

Our common shares trade on The Nasdaq Capital Market under the trading symbol “DMAC.” From January 2, 2024 to June 30, 2025, the sale price of our common shares ranged from $2.16 to $6.82 per share. A number of factors could influence the volatility in the market price of our common shares, including changes in the economy or in the financial markets, industry related developments, such as a general decline in the biotechnology sector, and the impact of material events and changes in our operations, such as the pursuit of an IND application for further clinical trials in PE, operating results and financial condition. Each of these factors could lead to increased volatility in the market price of our common shares. In addition, the market prices of the securities of our competitors may also lead to fluctuations in the trading price of our common shares.

We do not have a history of a very active trading market for our common shares.

From January 2, 2024 to June 30, 2025, the daily trading volume of our common shares ranged from 24,100 shares to 3,185,200 shares. Although we anticipate a more active trading market for our common shares in the future, due in part to our June 2025 inclusion in the Russel 2000 Index, we can give no assurance that a more active trading market will develop or be sustained. If we do not have an active trading market for our common shares, it may be difficult for you to sell our common shares at a favorable price or at all.

If you purchase common shares in this offering, you may experience immediate and substantial dilution of your investment.

The offering price per share in this offering may exceed the net tangible book value per share of our common shares. Assuming that an aggregate of 17,361,111 shares are sold at a price of $5.76 per share, the last reported sale price of our common shares on The Nasdaq Capital Market on August 19, 2025, for aggregate gross proceeds to us of $100.0 million, and after deducting commissions and estimated offering expenses payable by us, you will experience immediate dilution of $3.70 per share, representing the difference between our as adjusted net tangible book value per share as of June 30, 2025 after giving effect to this offering and the assumed offering price. See the section titled “Dilution” in this prospectus supplement for a more detailed discussion of the dilution you will incur if you participate in this offering.

Future sales and issuances of our common shares or rights to purchase our common shares could result in additional dilution of our shareholders and could cause our stock price to fall.

Additional capital will likely be needed in the future to continue our planned operations. To the extent we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our shareholders will be diluted. In addition, as of June 30, 2025, we had outstanding options to purchase 6,311,194 common shares, deferred share units representing 164,770 common shares, restricted share units representing 7,607 common shares and 1,112,419 common shares reserved for future issuance in connection with future grants under the 2019 Plan and the 2021 Plan and options to purchase 374,410 common shares and deferred share units representing 9,745 common shares under our Prior Plan and Prior DSU Plan. If these or any future outstanding options or deferred share units are exercised or otherwise converted into our common shares at prices below the price you pay for our common shares in this offering, you will experience additional dilution.

The actual number of shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to TD Cowen at any time throughout the term of the Sales Agreement. The number of shares that are sold by TD Cowen after delivering a placement notice will fluctuate based on a number of factors, including the market price of our common shares during the sales period, any limits we set with TD Cowen in any applicable placement notice and the demand for our common shares. Because the price per share of each share sold will fluctuate during the sales period, it is not possible at this stage to predict the number of shares that will be sold or the aggregate proceeds to be raised in connection with those sales, if any.

The common shares offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices and numbers of shares sold, and, subject to any restrictions we may place in any applicable placement notice, there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices they paid.

We are a “smaller reporting company,” and because we have opted to use the reduced disclosure requirements available to us, certain investors may find investing in our common shares less attractive.

We are currently a “smaller reporting company” under the federal securities laws and, as such, are subject to scaled disclosure requirements afforded to such companies. For example, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K, and we are subject to reduced executive compensation disclosure requirements. Our shareholders and investors may find our common shares less attractive as a result of our status as a “smaller reporting company” and our reliance on the reduced disclosure requirements afforded to these companies. If some of our shareholders or investors find our common shares less attractive as a result, there may be a less active trading market for our common shares and the market price of our common shares may be more volatile.

If securities or industry analysts do not continue to publish research or reports about our business, or publish negative reports about our business, the market price of our common shares and trading volume could decline.

The market price and trading volume for our common shares will depend in part on the research and reports that securities or industry analysts publish about us or our business. We do not have any control over the reporting of these analysts. There can be no assurance that analysts will continue to cover us or provide favorable coverage. If one or more of the analysts who cover us downgrade our common shares or negatively change their opinion of our common shares, the market price of our common shares would likely decline. If one or more of these analysts cease coverage of our Company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause the market price of our common shares or trading volume to decline.

We could be subject to securities class action litigation, which is expensive and could divert management attention.

In the past, securities class action litigation has often been brought against a company following a significant decline in the market price of its securities. This risk is especially relevant for us because biopharmaceutical companies have experienced significant stock price volatility in recent years. If we face such litigation, it could result in substantial costs and a diversion of management’s attention and our resources, which could harm our business. This is particularly true in light of our limited securities litigation insurance coverage.

We have broad discretion over the use of our cash, cash equivalents and marketable securities, including the net proceeds we receive in this offering, and may not use them effectively.

Our management has broad discretion to use our cash, cash equivalents and marketable securities, including the net proceeds we receive in this offering, to fund our operations and could spend these funds in ways that do not improve our results of operations or enhance the value of our common shares. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our common shares to decline and delay the development of our product candidate. Pending their use to fund operations, we may invest our cash, cash equivalents and marketable securities in a manner that does not produce income or that loses value.

Subsequent trials may fail to replicate promising data seen in earlier preclinical studies and clinical trials.

Interim data from the ongoing Part 1a portion of the investigator-sponsored Phase 2 study of DM199 for the treatment of preeclampsia provided promising results. However, promising results in our preclinical studies or clinical trials may not be replicated in ongoing and future studies or trials, and the final data analysis may differ from interim data analysis.

Even if ongoing and future trials of DM199 are conducted and completed as planned, the results may not replicate the promising results seen in preclinical studies and early clinical studies or meet the primary or secondary endpoints, or otherwise not prove sufficient to obtain regulatory approval or result in a restricted product label that could negatively impact commercialization. Success in preclinical testing does not ensure success in clinical trials, and success in early stage clinical trials does not ensure success in later clinical trials. This can be due to a variety of reasons, including variations in patient populations, or the inability of certain patients to complete all assessments required by the clinical trial protocol, adjustments to clinical trial protocols or designs as compared to earlier testing or trials, variations in the data that could produce inconclusive or uninterpretable results, or the use of additional trial sites or investigators.

Furthermore, if we fail to replicate the promising results from our preclinical studies or clinical trials in ongoing or future clinical trials, we may be unable to successfully develop, obtain regulatory approval for and commercialize our current or future product candidates.

USE OF PROCEEDS

We may issue and sell our common shares having aggregate sales proceeds of up to $100,000,000 from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will be able to sell any common shares under or fully utilize the Sales Agreement with TD Cowen.

We intend to use the net proceeds from this offering to continue our clinical and product development activities for DM199 in preeclampsia and general corporate purposes.

The amounts and timing of our use of the net proceeds from this offering will depend on a number of factors, such as the timing, progress and results of our clinical trials, regulatory requirements, the timing and progress of any partnering efforts, technological advances and the competitive environment for our products. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to us from the sale of our common shares offered by us hereunder. Accordingly, our management will have broad discretion in the timing and application of these proceeds.

Pending the uses described above, we intend to deposit the proceeds in our non-interest bearing checking account Unless otherwise indicated in the applicable prospectus supplement, we intend to use the net proceeds from the sale of securities and any exercise of warrants under this prospectus and the applicable prospectus supplement to continue our clinical and product development activities and for other working capital and general corporate purposes. The prospectus supplement relating to a particular offering of securities by us will identify the use of proceeds for that offering. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the proceeds. Pending the uses described above, we intend to deposit the proceeds in our non-interest bearing checking account or interest bearing money market fund or invest them in short-term or marketable securities until we use them for their stated purpose.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our common shares and do not anticipate paying any cash dividends in the foreseeable future. We expect to retain our future earnings, if any, for use in the operation and expansion of our business. Additionally, we may in the future become subject to contractual restrictions on, or prohibitions against, the payment of dividends. Subject to the foregoing, the payment of cash dividends in the future, if any, will be at the discretion of our Board of Directors and will depend upon such factors as earnings levels, capital requirements, our overall financial condition and any other factors deemed relevant by our Board of Directors. As a result, our shareholders will likely need to sell their common shares to realize a return on their investment and may not be able to sell their common shares at or above the price paid for them.

DILUTION

If you invest in our common shares in this offering, your ownership interest will be immediately diluted to the extent of the difference between the public offering price per common share and the as adjusted net tangible book value per share of our common shares immediately after this offering. Net tangible book value per common share is determined at any date by subtracting our total liabilities from the amount of our total tangible assets (total assets less intangible assets) and dividing the difference by the number of our common shares deemed to be outstanding at that date.

Our net tangible book value as of June 30, 2025 was approximately $27.2 million, or $0.63 per common share, based on 43,072,488 common shares outstanding as of June 30, 2025. After giving effect to the sale of our common shares in the aggregate amount of $100.0 million in this offering at an assumed offering price of $5.76 per common share, the last reported sale price of our common shares on The Nasdaq Capital Market on August 19, 2025, and after deducting commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2025 would have been $124.7 million, or $2.06 per common share. This amount represents an immediate increase in net tangible book value of $1.43 per common share to existing shareholders and an immediate dilution in net tangible book value of $3.70 per common share to new investors purchasing common shares in this offering.

The following table illustrates this dilution on a per common share basis:

|

Assumed offering price per share |

5.76 | |||||||

|

Net tangible book value per share as of June 30, 2025 |

0.63 | |||||||

|

Increase in net tangible book value per share attributable to this offering |

1.43 | |||||||

|

As adjusted net tangible book value per share after giving effect to this offering |

2.06 | |||||||

|

Dilution per share to new investors purchasing shares in this offering |

3.70 |

The table above assumes for illustrative purposes that an aggregate of 17,361,111 common shares are sold at a price of $5.76 per share, the last reported sale price of our common shares on The Nasdaq Capital Market on August 19, 2025, for aggregate gross proceeds of $100.0 million. The common shares sold in this offering, if any, will be sold from time to time at various prices.

The number of our common shares to be outstanding after this offering is based on 43,072,488 common shares outstanding as of June 30, 2025, and excludes as of that date the following:

|

● |

5,721,194 common shares reserved for issuance upon the exercise of outstanding stock options under the DiaMedica Therapeutics Inc. Amended and Restated 2019 Omnibus Incentive Plan (2019 Plan), with a weighted average exercise price of $3.74 per share; |

|

● |

164,770 common shares reserved for issuance upon the settlement of deferred share units outstanding under the 2019 Plan; |

|

● |

7,607 common shares reserved for issuance upon the settlement of restricted share units outstanding under the 2019 Plan; |

|

● |

374,410 common shares reserved for issuance upon the exercise of outstanding stock options under the DiaMedica Therapeutics Inc. Stock Option Plan (Prior Plan), with a weighted average exercise price of $4.97 per share; |

|

● |

9,745 common shares reserved for issuance upon the settlement of deferred share units outstanding under the DiaMedica Therapeutics Inc. Deferred Share Unit Plan (Prior DSU Plan); |

|

● |

590,000 common shares reserved for issuance upon the exercise of outstanding stock options under the DiaMedica Therapeutics Inc. 2021 Employment Inducement Plan (2021 Plan), with a weighted average exercise price of $2.53 per share; |

|

● |

754,919 common shares reserved for future issuance in connection with future grants under the 2019 Plan; and |

|

● |

357,500 common shares reserved for future issuance in connection with future grants under the 2021 Plan. |

The number of our common shares to be outstanding after this offering also excludes 8,606,425 shares issued and 1,000,000 common shares reserved for future issuance in connection with future grants under the 2021 Plan subsequent to June 30, 2025 through August 20, 2025.

PLAN OF DISTRIBUTION

We have entered into a Sales Agreement with TD Cowen, under which we may issue and sell from time to time up to $100,000,000 of our common shares through or to TD Cowen as our sales agent or principal. Sales of our common shares, if any, will be made in negotiated transactions, including block trades or block sales, or by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act, including without limitation sales made through Nasdaq or on any other existing trading market for our common shares, or by any other method permitted by law. Sales pursuant to the Sales Agreement may be made through an affiliate of TD Cowen. No common shares will be offered or sold pursuant to the Sales Agreement in Canada, to anyone known to be a resident of Canada or on or through the facilities of any exchange or trading market in Canada, and there will be no solicitations or advertising activities undertaken in Canada in connection with this offering.

TD Cowen will offer our common shares subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by us and TD Cowen. We will designate the maximum amount of common shares to be sold through TD Cowen on a daily basis or otherwise determine such maximum amount together with TD Cowen. Subject to the terms and conditions of the Sales Agreement, TD Cowen will use its commercially reasonable efforts to sell on our behalf all of the common shares requested to be sold by us. We may instruct TD Cowen not to sell common shares if the sales cannot be effected at or above the price designated by us in any such instruction. TD Cowen or we may suspend the offering of our common shares being made through TD Cowen under the Sales Agreement upon proper notice to the other party. TD Cowen and we each have the right, by giving written notice as specified in the Sales Agreement, to terminate the Sales Agreement in each party’s sole discretion at any time.

The aggregate compensation payable to TD Cowen as sales agent equals up to 3.0% of the gross sales price of the common shares sold through it pursuant to the Sales Agreement. We have also agreed to reimburse TD Cowen up to $75,000 of TD Cowen’s actual outside legal expenses incurred by TD Cowen in connection with the execution of the Sales Agreement, in addition to certain ongoing disbursements of its legal counsel. We estimate that the total expenses of the offering payable by us, excluding commissions payable to TD Cowen under the Sales Agreement, will be approximately $150,000.

The remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such common shares.

TD Cowen will provide written confirmation to us following the close of trading on The Nasdaq Capital Market on each day in which common shares are sold through it as sales agent under the Sales Agreement. Each confirmation will include the number of common shares sold through it as sales agent on that day, the volume weighted average price of the common shares sold, the percentage of the daily trading volume and the net proceeds to us.

We will report at least quarterly the number of common shares sold through TD Cowen under the Sales Agreement and the net proceeds to us in connection with the sales of common shares.

Settlement for sales of common shares will occur, unless the parties agree otherwise, on the first business day that is also a trading day following the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sales of our common shares on our behalf, TD Cowen will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to TD Cowen will be deemed to be underwriting commissions or discounts. We have agreed in the Sales Agreement to provide indemnification and contribution to TD Cowen against certain liabilities, including liabilities under the Securities Act. As sales agent, TD Cowen will not engage in any transactions that stabilizes our common shares.

Our common shares are listed on The Nasdaq Capital Market and trades under the symbol “DMAC.” The transfer agent of our common shares is Computershare Investor Services.

TD Cowen and/or its affiliates have provided, and may in the future provide, various investment banking and other financial services for us for which services they have received and, may in the future receive, customary fees.

CERTAIN UNITED STATES INCOME TAX CONSIDERATIONS

The following discussion is generally limited to certain material U.S. federal income tax considerations relating to the purchase, ownership and disposition of our common shares by U.S. Holders (as defined below). This discussion applies to U.S. Holders that hold our common shares as capital assets. This summary is for general information purposes only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax considerations that may apply to a U.S. Holder arising from and relating to the acquisition, ownership, and disposition of our common shares. Accordingly, this summary is not intended to be, and should not be construed as, legal or U.S. federal income tax advice with respect to any U.S. Holder. Although this discussion is generally limited to the U.S. federal income tax considerations to U.S. Holders, the U.S. federal income tax treatment of dividends on and gain on sale or exchange of our common shares by certain “Non-U.S. Holders” (as defined below) is included below at “U.S. Federal Income Taxation of Non-U.S. Holders.”

No legal opinion from U.S. legal counsel or ruling from the Internal Revenue Service (IRS) has been requested, or will be obtained, regarding the U.S. federal income tax consequences of the acquisition, ownership, and disposition of common shares. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions presented in this summary. In addition, because the guidance on which this summary is based is subject to various interpretations, the IRS and the U.S. courts could disagree with one or more of the positions described in this summary.

This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (Code), U.S. Treasury regulations promulgated thereunder and administrative and judicial interpretations thereof, and the income tax treaty between the United States and Canada (Convention), all as in effect on the date hereof and all of which are subject to change, possibly with retroactive effect. This summary is applicable to U.S. Holders who are residents of the United States for purposes of the Convention and who qualify for the full benefits of the Convention. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation. Each prospective investor is responsible for monitoring developments with their own tax advisors, we do not undertake to update any of the information in this summary based on any change in law after the effective date hereof, including any change that may have retroactive effect.

This discussion does not address all of the U.S. federal income tax considerations that may be relevant to specific U.S. Holders in light of their particular circumstances or to U.S. Holders subject to special treatment under U.S. federal income tax law (such as certain financial institutions, insurance companies, broker-dealers and traders in securities or other persons that generally mark their securities to market for U.S. federal income tax purposes, tax-exempt entities, retirement plans, regulated investment companies, real estate investment trusts, certain former citizens or residents of the United States, persons who hold common shares as part of a “straddle,” “hedge,” “conversion transaction,” “synthetic security” or integrated investment, persons that have a “functional currency” other than the U.S. dollar, persons that own (or are deemed to own) 10% or more (by voting power or value) of our common shares, persons that acquire their common shares as part of a compensation arrangement, corporations that accumulate earnings to avoid U.S. federal income tax, partnerships and other pass-through entities, and investors in such pass-through entities). This discussion does not address any U.S. state or local or non-U.S. tax considerations or any U.S. federal estate, gift or alternative minimum tax considerations. In addition, except as specifically set forth below, this summary does not discuss applicable tax reporting requirements.

As used in this discussion, the term “U.S. Holder” means a beneficial owner of common shares that is, for U.S. federal income tax purposes, (1) an individual who is a citizen or resident of the United States, (2) a corporation (or entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District of Columbia, (3) an estate the income of which is subject to U.S. federal income tax regardless of its source or (4) a trust (x) with respect to which a court within the United States is able to exercise primary supervision over its administration and one or more United States persons have the authority to control all of its substantial decisions or (y) that has elected under applicable U.S. Treasury regulations to be treated as a domestic trust for U.S. federal income tax purposes.

If an entity treated as a partnership for U.S. federal income tax purposes holds the common shares, the U.S. federal income tax considerations relating to an investment in the common shares will depend in part upon the status and activities of such entity and the particular partner. Any such entity should consult its own tax advisor regarding the U.S. federal income tax considerations applicable to it and its partners of the purchase, ownership and disposition of the common shares.

Persons holding common shares should consult their own tax advisors as to the particular tax considerations applicable to them relating to the purchase, ownership and disposition of common shares, including the applicability of U.S. federal, state and local tax laws and non-U.S. tax laws.

Distributions

Subject to the discussion below under “Passive Foreign Investment Company Considerations,” a U.S. Holder that receives a distribution with respect to the common shares generally will be required to include the gross amount of such distribution (before reduction for any Canadian withholding taxes) in gross income as a dividend when actually or constructively received to the extent of the U.S. Holder’s pro rata share of our current and/or accumulated earnings and profits (as determined under U.S. federal income tax principles). To the extent a distribution received by a U.S. Holder is not a dividend because it exceeds the U.S. Holder’s pro rata share of our current and accumulated earnings and profits, it will be treated first as a tax-free return of capital and reduce (but not below zero) the adjusted tax basis of the U.S. Holder’s common shares. To the extent the distribution exceeds the adjusted tax basis of the U.S. Holder’s common shares, the remainder will be taxed as capital gain. However, we cannot provide any assurance that we will maintain or provide earnings and profits determinations in accordance with U.S. federal income tax principles. Therefore, U.S. Holders should expect that a distribution will generally be treated as a dividend even if that distribution would otherwise be treated as a non-taxable return of capital or as capital gain under the rules described above.

The U.S. dollar value of any distribution on the common shares made in Canadian dollars generally should be calculated by reference to the exchange rate between the U.S. dollar and the Canadian dollar in effect on the date of receipt (or deemed receipt) of such distribution by the U.S. Holder regardless of whether the Canadian dollars so received are in fact converted into U.S. dollars at that time. If the Canadian dollars received are converted into U.S. dollars on the date of receipt (or deemed receipt), a U.S. Holder generally should not recognize currency gain or loss on such conversion. If the Canadian dollars received are not converted into U.S. dollars on the date of receipt (or deemed receipt), a U.S. Holder generally will have a basis in such Canadian dollars equal to the U.S. dollar value of such Canadian dollars on the date of receipt (or deemed receipt). Any gain or loss on a subsequent conversion or other disposition of such Canadian dollars by such U.S. Holder generally will be treated as ordinary income or loss and generally will be income or loss from sources within the United States for U.S. foreign tax credit purposes. Different rules apply to U.S. Holders who use the accrual method of tax accounting. Each U.S. Holder should consult its own U.S. tax advisors regarding the U.S. federal income tax consequences of receiving, owning, and disposing of foreign currency.

Distributions on the common shares that are treated as dividends generally will constitute income from sources outside the United States for foreign tax credit purposes and generally will constitute “passive category income.” Because we are not a United States corporation, such dividends will not be eligible for the “dividends received” deduction generally allowed to corporate shareholders with respect to dividends received from U.S. corporations. Dividends paid by a “qualified foreign corporation” to a U.S. Holder who is an individual, trust or estate will generally be treated as “qualified dividend income” and are eligible for taxation at a reduced capital gains rate rather than the marginal tax rates generally applicable to ordinary income provided that a holding period requirement (more than 60 days of ownership, without protection from the risk of loss, during the 121-day period beginning 60 days before the ex-dividend date) and certain other requirements are met, subject to certain exceptions (including, but not limited to, dividends treated as investment income for purposes of investment interest deduction limitations). However, if we are treated as a “passive foreign investment company” (a PFIC) for the taxable year in which the dividend is paid or the preceding taxable year (see discussion below under “Passive Foreign Investment Company Considerations”), we will not be treated as a qualified foreign corporation, and therefore the reduced capital gains tax rate described above will not apply. Each U.S. Holder is advised to consult its own tax advisors regarding the availability of the reduced tax rate on dividends.

If a U.S. Holder is subject to Canadian withholding tax on dividends paid on the holder’s common shares (see discussion below under “Material Canadian Federal Income Tax Considerations-Dividends”), the U.S. Holder may be eligible, subject to a number of complex limitations, to claim a credit against its U.S. federal income tax for the Canadian withholding tax imposed on the dividends. However, if U.S. persons collectively own, directly or indirectly, 50% or more of the voting power or value of our common shares it is possible that a portion of any dividends we pay will be considered U.S.-source income in proportion to our U.S.-source earnings and profits, which could limit the ability of a U.S. Holder to claim a foreign tax credit for the Canadian withholding taxes imposed in respect of such a dividend, although certain elections may be available under the Code and the Convention to mitigate these effects. A U.S. Holder may claim a deduction for the Canadian withholding tax in lieu of a credit, but only for a year in which the U.S. Holder elects to do so for all creditable foreign income taxes. The rules governing the foreign tax credit are complex. Each U.S. Holder is advised to consult its tax advisor regarding the availability of the foreign tax credit under its particular circumstances.

Sale, Exchange or Other Disposition of Common Shares

Subject to the discussion below under “Passive Foreign Investment Company Considerations,” a U.S. Holder generally will recognize capital gain or loss for U.S. federal income tax purposes upon the sale, exchange or other disposition of common shares. The amount of gain recognized will equal the excess of the amount realized (i.e., the amount of cash plus the fair market value of any property received) over the U.S. Holder’s adjusted tax basis in the common shares sold or exchanged. The amount of loss recognized will equal the excess of the U.S. Holder’s adjusted tax basis in the common shares sold or exchanged over the amount realized. Such capital gain or loss generally will be long-term capital gain or loss if, on the date of sale, exchange or other disposition, the common shares were held by the U.S. Holder for more than one year. Net long-term capital gain derived by a non-corporate U.S. Holder with respect to capital assets is currently subject to tax at reduced rates. The deductibility of a capital loss is subject to significant limitations. Any gain or loss recognized from the sale, exchange or other disposition of common shares will generally be gain or loss from sources within the United States for U.S. foreign tax credit purposes, except as otherwise provided in an applicable income tax treaty and if an election is properly made under the Code.

If common shares are sold, exchanged or otherwise disposed of in a taxable transaction for Canadian dollars or other non-U.S. currency, the amount realized generally will be the U.S. dollar value of the Canadian dollars or other non-U.S. currency received based on the spot rate in effect on the date of sale, taxable exchange or other taxable disposition. If a U.S. Holder is a cash method taxpayer and the common shares are traded on an established securities market, Canadian dollars or other non-U.S. currency paid or received by such U.S. Holder will be translated into U.S. dollars at the spot rate on the settlement date of the sale. An accrual method taxpayer may elect the same treatment with respect to the sale of common shares traded on an established securities market, provided that the election is applied consistently from year to year. Such election cannot be changed without the consent of the IRS. Canadian dollars or other non-U.S. currency received on the sale, taxable exchange or other taxable disposition of common shares generally will have a tax basis equal to its U.S. dollar value as determined pursuant to the rules above. Any gain or loss recognized by a U.S. Holder on a sale, taxable exchange or other taxable disposition of the Canadian dollars or other non-U.S. currency will be ordinary income or loss and generally will be U.S.-source gain or loss.

Passive Foreign Investment Company Considerations

General Rule. For any taxable year in which 75% or more of our gross income is passive income, or at least 50% of the value of our assets (where the value of our total assets is determined based upon the market value of our common shares at the end of each quarter or other measuring period) are held for the production of, or produce, passive income, we would be characterized as a PFIC for U.S. federal income tax purposes. The percentage of a corporation’s assets that produce or are held for the production of passive income generally is determined based upon the average ratio of passive assets to total assets calculated at the end of each measuring period. Calculation of the value of assets at the end of each measuring period is generally made at the end of each of the four quarters that make up the company’s taxable year, unless an election is made to use an alternative measuring period (such as a week or month). The “weighted average” of those periodic values is then used to determine the value of assets for the passive asset test for the taxable year. Assets that produce or are held for the production of passive income generally include cash, even if held as working capital or raised in a public offering, marketable securities and other assets that may produce passive income. However, in proposed regulations section 1.1297-1(d)(2), a limited exception to the passive asset test valuation rules is provided for the treatment of working capital in order to take into account the short-term cash needs of operating companies. This proposed regulation provides that an amount of cash held in a non-interest bearing account that is held for the present needs of an active trade or business and is no greater than the amount reasonably expected to cover 90 days of operating expenses incurred in the ordinary course of the trade or business of the foreign corporation (for example, accounts payable for ordinary operating expenses or employee compensation) is not treated as a passive asset. Taxpayers are permitted to rely on the proposed rule provided they consistently follow the rule for each subsequent taxable year beginning before the date of filing of the Treasury decision adopting the rule as a final regulation. The Treasury Department and the IRS indicated that they continue to study the appropriate treatment of working capital for purposes of the passive asset test.

PFIC Status Determination. The tests for determining PFIC status for any taxable year are dependent upon a number of factors, some of which are beyond our control, including the value of our assets, the market price of our common shares, and the amount and type of our gross income. Based on these tests (i) we believe that we were a PFIC for the taxable year ended December 31, 2016, (ii) we do not believe that we were a PFIC for any of the taxable years ended December 31, 2017 through December 31, 2021, and (iii) we believe that we were a PFIC for the taxable years ended December 31, 2022 through December 31, 2024. Our status as a PFIC is a fact-intensive determination made for each taxable year, and we cannot provide any assurance regarding our PFIC status for the taxable year ending December 31, 2025 or for future taxable years. U.S. shareholders who own our common shares for any period during which we are a PFIC (which we believe would currently only be those shareholders that held our common shares in the taxable year ended December 31, 2016, December 31, 2022, December 31, 2023 or December 31, 2024) will be required to file IRS Form 8621 for each tax year during which they hold our common shares, unless, after we are no longer a PFIC, any such shareholder makes the “purging election” discussed below.